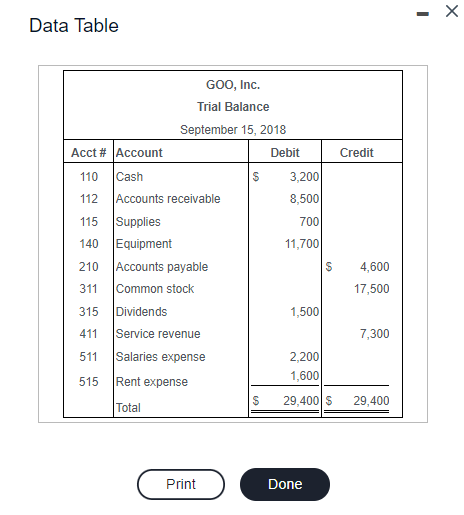

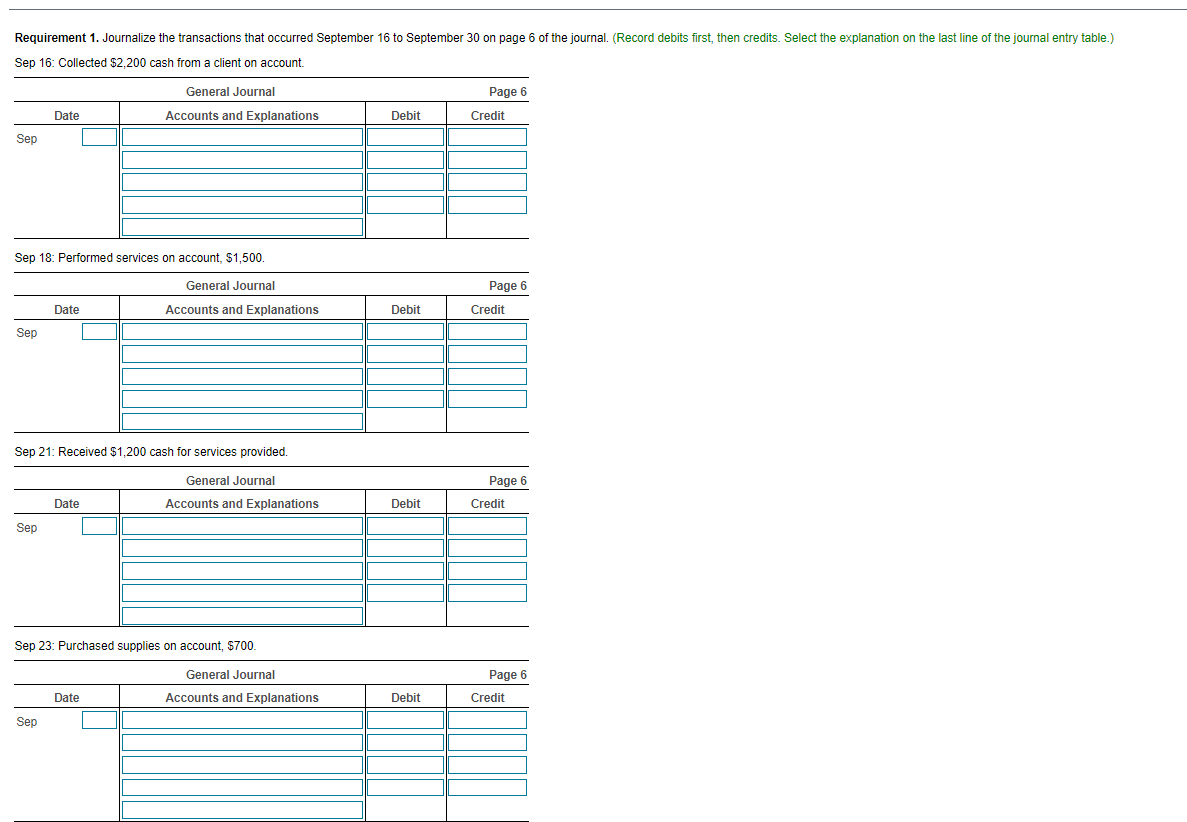

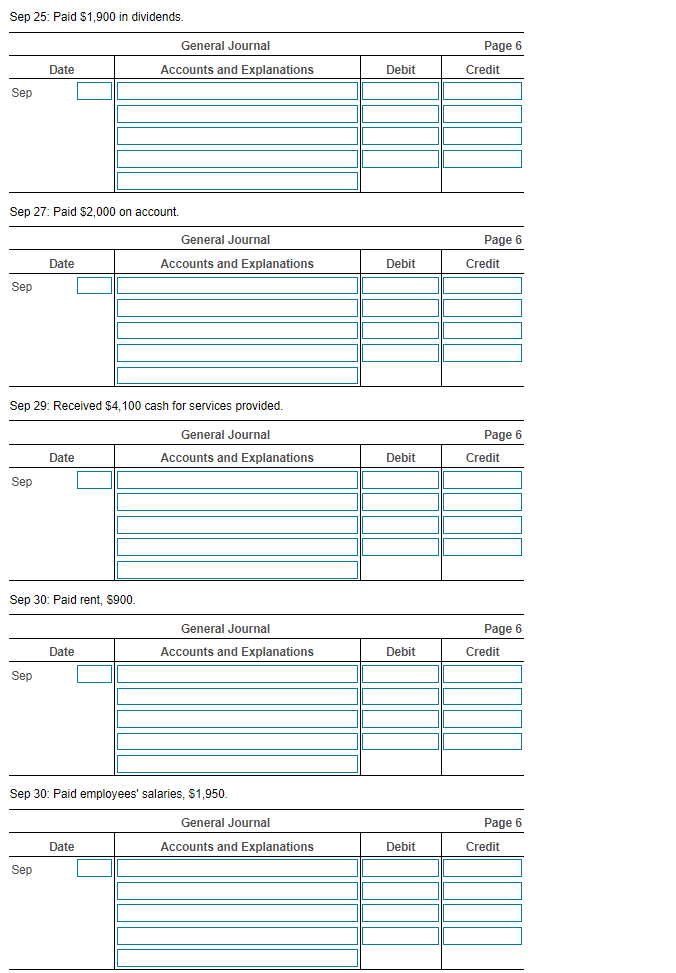

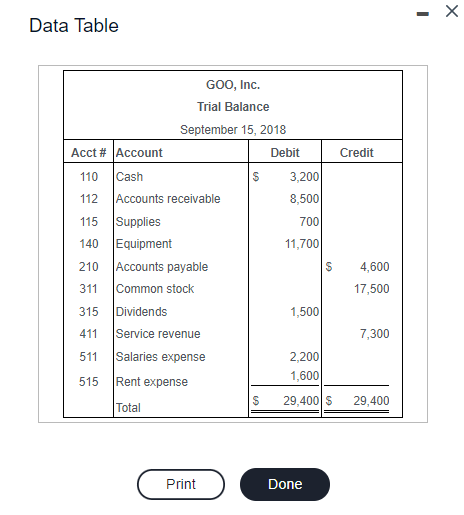

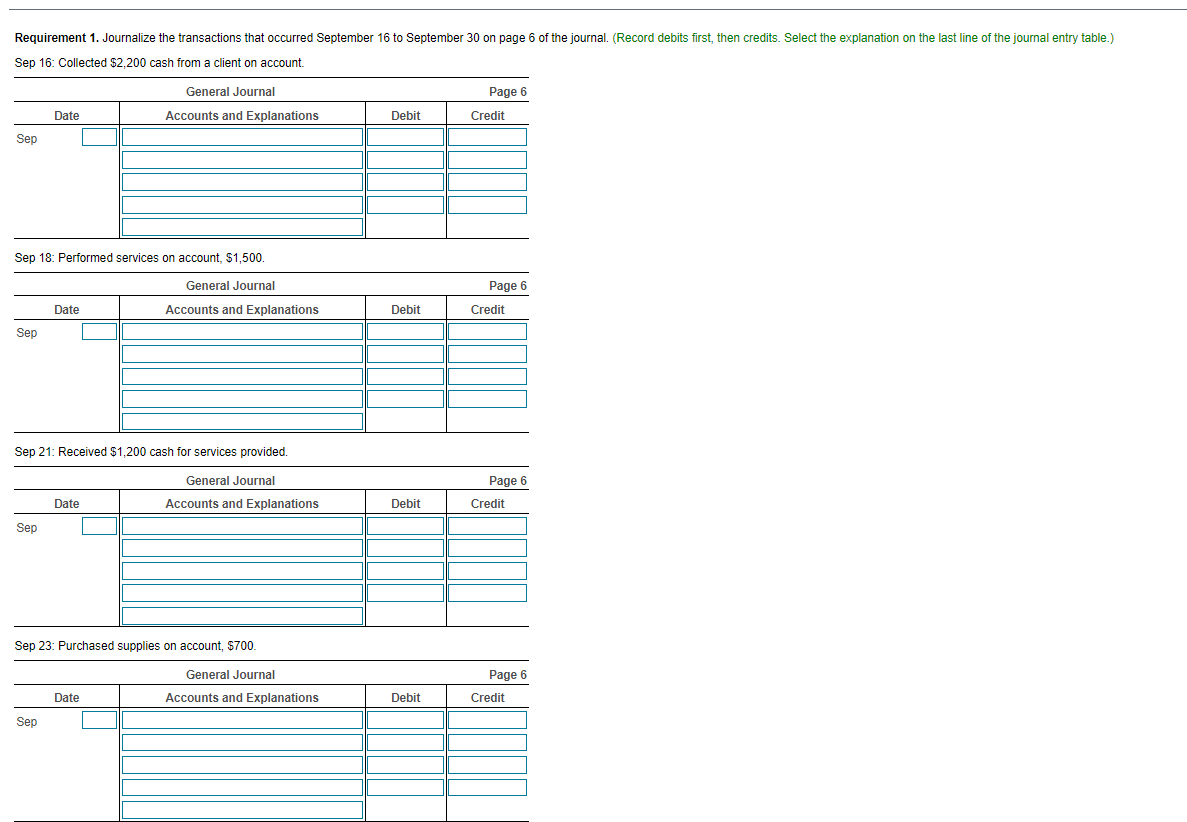

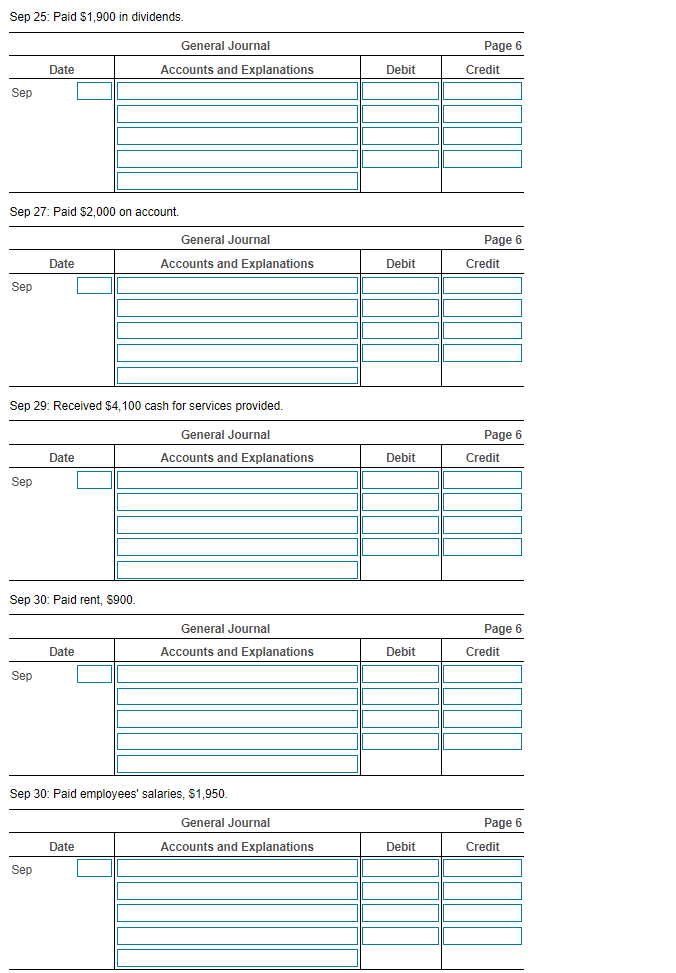

Data Table Credit GOO, Inc. Trial Balance September 15, 2018 Acct # Account Debit 110 Cash $ 3,200 112 Accounts receivable 8,500 115 Supplies 700 140 Equipment 11,700 210 Accounts payable 311 Common stock 315 Dividends 1,500 411 Service revenue 511 Salaries expense 2,200 515 Rent expense 1,600 S Total 29,400 $ s 4,600 17,500 7,300 29,400 Print Done Requirement 1. Journalize the transactions that occurred September 16 to September 30 on page 6 of the journal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Sep 16: