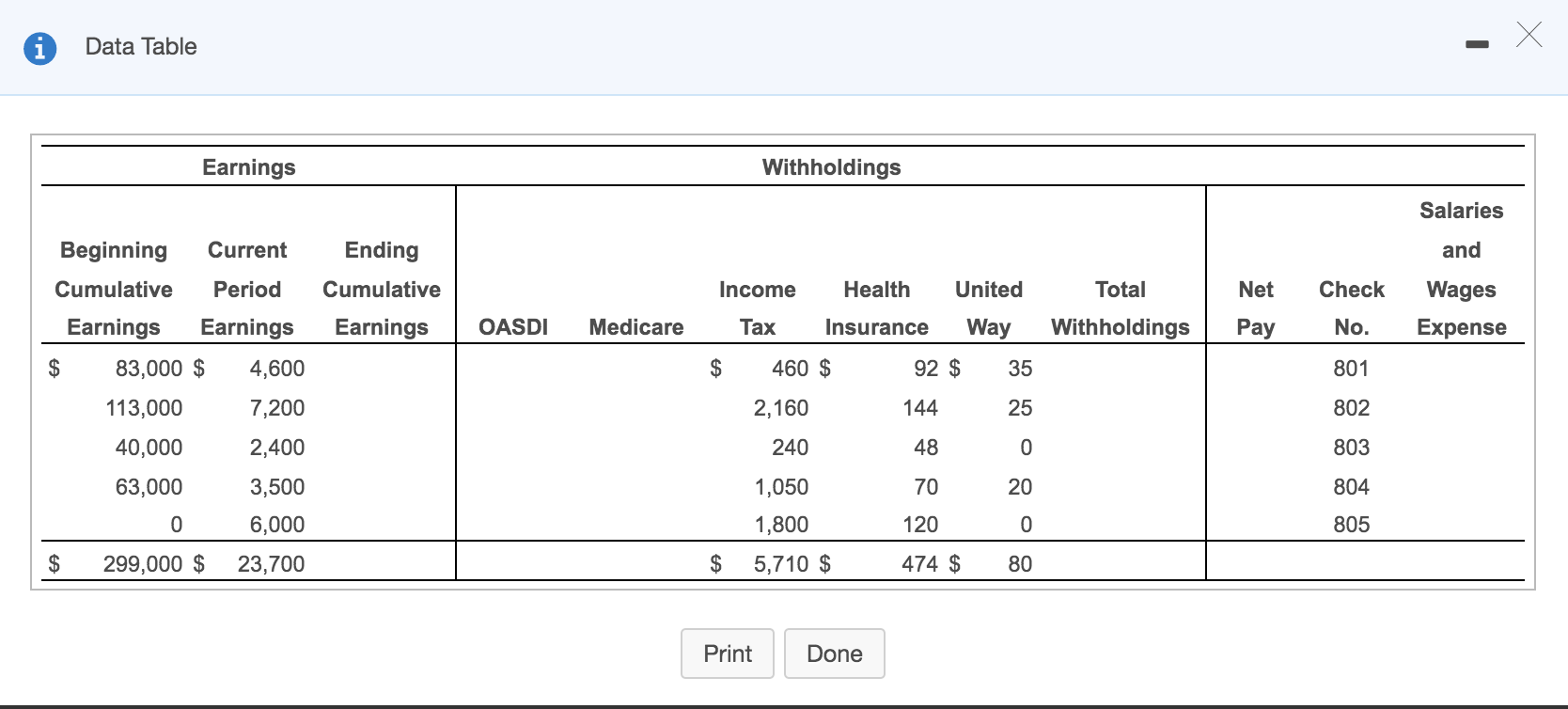

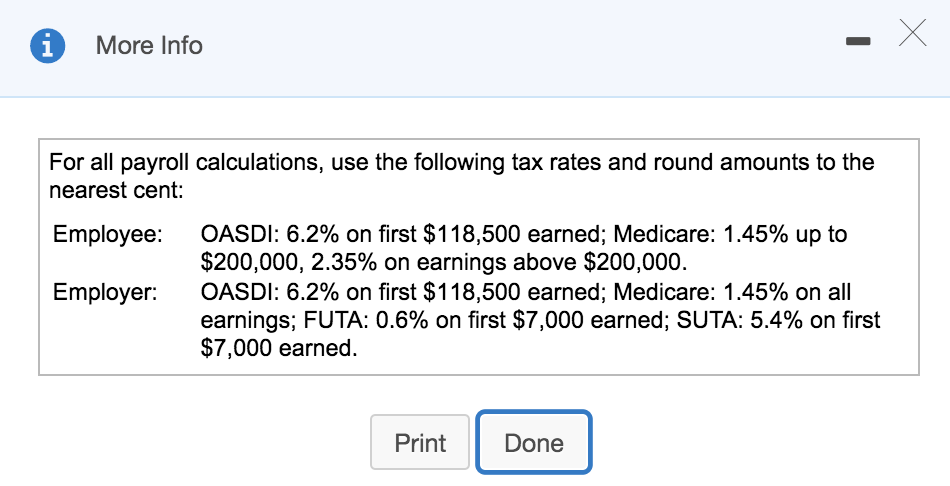

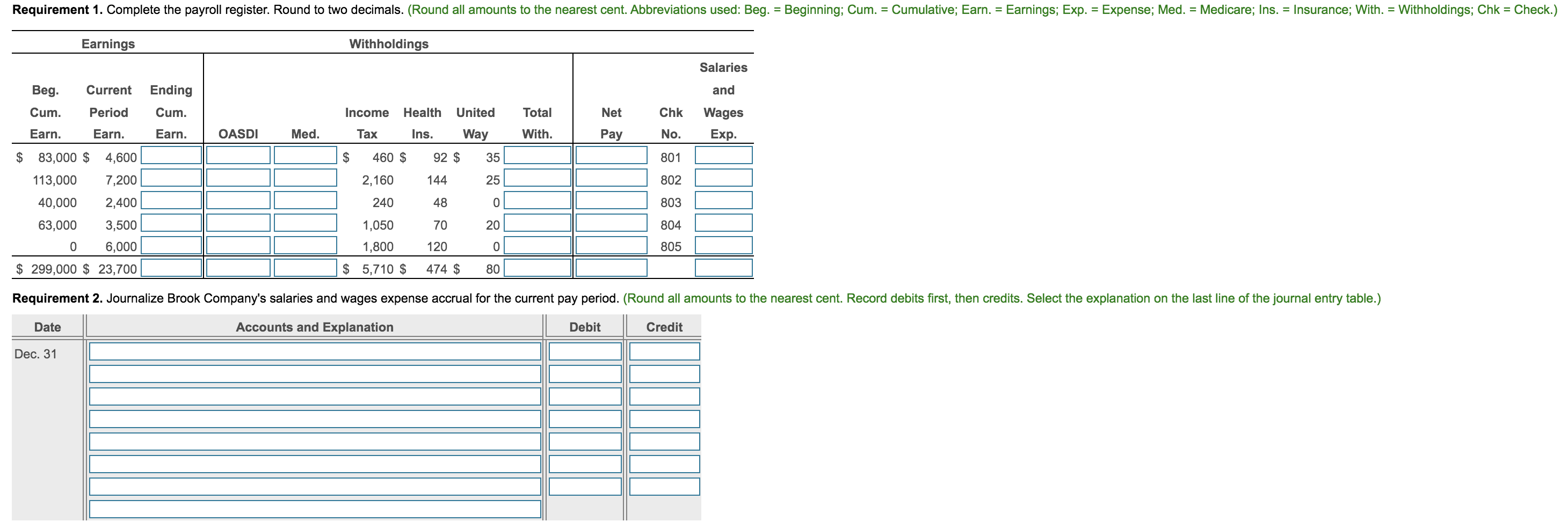

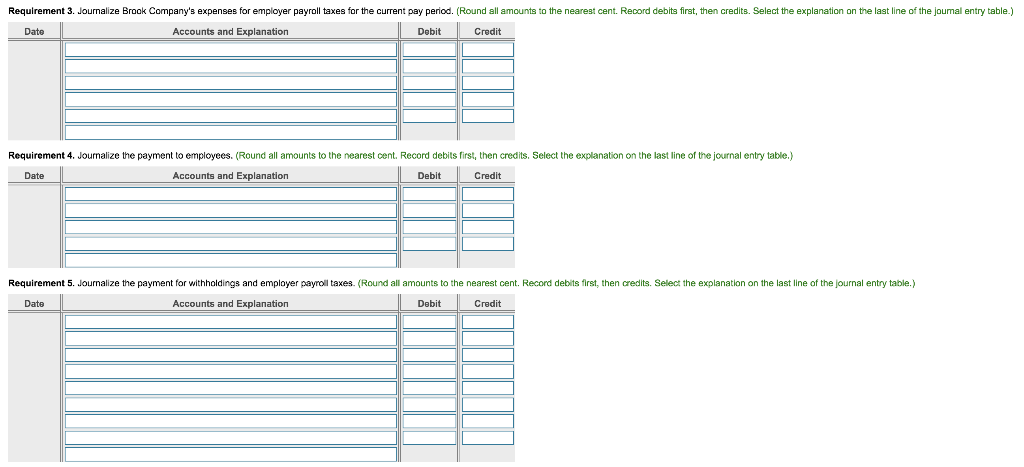

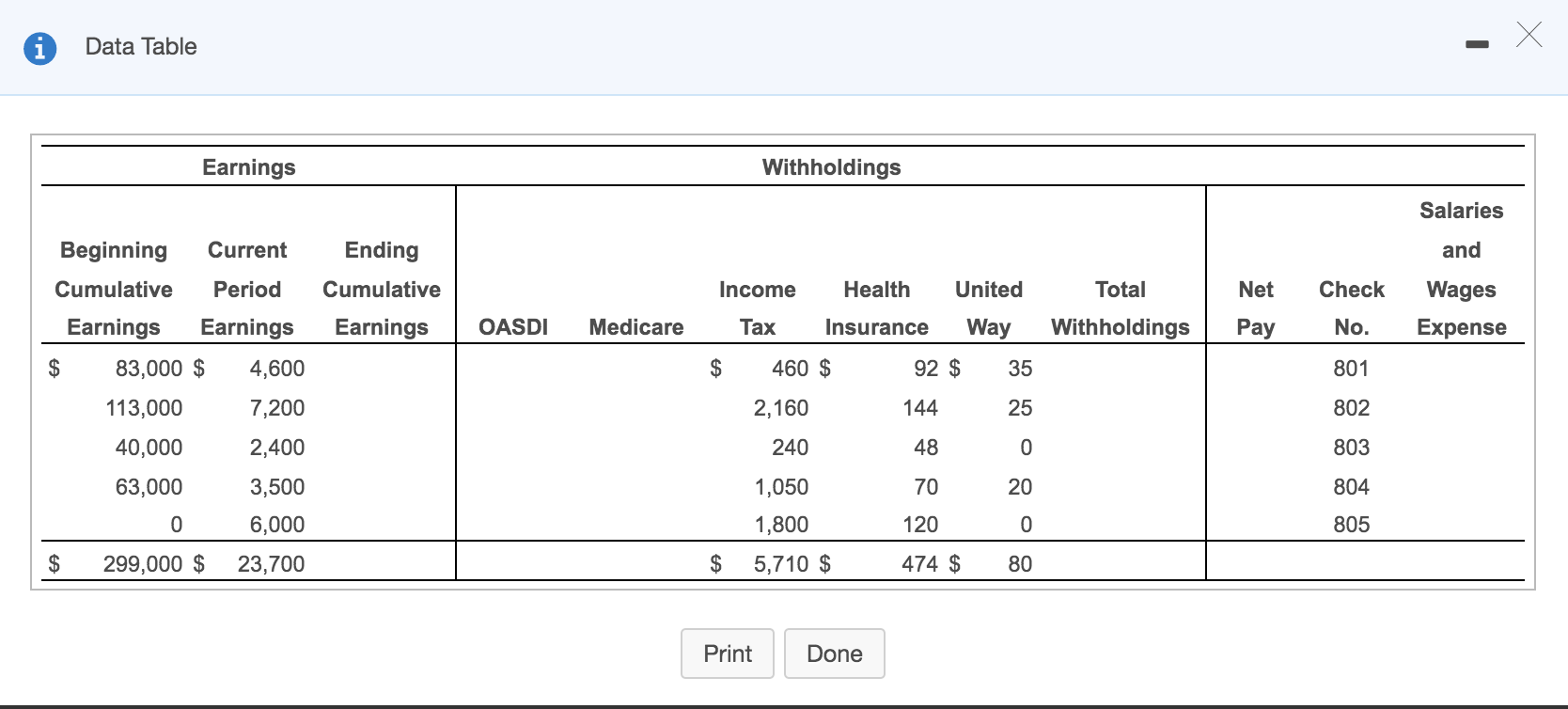

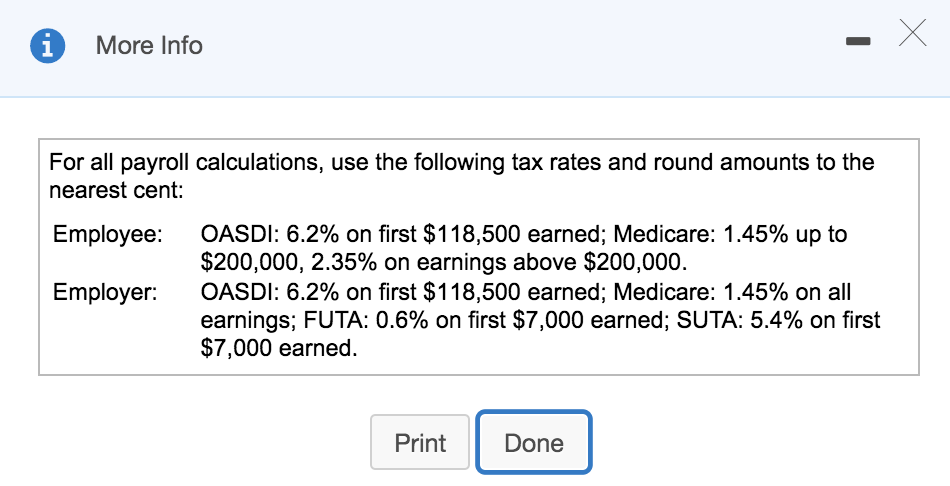

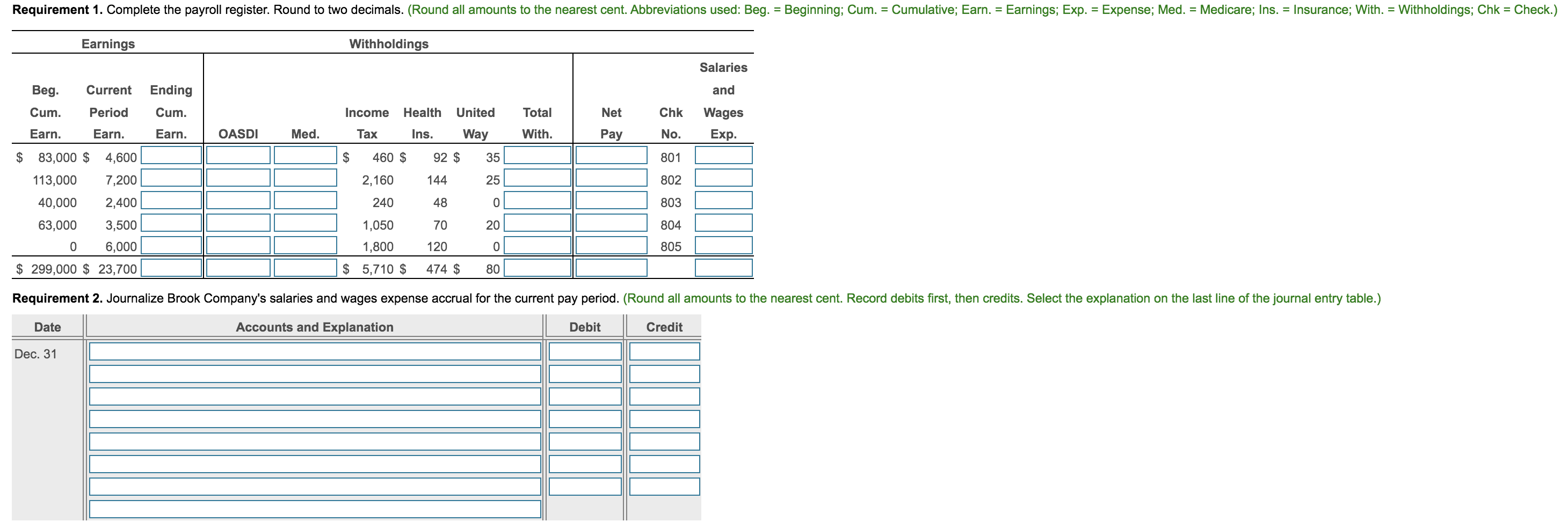

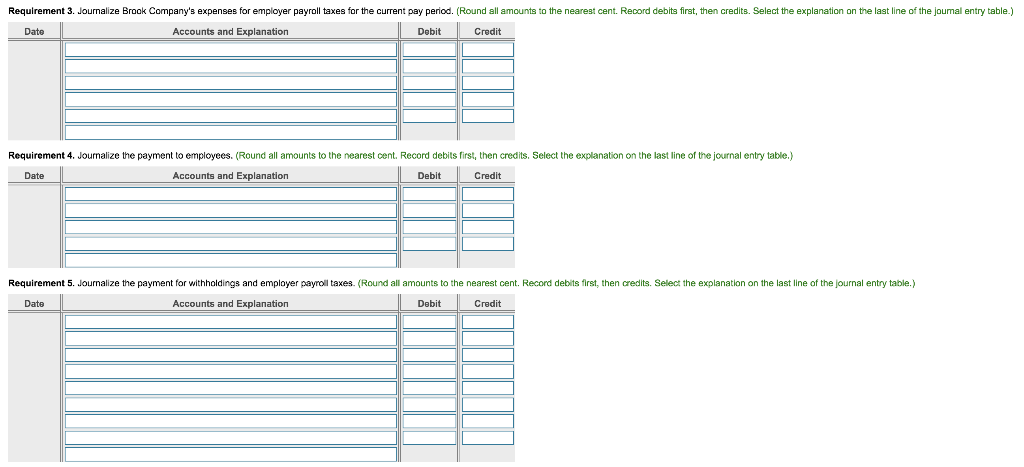

Data Table Earnings Withholdings Salaries Beginning Current Ending and Cumulative