Answered step by step

Verified Expert Solution

Question

1 Approved Answer

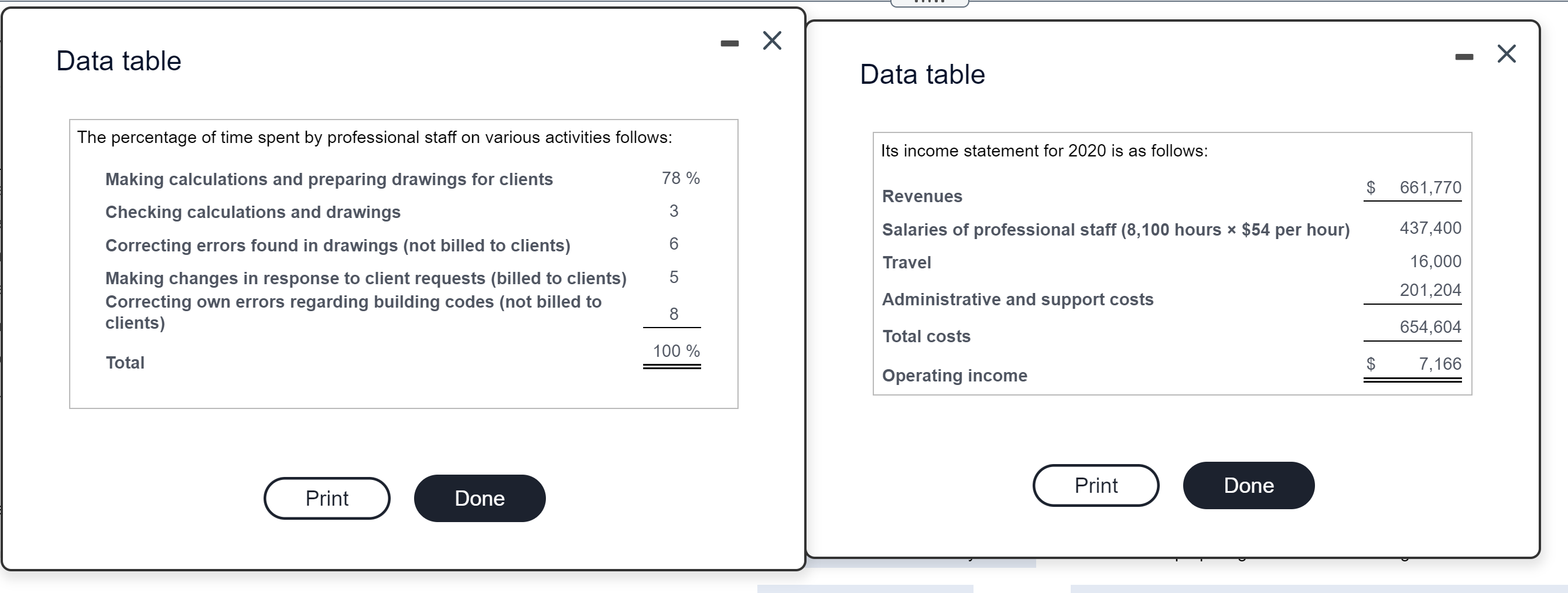

Data table Data table - The percentage of time spent by professional staff on various activities follows: Making calculations and preparing drawings for clients