Collected $2,200 cash from a client on account. General Journal Page 6 Date Accounts and Explanations Debit Credit Sep Sep 18: Performed services on account, $1,500. General Journal Page 6 Date Accounts and Explanations Debit Credit Sep Sep 21: Received $1,200 cash for services provided. General Journal Page 6 Credit Date Accounts and Explanations Debit Sep Sep 23: Purchased supplies on account, $700. General Journal Page 6 Date Accounts and Explanations Debit Credit Sep Sep 25: Paid $1,900 in dividends. General Journal Page 6 Date Accounts and Explanations Debit Credit Sep Sep 27: Paid $2,000 on account. General Journal Page 6 Date Accounts and Explanations Debit Credit Sep Sep 29: Received $4,100 cash for services provided. General Journal Page 6 Credit Date Accounts and Explanations Debit Sep Sep 30: Paid rent, $900 General Journal Accounts and Explanations Page 6 Credit Date Debit Sep Sep 30: Paid employees' salaries, $1,950 General Journal Page 6 Credit Date Accounts and Explanations Debit Sep Requirement 2. The four-column ledger accounts, together with their beginning balances, have been opened for you. Post the transactions to the ledger using dates, accounts numbers, and posting references. Calculate the new account balances Post the transactions to the ledger accounts below. Post to each account in the order the transactions are presented in the data Cash Account No. Balance Post Ref. Date Item Debit Credit Debit Credit Sep 15 Bal. 3,2001 Accounts receivable Account No. Post Balance Date Item Ref. Debit Credit Debit Credit Sep 15 Bal. 8,500 Supplies Account No. Post Balance Date Item Ref. Debit Credit Credit Debit 700 Sep 15 Bal. Accounts payable Account No. Post Balance Date Item Ref. Debit Credit Debit Credit Sep 15 Bal. 4.600 Dividends Account No. Post Balance Date Item Ref. Debit Credit Debit Credit Sep 15 Bal. 1,500 Service revenue Account No. Post Balance Date Item Ref. Debit Credit Debit Credit 7,300 Sep 15 Bal. Salaries expense Account No. Post Balance Date Item Ref. Debit Credit Credit Debit 2,200 Sep 15 Bal. Rent expense Post Account No. Balance Debit Credit Date Item Ref. Debit Credit Sep 15 Bal. 1,600 Requirement 3. Prepare the trial balance for GOO, Inc., at September 30, 2018 GOO, Inc. Trial Balance September 30, 2018 Acct # Account Debit Credit Total