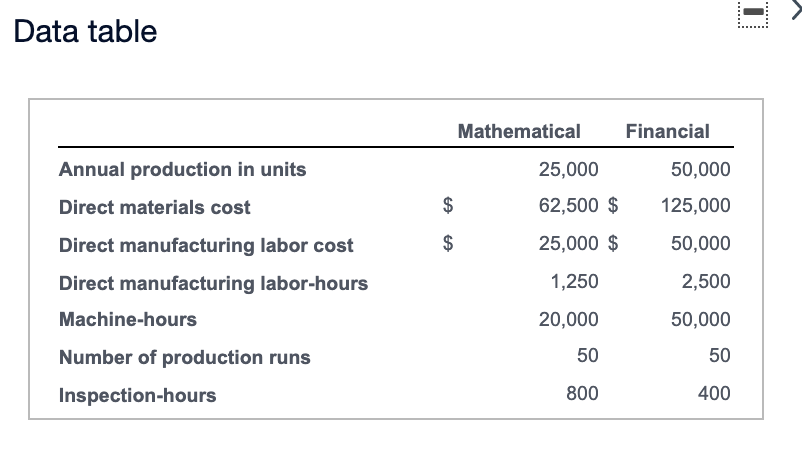

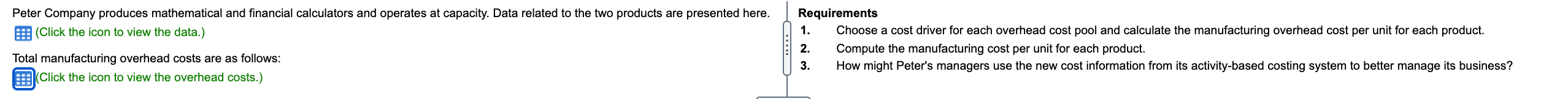

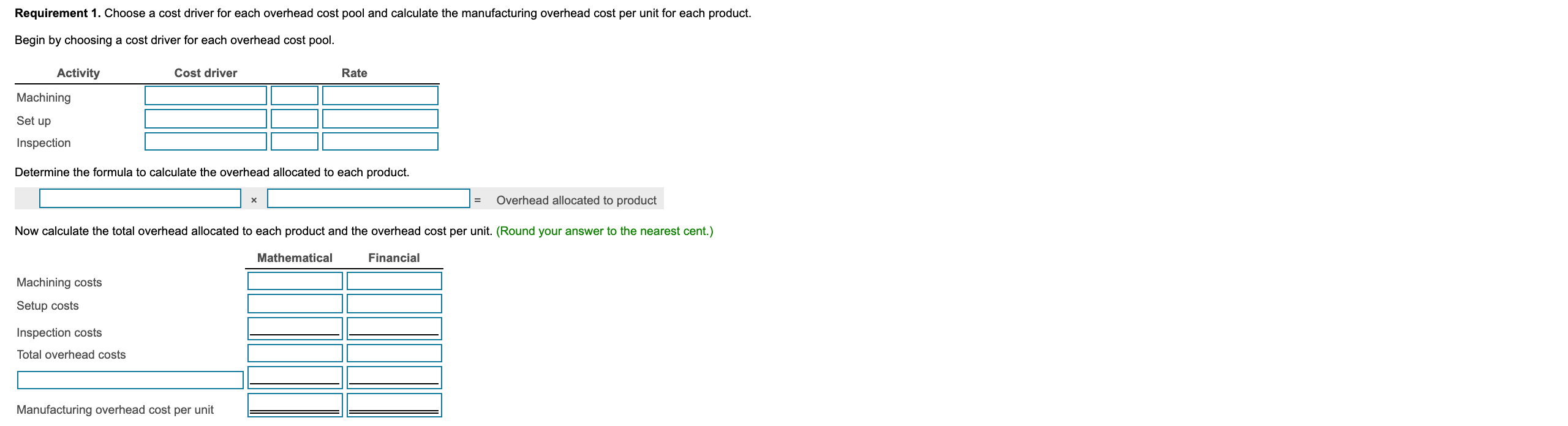

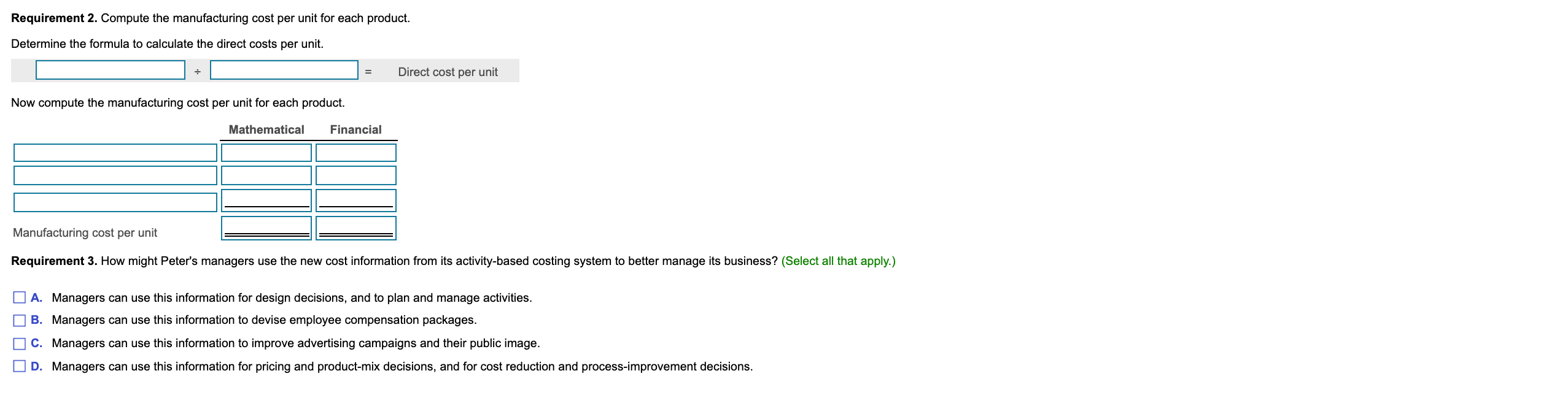

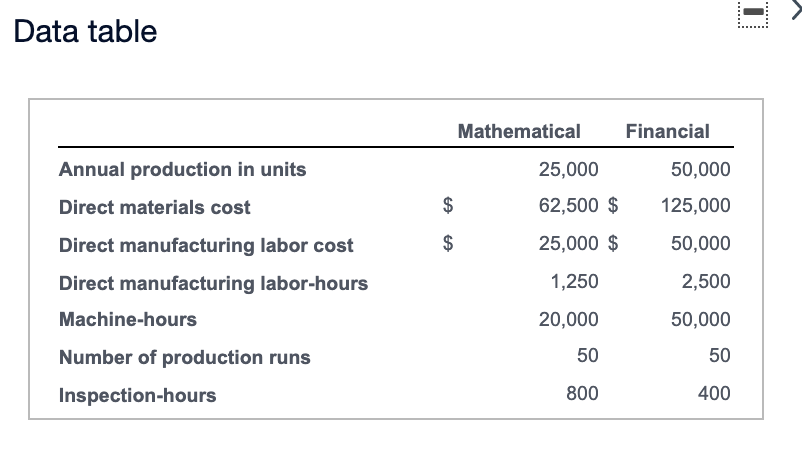

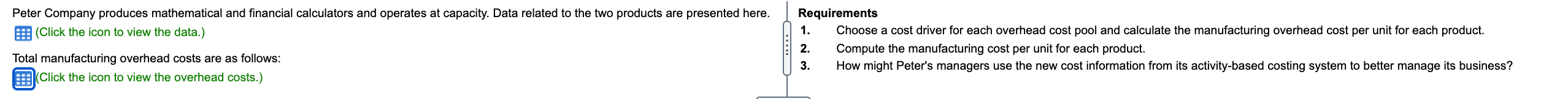

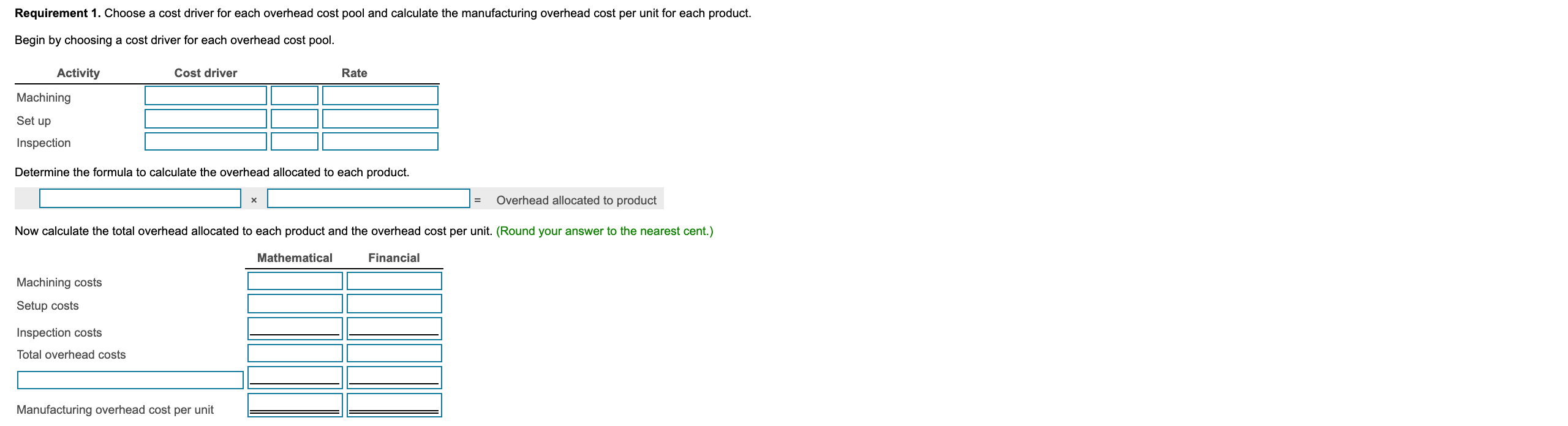

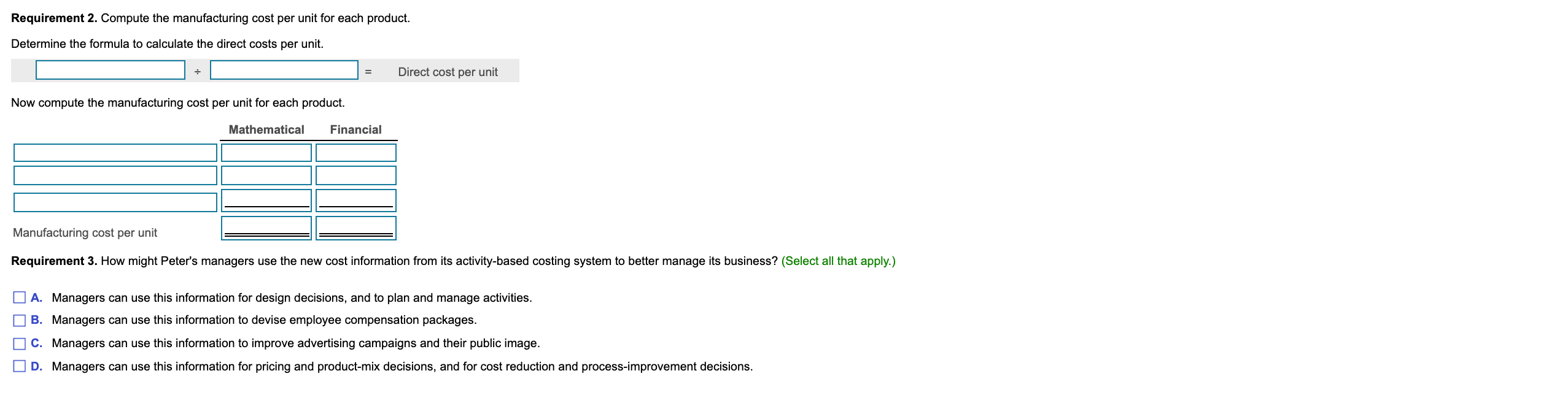

Data table Financial Mathematical 25,000 Annual production in units 50,000 Direct materials cost $ 62,500 $ 125,000 $ 25,000 $ 50,000 1,250 2,500 Direct manufacturing labor cost Direct manufacturing labor-hours Machine-hours Number of production runs Inspection-hours 50,000 20,000 50 50 800 400 Data table Total Machining costs $ 350,000 Setup costs 117,000 Inspection costs 96,000 Peter Company produces mathematical and financial calculators and operates at capacity. Data related to the two products are presented here. (Click the icon to view the data.) Total manufacturing overhead