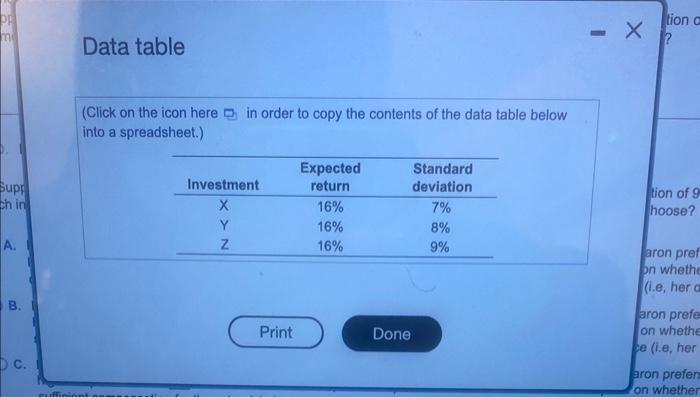

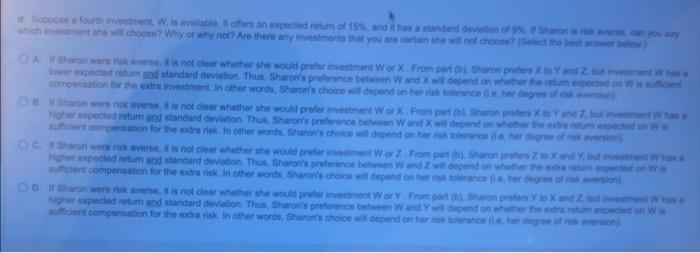

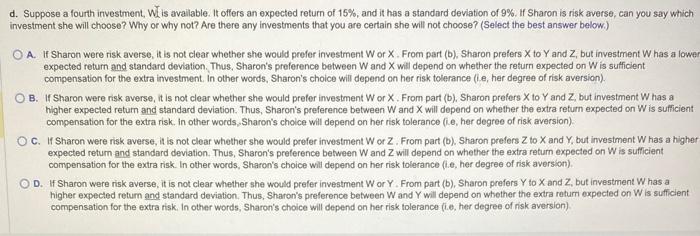

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) d. Suppose a fourth investment, Wi is available. It offers an expected return of 15%, and it has a standard deviation of 9%. If Sharon is risk averse, can you say which investment she will choose? Why or why not? Are there any investments that you are certain she will not choose? (Select the best answer below.) A. If Sharon were risk averse, it is not clear whether she would prefer investment W or X. From part (b), Sharon prefers X to Y and Z, but investment W has a lowe expected return and standard deviation. Thus. Sharon's preference between W and X will depend on whether the raturn expected on W is sufficient compensation for the extra investment. In other words, Sharon's choice will depend on her risk tolerance (ie, her degree of risk aversion). B. If Sharon were risk averse, it is not clear whether she would prefer investment W or X. From part (b), Sharon prefers X to Y and Z, but investment W has a higher expected return and standard deviation. Thus, Sharon's preference between W and X will depend on whether the extra return expected on W is suticient compensation for the extra risk. In other words, Sharon's choice will depend on her risk tolerance (i.e, her degree of risk aversion). C. If Sharon were risk averse, it is not clear whether she would prefer investment W or Z. From part (b), Sharon prefers Z to X and Y, but investment W has a highei expected retum and standard deviation. Thus, Sharon's preference behween W and Z will depend on whether the extra return expected on W is sufficient compensation for the extra risk. In other words, Sharon's choice will depend on her risk tolerance (i.e, her degree of risk aversion). D. If Sharon were risk averse, it is not clear whether she would prefer investment W or Y. From part (b), Sharon prefers Y to X and Z, but investment W has a higher expected return and standard deviation. Thus, Sharon's preference between W and Y will depend on whether the extra returt oxpected on W is sufficient compensation for the extra risk. In other words, Sharon's choice will depend on her risk tolerance (i.e, her degree of risk aversion)