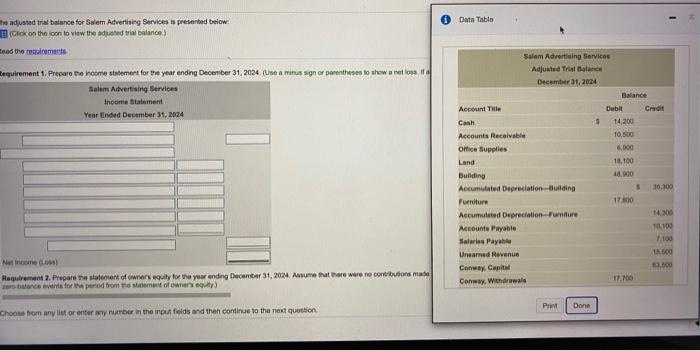

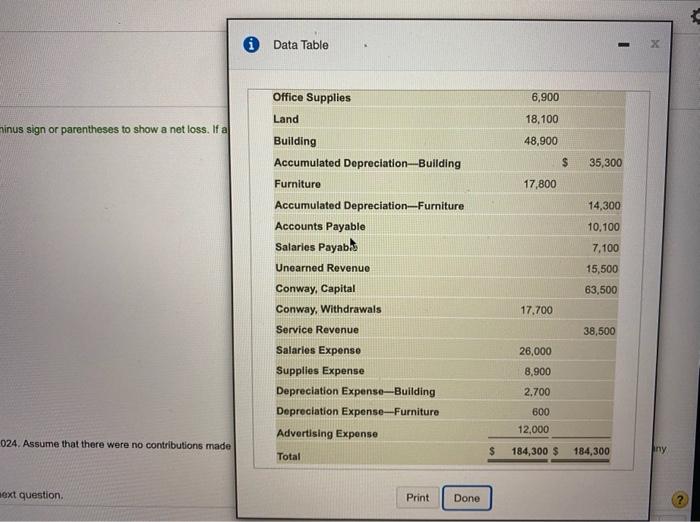

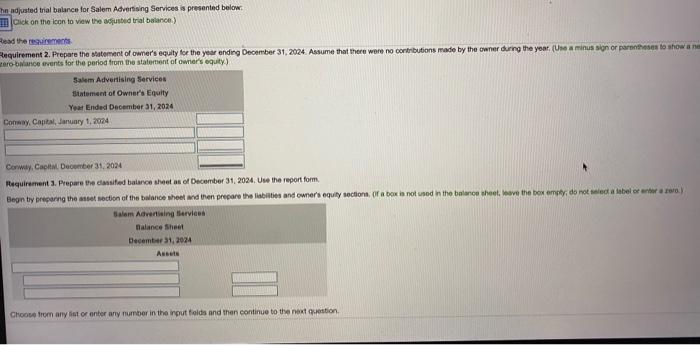

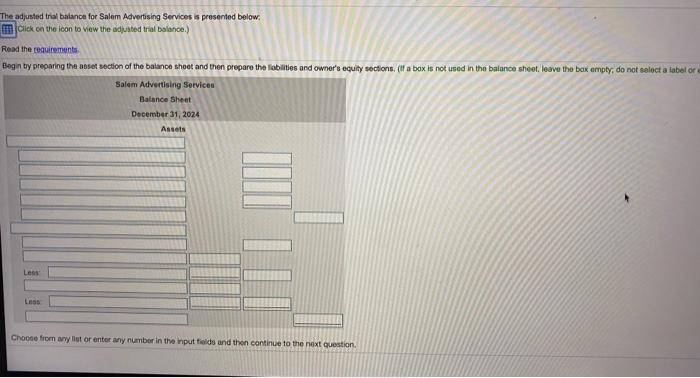

Data Table e adjusted trial balance for Swem Advertising Services is presented below: Click on the icon to view the adjusted trial balance) nad the girements requirement 1. Prepare the income statement for the year ending December 31, 2024. (Use a minus sign or parentheses to show a neto 11 Salum Atvertising Services Income Statement Year Ended December 31, 2024 1.100 Salam Advertising Services Adjusted Trial Balance December 31, 2024 Balance Account Title Debit Chat Cash 5 14,200 Accounts Receivable 10,500 Office Supplies 6000 Land Building 100 Accumulated Depreciation-Building 30.300 Furniture 17.00 Accumulated Depreciation Furniture Accounts Payable 10.100 Satarles Payable 7.100 Unnamed Revenus 1500 Coway, Capital 3.000 Conway. Withdrawal 11.100 Net income.) Hequirement 2. Prepare the statement of owner's equity for the yow ending December 31, 2021. Assume there were no contributions made be event for the period from the aim of owners) Print Done Choose from any list or enter number in the input fields and then continue to the next question Data Table - x Office Supplies 6,900 Land minus sign or parentheses to show a net loss. If al 18,100 48,900 $ 35,300 17,800 14,300 Building Accumulated Depreciation Building Furniture Accumulated Depreciation-Furniture Accounts Payable Salaries Payab Unearned Revenue Conway, Capital Conway, Withdrawals 10.100 7,100 15,500 63,500 17.700 Service Revenue 38,500 26,000 8,900 2.700 Salaries Expense Supplies Expense Depreciation Expense-Building Depreciation Expense-Furniture Advertising Expense Total 600 12.000 024. Assume that there were no contributions made $ 184,300 $ 184,300 ny next question Print Done The adjusted trial balance for Salem Advertising Services is presented below 1. Click on the icon to view the adjusted trial balance) Read the rest Requirement 2. Prepare the statement of owner's equity for the year ending December 31, 2024. Assume that there were no contributions made by the owner during the year (Use a minus signor press to shown aro-balance events for the period from the statement of owner's equity) Salem Advertising Services statement of Owner's Equity Year Ended December 31, 2024 Cowy. Cantal, January 1, 2024 Conway, Capita December 31, 2024 Requirements. Prepare the wife balance sheet as of December 31, 2024. Use the report for Begin by Deparng the section of the balance sheet and then prepare the abities and owner's equity section of a box is not used in the balance sheet wave the box empty, do not labelorante ao Salom Advertising Services Balance sheet December 31, 2024 Assets Choose from any of enter any number in the input fields and then continue to the next question The adjusted trial balance for Salem Advertising Services is presented below. Click on the loon to view the adjusted trial balance) Read the requirements Begin by preparing the set section of the balance shoot and then prepare the liabilities and owner's equity sections. ( a box is not used in the balance sheet leave the box empty, do not select a tabel or Salem Advertising Services Balance Sheet December 31, 2024 Assets Les Choose from any lot or enter any number in the input fields and then continue to the next question. The adjusted trial balance for Salem Advertising Services is presented below Click on the loon to view the adjusted trial balance.) Read the requirements Less Los Liabilities IIII III TO Owner's Equity Choose from any lot or enter any number in the input fields and then continue to the next