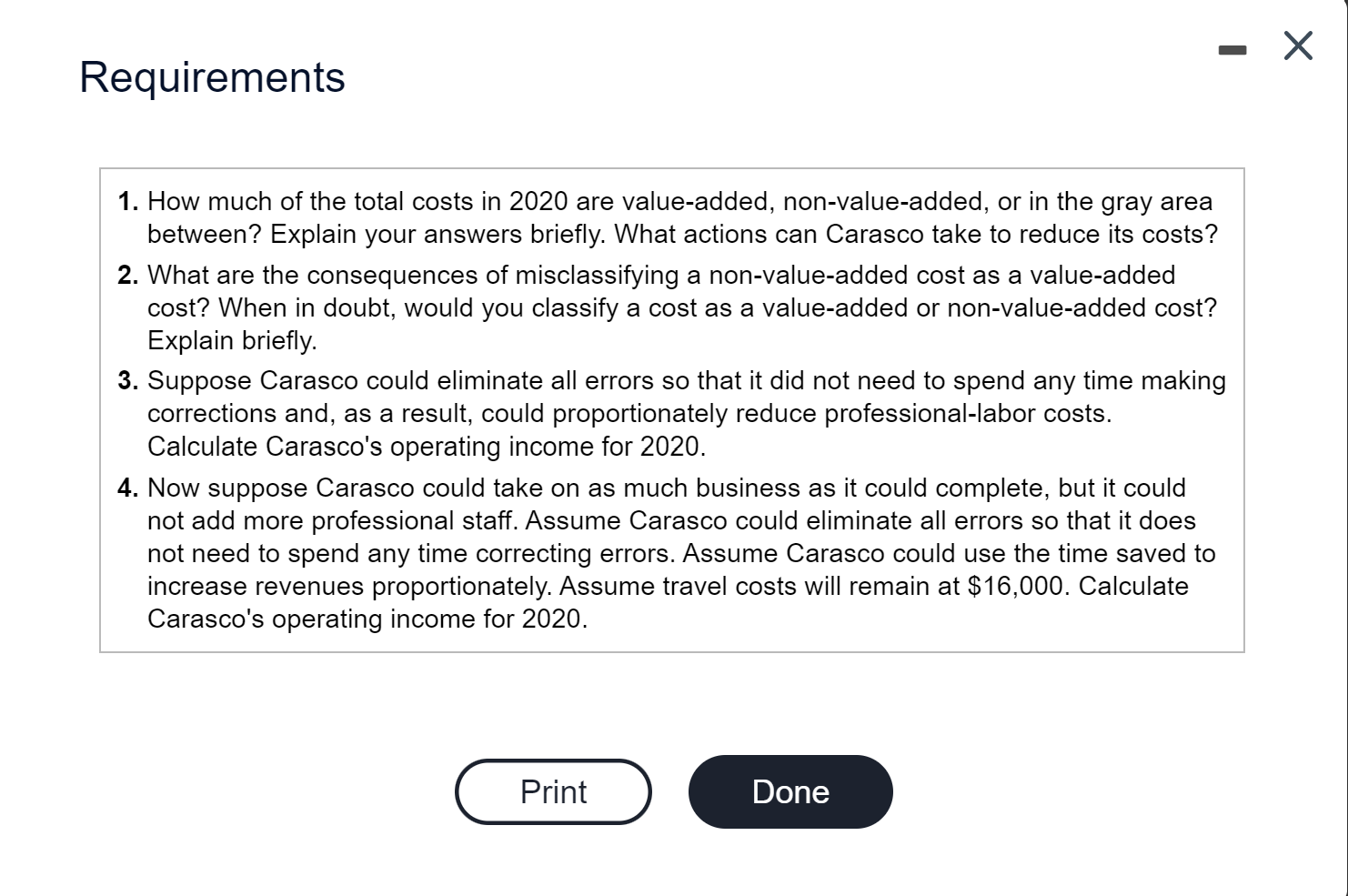

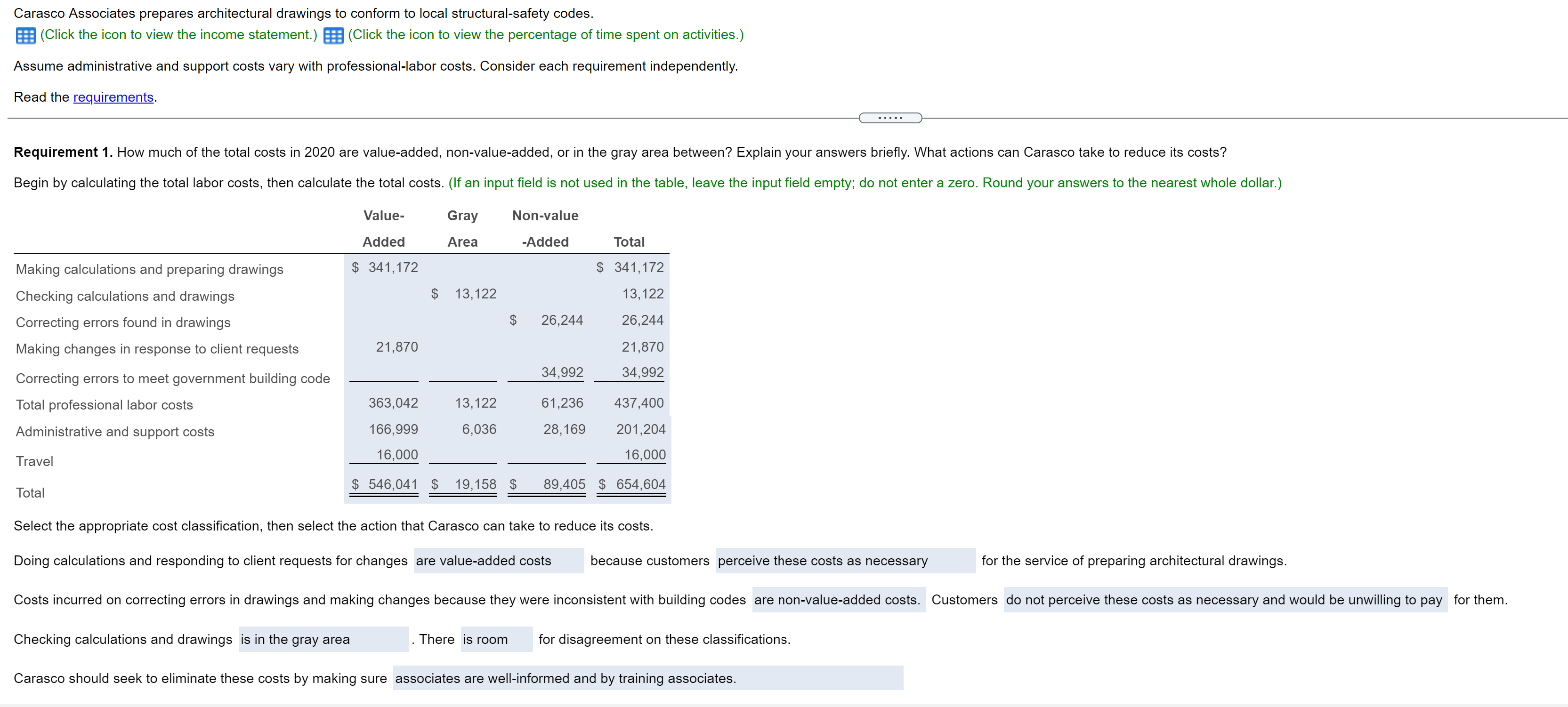

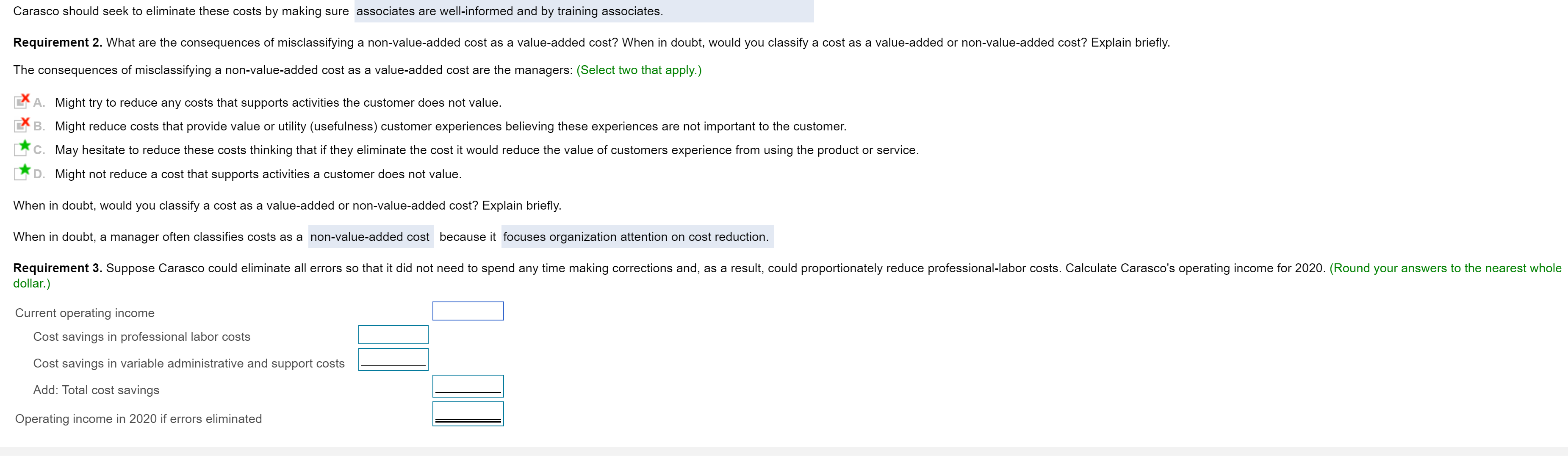

Data table Data table - The percentage of time spent by professional staff on various activities follows: Making calculations and preparing drawings for clients Checking calculations and drawings Its income statement for 2020 is as follows: 78% $ 661,770 Revenues 3 Correcting errors found in drawings (not billed to clients) 6 Salaries of professional staff (8,100 hours $54 per hour) Travel 437,400 16,000 Making changes in response to client requests (billed to clients) Correcting own errors regarding building codes (not billed to clients) 201,204 Administrative and support costs 8 654,604 Total costs 100% Total 7,166 Operating income Print Done Print Done Requirements 1. How much of the total costs in 2020 are value-added, non-value-added, or in the gray area between? Explain your answers briefly. What actions can Carasco take to reduce its costs? 2. What are the consequences of misclassifying a non-value-added cost as a value-added cost? When in doubt, would you classify a cost as a value-added or non-value-added cost? Explain briefly. 3. Suppose Carasco could eliminate all errors so that it did not need to spend any time making corrections and, as a result, could proportionately reduce professional-labor costs. Calculate Carasco's operating income for 2020. 4. Now suppose Carasco could take on as much business as it could complete, but it could not add more professional staff. Assume Carasco could eliminate all errors so that it does not need to spend any time correcting errors. Assume Carasco could use the time saved to increase revenues proportionately. Assume travel costs will remain at $16,000. Calculate Carasco's operating income for 2020. Print Done Carasco Associates prepares architectural drawings to conform to local structural-safety codes. | (Click the icon