Answered step by step

Verified Expert Solution

Question

1 Approved Answer

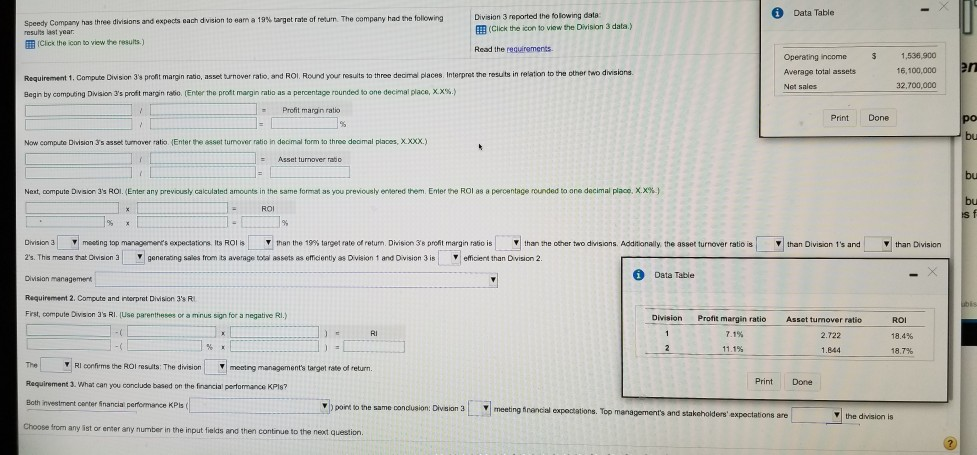

Data Table Division 3 reported the tolowing data EB (Click the icon to viaw the Division 3 data.) Read the requirements Speedy Company has three

Data Table Division 3 reported the tolowing data EB (Click the icon to viaw the Division 3 data.) Read the requirements Speedy Company has three divisions and expects each dvision1o earn a 19% target rate of return The company had the following results last year IClick the ican to view the results.) 1,536,900 16,100,000 32,700,000 Operating income Average total assets Net sales $1 Requirement 1. Campute Divson 3's pront margin raio, asset burnower ratio, and ROl. Round your results to three decimal places Interpret t Begn by computing Division 3 s proft margn raio. Enter the prott magn ratio as a percentage rounded to one decimal place, XX%) the resuts in relation to the other two dmsians - Profit margin ratio Print Done bu Now compute Division 3s asset bunover ratio (Enter the asset tumover ratio in decimal form to three deaimal places, X.xxx) - Asset turnover rabo m. Enter the ROI as a percentage rounded o one decimal place.xx Na t, compute D sion 3's ROI Enter any prevously calculated amounts in the same for at 35 you prevously emered ROI Division 3 | | maong iap managemert's expectations lts ROI is | ran the 19% target rate of return, Divison 3s profit margin ratio is 2's. Th means that Or son 3 ganaraong sales from ts average toal assets as emiciently as Division 1 and Di sion 3 is effio ent than Onsion 2 Divisian management Requirement 2. Compute and inberpret Division 3s R First, compute Divison 3's RI. (Use parentheses or a minus sign for a negative RI.) than the other two dnisians. Additionally, the asset turnover ratio is than Division than Divisian 1's and i Data Table Profit margin ratio Division Asset turnover ratio ROI 18.4% 18.7% RI 7.1% 2.722 1.844 The Requirement 3. What can you conclude based on the financial pertormance KPls? Both investment canter inancial performance KPls ( RI confrms the ROI resuts: The divisionmeeting management's target rate of return. Print Done point to the same condusion: Division 3meeting fnancial expoctations. Top management's and staksholders' expectations are the dvision is from any ist or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started