costs are as follows: Click the icon to view the overhead costs.) Requirements 1. Choose a cost driver for each overhead cost pool and calculate the manufacturing overhead cost per unit for each product. 2. Compute the manufacturing cost per unit for each product. 3. How might Peter's managers use the new cost information from its activity-based costing system to better manage its business? Requirement 1. Choose a cost driver for each overhead cost pool and calculate the manufacturing overhead cost per unit for each product. Begin by choosing a cost driver for each overhead cost pool. Cost driver Rate Activity Machining Set up Inspection Determine the formula to calculate the overhead allocated to each product. X = Overhead allocated to product Now calculate the total overhead allocated to each product and the overhead cost per unit. (Round your answer to the nearest cent.) Mathematical Financial Machining costs Setup costs Inspection costs Total overhead costs Manufacturing overhead cost per unit Requirement 2. Compute the manufacturing cost per unit for each product. Determine the formula to calculate the direct costs per unit. - = Direct cost per unit Now compute the manufacturing cost per unit for each product. Mathematical Financial Manufacturing cost per unit Requirement 3. How might Peter's managers use the new cost information from its activity-based costing system to better manage its business? (Select all that apply.) 0 0 A. Managers can use this information for design decisions, and to plan and manage activities. B. Managers can use this information to devise employee compensation packages. C. Managers can use this information to improve advertising campaigns and their public image. D. Managers can use this information for pricing and product-mix decisions, and for cost reduction and process-improvement decisions