to view the income statement.) (Click the icon to view the percentage of time spent on activities.) Assume administrative and support costs vary with professional-labor costs. Consider each requirement independently. Read the requirements. ..... Requirement 1. How much of the total costs in 2020 are value-added, non-value-added, or in the gray area between? Explain your answers briefly. What actions can Carasco take to reduce its costs? Begin by calculating the total labor costs, then calculate the total costs. (If an input field is not used in the table, leave the input field empty; do not enter a zero. Round your answers to the nearest whole dollar.) Gray Area Non-value Total Making calculations and preparing drawings Checking calculations and drawings Correcting errors found in drawings Making changes in response to client requests Correcting errors to meet government building code Total professional labor costs Administrative and support costs Value- Added -Added $ 341,172 $ 341,172 $ 13,122 13,122 $ 26,244 26,244 21,870 21,870 34,992 34,992 363,042 166,999 16,000 13,122 6,036 61,236 437,400 28,169 201,204 16,000 $ 546,041 $ 19,158 $ 89,405 $ 654,604 Travel Total Select the appropriate cost classification, then select the action that Carasco can take to reduce its costs. Doing calculations and responding to client requests for changes are value-added costs because customers perceive these costs as necessary for the service of preparing architectural drawings. Costs incurred on correcting errors in drawings and making changes because they were inconsistent with building codes are non-value-added costs. Customers do not perceive these costs as necessary and would be unwilling to pay for them. Checking calculations and drawings is in the gray area There is room for disagreement on these classifications. Carasco should seek to eliminate these costs by making sure associates are well-informed