Answered step by step

Verified Expert Solution

Question

1 Approved Answer

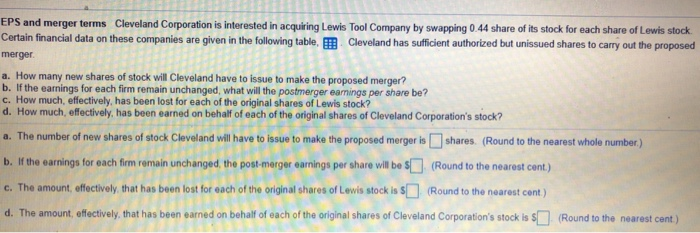

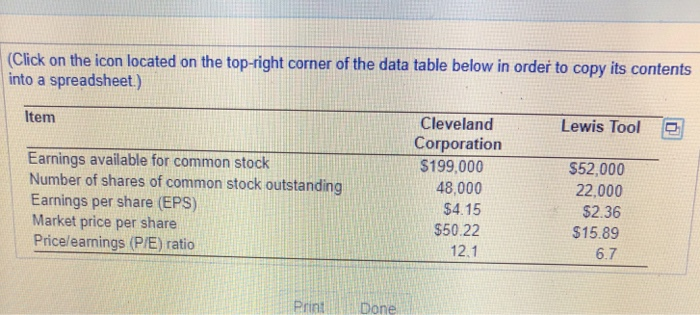

data table in second pic :) EPS and merger terms Cleveland Corporation is interested in acquiring Lewis Tool Company by swapping 0.44 share of ts

data table in second pic :)

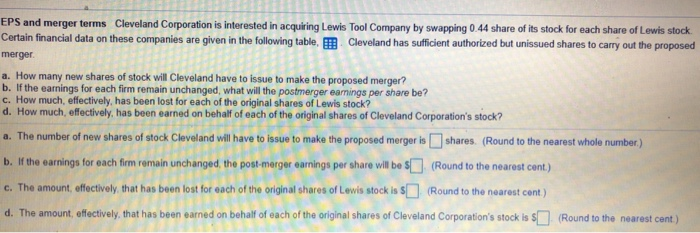

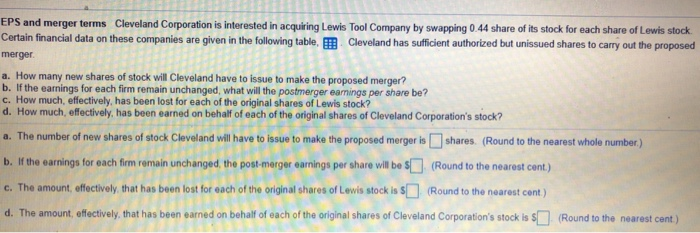

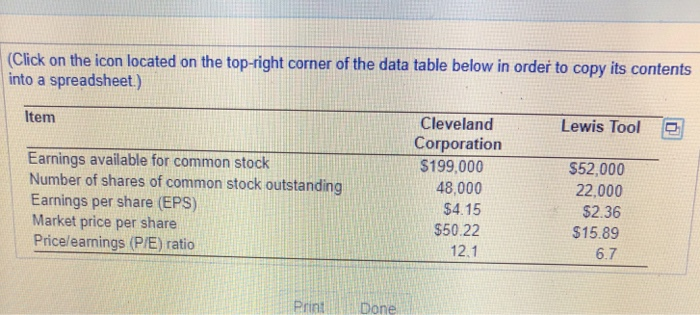

EPS and merger terms Cleveland Corporation is interested in acquiring Lewis Tool Company by swapping 0.44 share of ts stock for each share of Lewis stock Certain financial data on these companies are given in the following table, EB Cleveland has sufficient authorized but unissued shares to carry out the proposed merger a. How many new shares of stock will Cleveland have to issue to make the proposed merger? b. If the earnings for each firm remain unchanged, what will the postmerger eanings per share be? c. How much, effectively, has been lost for each of the original shares of Lewis stock? d. How much, effectively, has been earned on behalf of each of the original shares of Cleveland Corporation's stock? a. The number of new shares of stock Cleveland will have to issue to make the proposed merger is shares, (Round to the nearest whole number) b. If the earnings for each firm remain unchanged, the post-merger earnings per share will be S(Round to the nearest cent) c. The amount offectively, that has been lost for each of the original shares of Lewis stock is Round to the nearest cont) d. The amount, offectively, that has been earned on behalf of each of the original shares of Cleveland Corporation's stock is s(Round to the nearest cent ) (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet) Item Cleveland Corporation $199,000 48,000 $4.15 $50.22 12.1 Lewis Tool Earnings available for common stock Number of shares of common stock outstanding Earnings per share (EPS) Market price per share Price/earnings (P/E) ratio $52,000 22,000 $2.36 $15.89 6.7 Print Done

EPS and merger terms Cleveland Corporation is interested in acquiring Lewis Tool Company by swapping 0.44 share of ts stock for each share of Lewis stock Certain financial data on these companies are given in the following table, EB Cleveland has sufficient authorized but unissued shares to carry out the proposed merger a. How many new shares of stock will Cleveland have to issue to make the proposed merger? b. If the earnings for each firm remain unchanged, what will the postmerger eanings per share be? c. How much, effectively, has been lost for each of the original shares of Lewis stock? d. How much, effectively, has been earned on behalf of each of the original shares of Cleveland Corporation's stock? a. The number of new shares of stock Cleveland will have to issue to make the proposed merger is shares, (Round to the nearest whole number) b. If the earnings for each firm remain unchanged, the post-merger earnings per share will be S(Round to the nearest cent) c. The amount offectively, that has been lost for each of the original shares of Lewis stock is Round to the nearest cont) d. The amount, offectively, that has been earned on behalf of each of the original shares of Cleveland Corporation's stock is s(Round to the nearest cent ) (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet) Item Cleveland Corporation $199,000 48,000 $4.15 $50.22 12.1 Lewis Tool Earnings available for common stock Number of shares of common stock outstanding Earnings per share (EPS) Market price per share Price/earnings (P/E) ratio $52,000 22,000 $2.36 $15.89 6.7 Print Done

data table in second pic :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started