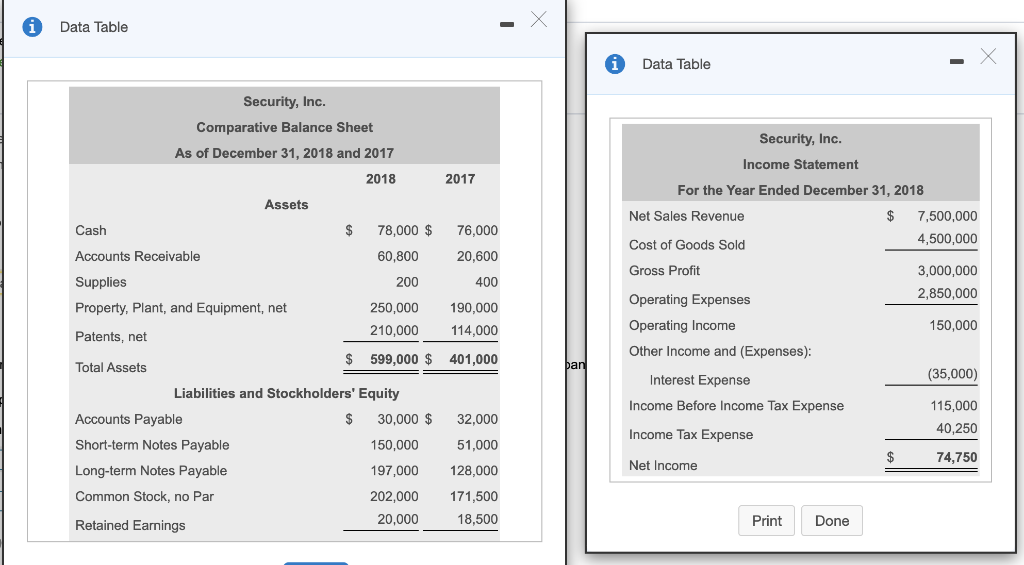

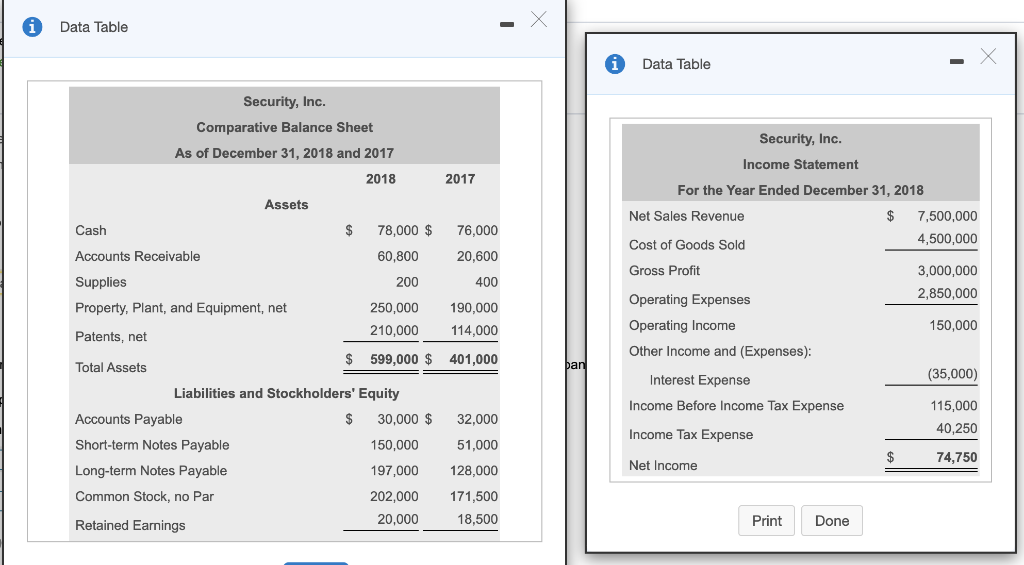

Data Table Data Table Security, Inc. Comparative Balance Sheet As of December 31, 2018 and 2017 Security, Inc. Income Statement 2018 2017 Assets For the Year Ended December 31, 2018 Net Sales Revenue $ 7,500,000 Cost of Goods Sold 4,500,000 Cash $ 78,000 $ 76,000 60,800 20,600 Gross Profit Accounts Receivable Supplies Property, Plant, and Equipment, net 200 400 3,000,000 2,850,000 250,000 210,000 190,000 114,000 150,000 Patents, net $ Total Assets 599,000 $ 401,000 pan Operating Expenses Operating Income Other Income and (Expenses): Interest Expense Income Before Income Tax Expense Income Tax Expense (35,000) 32.000 115,000 40,250 51,000 Liabilities and Stockholders' Equity Accounts Payable $ 30,000 $ Short-term Notes Payable 150,000 Long-term Notes Payable 197,000 Common Stock, no Par 202,000 Retained Earnings 20,000 $ 74,750 128,000 Net Income 171,500 18,500 Print Done Requirement 5. Calculate the company's RI. Interpret your results. First, select the formula to calculate residual income (RI). Operating income Average total assets x Target rate of return = RI The RI for Security, Inc. is $ Security, Inc. is exceeding management's target rate of return. Data Table Data Table Security, Inc. Comparative Balance Sheet As of December 31, 2018 and 2017 Security, Inc. Income Statement 2018 2017 Assets For the Year Ended December 31, 2018 Net Sales Revenue $ 7,500,000 Cost of Goods Sold 4,500,000 Cash $ 78,000 $ 76,000 60,800 20,600 Gross Profit Accounts Receivable Supplies Property, Plant, and Equipment, net 200 400 3,000,000 2,850,000 250,000 210,000 190,000 114,000 150,000 Patents, net $ Total Assets 599,000 $ 401,000 pan Operating Expenses Operating Income Other Income and (Expenses): Interest Expense Income Before Income Tax Expense Income Tax Expense (35,000) 32.000 115,000 40,250 51,000 Liabilities and Stockholders' Equity Accounts Payable $ 30,000 $ Short-term Notes Payable 150,000 Long-term Notes Payable 197,000 Common Stock, no Par 202,000 Retained Earnings 20,000 $ 74,750 128,000 Net Income 171,500 18,500 Print Done Requirement 5. Calculate the company's RI. Interpret your results. First, select the formula to calculate residual income (RI). Operating income Average total assets x Target rate of return = RI The RI for Security, Inc. is $ Security, Inc. is exceeding management's target rate of return