and by training associates. Carasco should seek to eliminate these costs by making sure associates are well-informed and by training associates. Requirement 2. What are the consequences of misclassifying a non-value-added cost as a value-added cost? When in doubt, would you classify a cost as a value-added or non-value-added cost? Explain briefly. The consequences of misclassifying a non-value-added cost as a value-added cost are the managers: (Select two that apply.) A. Might try to reduce any costs that supports activities the customer does not value. B. Might reduce costs that provide value or utility (usefulness) customer experiences believing these experiences are not important to the customer. C. May hesitate to reduce these costs thinking that if they eliminate the cost it would reduce the value of customers experience from using the product or service. D. Might not reduce a cost that supports activities a customer does not value. When in doubt, would you classify a cost as a value-added or non-value-added cost? Explain briefly. When in doubt, a manager often classifies costs as a non-value-added cost because it focuses organization attention on cost reduction. Requirement 3. Suppose Carasco could eliminate all errors so that it did not need to spend any time making corrections and, as a result, could proportionately reduce professional-labor costs. Calculate Carasco's operating income for 2020. (Round your answers to the nearest whole dollar.) Current operating income Cost savings in professional labor costs Cost savings in variable administrative and support costs Add: Total cost savings Operating income in 2020 if errors eliminated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the completed homework assignment Name Your Name Student ID Your Student ID Course Name Homers Accounting Part 1 Accounting Basics 1 Define th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started