Earnings Total Withholdings Net Pay Check No. Wages Expense OASDI Medicare 801 802 Cumulative Period Earnings Earnings 83,000 $ 4,600 113,000 7,200 40,000 2,400 63,000 3,500 6,000 $ 299,000 $ 23,700 Income Health United Tax Insurance Way $ 460 $ 92 $ 35 2,160 1 44 25 240 48 0 1,050 70 1,800 120 $ 5,710 $ 474 $ 80 803 804 805 0 Print Done More Info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: Employer: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Print Print Done Done] Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. = Beginning; Cum. = Cumulative; Earn. = Earnings; Exp. = Expense; Med. = Medicare; Ins. = Insurance; With. = Withholdings; Chk = Check.) Earnings Withholdings Salaries and Ending Cum. Earn. Net Total With. OASDI Med. Pay Beg. Current Cum. Period Earn. Earn. $ 83,000 $ 4,600 113,000 7,200 40,000 2,400 63,000 3,500 0 6,000 $ 299,000 $ 23,700 Chk Wages No. Exp. 801 802 Income Health United Tax Ins. Way $ 460 $ 92 $ 35 2,160 144 25 240 - 48 1,05070 20L 1,800 120 o $ 5,710 $ 474 $ 80 | 803 804 805 Requirement 2. Journalize Brook Company's salaries and wages expense accrual for the current pay period. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 Requirement 3. Journalize Brook Company's expenses for employer payroll taxes for the current pay period. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Date Accounts and Explanation Debit Credit Requirement 4. Journalize the payment to employees. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Requirement 5. Journalize the payment for withholdings and employer payroll taxes. (Round all amounts to the nearest cent. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit