Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data table Irate assuming that Cregg's expects to incur 26,000 total DL hours during the yea (Round your answer to the nearest whole dollar.) Haas

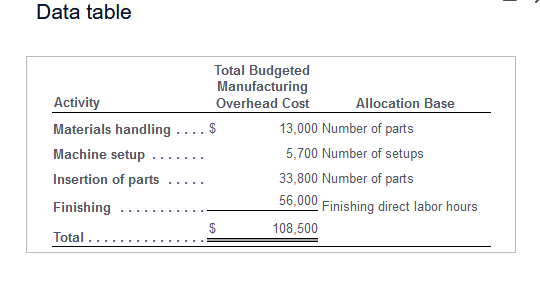

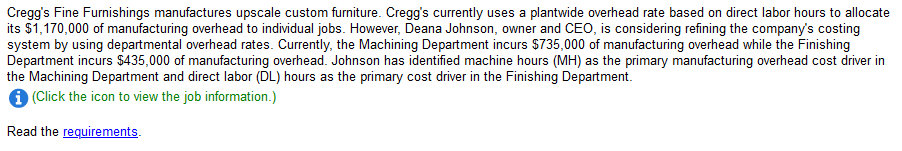

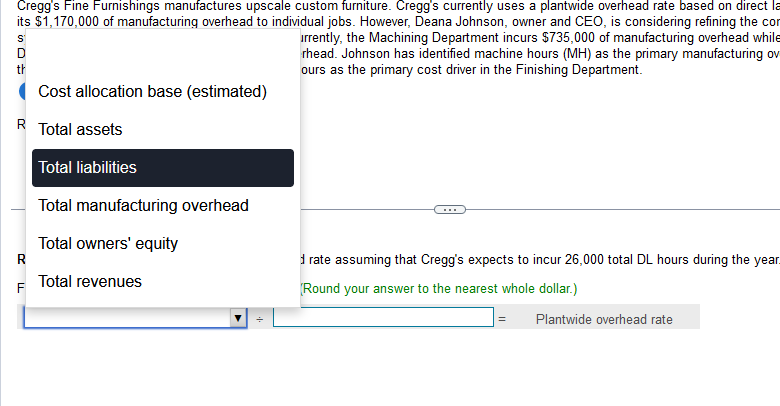

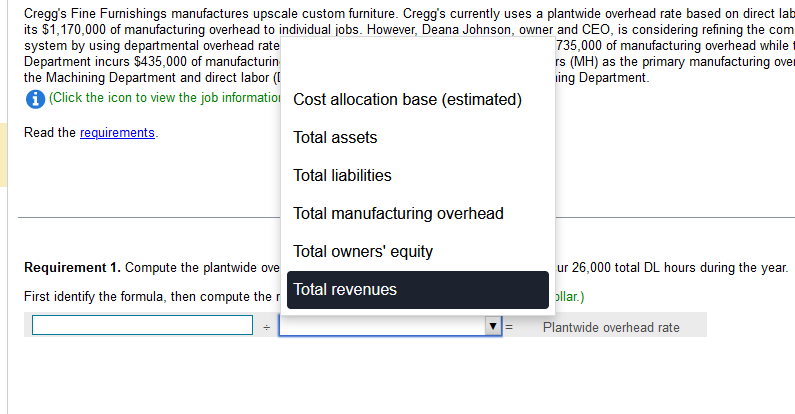

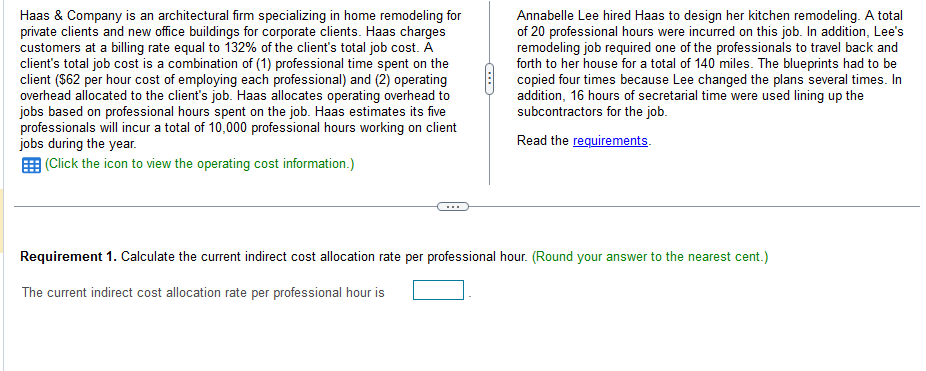

Data table Irate assuming that Cregg's expects to incur 26,000 total DL hours during the yea (Round your answer to the nearest whole dollar.) Haas \& Company is an architectural firm specializing in home remodeling for private clients and new office buildings for corporate clients. Haas charges customers at a billing rate equal to 132% of the client's total job cost. A client's total job cost is a combination of (1) professional time spent on the client (\$62 per hour cost of employing each professional) and (2) operating overhead allocated to the client's job. Haas allocates operating overhead to jobs based on professional hours spent on the job. Haas estimates its five professionals will incur a total of 10,000 professional hours working on client jobs during the year. (Click the icon to view the operating cost information.) Annabelle Lee hired Haas to design her kitchen remodeling. A total of 20 professional hours were incurred on this job. In addition, Lee's remodeling job required one of the professionals to travel back and forth to her house for a total of 140 miles. The blueprints had to be copied four times because Lee changed the plans several times. In addition, 16 hours of secretarial time were used lining up the subcontractors for the job. Read the requirements. Requirement 1. Calculate the current indirect cost allocation rate per professional hour. (Round your answer to the nearest cent.) The current indirect cost allocation rate per professional hour is Franklin Company uses ABC to account fu chrome wheel manufacturing process. Cor managers have identified four manufacturir activities that incur manufacturing overhea materials handling, machine setup, inserti parts, and finishing. The budgeted activity for the upcoming year and their allocation are as follows: (Click the icon to view the data.) Requirement 1. Compute the cost alloca compute the rate for each activity. Cregg's Fine Furnishings manufactures upscale custom furniture. Cregg's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,170,000 of manufacturing overhead to individual jobs. However, Deana Johnson, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $735,000 of manufacturing overhead while the Finishing Department incurs $435,000 of manufacturing overhead. Johnson has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department. (Click the icon to view the job information.) Cregg's Fine Furnishings manufactures upscale custom furniture. Cregg's currently uses a plantwide overhead rate based on direct lab its $1,170,000 of manufacturina nverhead to individual inhs However Deana .Inhnson nwner and C.FO is c.nnsidering refining the com system by using dep Department incurs $4 :uring overhead while the Machining Depart ary manufacturing ove (Click the icon to Read the requirement Requirement 1. Corr ours during the year. First identify the form

Data table Irate assuming that Cregg's expects to incur 26,000 total DL hours during the yea (Round your answer to the nearest whole dollar.) Haas \& Company is an architectural firm specializing in home remodeling for private clients and new office buildings for corporate clients. Haas charges customers at a billing rate equal to 132% of the client's total job cost. A client's total job cost is a combination of (1) professional time spent on the client (\$62 per hour cost of employing each professional) and (2) operating overhead allocated to the client's job. Haas allocates operating overhead to jobs based on professional hours spent on the job. Haas estimates its five professionals will incur a total of 10,000 professional hours working on client jobs during the year. (Click the icon to view the operating cost information.) Annabelle Lee hired Haas to design her kitchen remodeling. A total of 20 professional hours were incurred on this job. In addition, Lee's remodeling job required one of the professionals to travel back and forth to her house for a total of 140 miles. The blueprints had to be copied four times because Lee changed the plans several times. In addition, 16 hours of secretarial time were used lining up the subcontractors for the job. Read the requirements. Requirement 1. Calculate the current indirect cost allocation rate per professional hour. (Round your answer to the nearest cent.) The current indirect cost allocation rate per professional hour is Franklin Company uses ABC to account fu chrome wheel manufacturing process. Cor managers have identified four manufacturir activities that incur manufacturing overhea materials handling, machine setup, inserti parts, and finishing. The budgeted activity for the upcoming year and their allocation are as follows: (Click the icon to view the data.) Requirement 1. Compute the cost alloca compute the rate for each activity. Cregg's Fine Furnishings manufactures upscale custom furniture. Cregg's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,170,000 of manufacturing overhead to individual jobs. However, Deana Johnson, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $735,000 of manufacturing overhead while the Finishing Department incurs $435,000 of manufacturing overhead. Johnson has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department. (Click the icon to view the job information.) Cregg's Fine Furnishings manufactures upscale custom furniture. Cregg's currently uses a plantwide overhead rate based on direct lab its $1,170,000 of manufacturina nverhead to individual inhs However Deana .Inhnson nwner and C.FO is c.nnsidering refining the com system by using dep Department incurs $4 :uring overhead while the Machining Depart ary manufacturing ove (Click the icon to Read the requirement Requirement 1. Corr ours during the year. First identify the form Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started