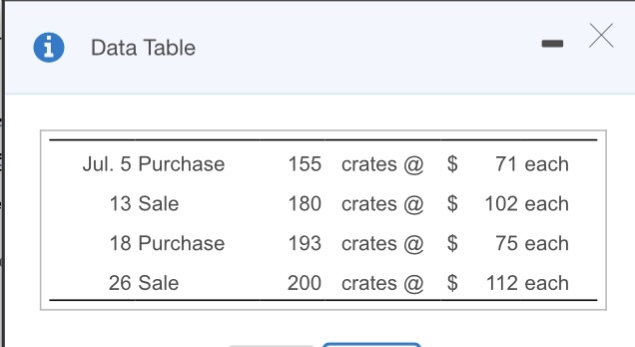

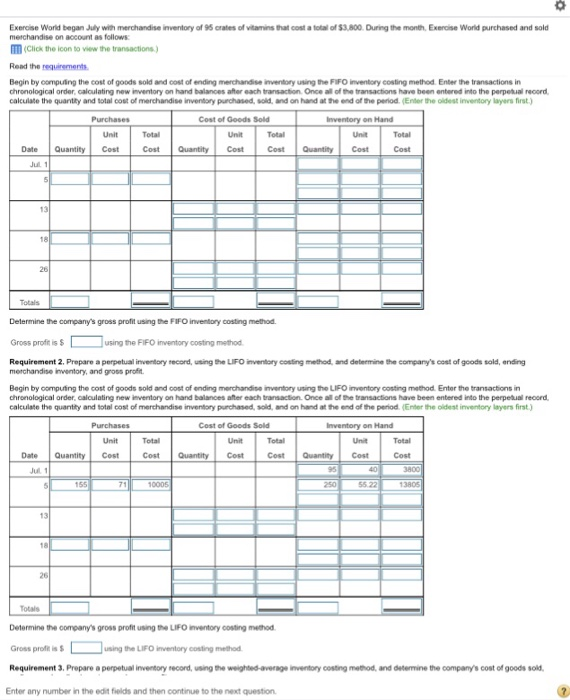

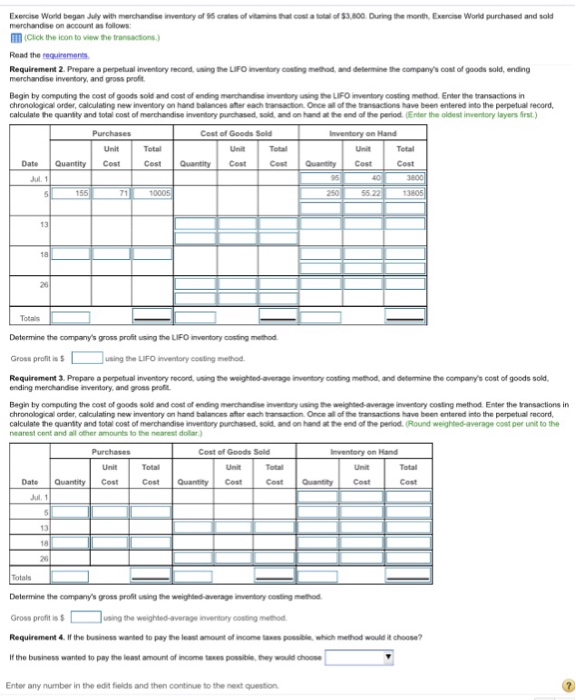

Data Table Jul. 5 Purchase 155 crates@ $ 71 each 180 crates $ 102 each 18 Purchase 193 crates @75 each 200 crates $ 112 each 13 Sale 26 Sale Exeroise World began July with merchandise inventory of 95 orates of vitamins thait cost a total of $3,800. During the month, Exercise World purchased and sold merchandise on account as follows (Click the icon to view the transactions) Read the requirements Begin by compuing the cost of goods sold and cost of ending merchandise inventory using the FiFO inventory costing method. Enter the transactions in calculate the quantty and total cost of merhandise inventory puchased, sold, and on hand at e d afthe period (Efter the oldest inventory layers first ) Cost of Goods Sold Iinventory on Hand Unit Total Unit Total Date Quantity CostCostQuantity Cost Cost Quantity Cot Cost Jul 1 18 Determine the company's gross profit using the FIFO inventory costing method Gross profr is using the FIFO inventory costing method Requirement 2. Prepare a perpetual inventory record, using the LiFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit Begin by oomputing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpebual reoord calculate the quantty and total cost of merhandise inventory purchased, sold, and on hand at te d ofte period (Enter the oldest inventory layers first ) Cest of Goods Sold Total Unit Total Date Quantity Cost CostQuantity Cost Cost Quantity CostCost 55.22 Determine the company's gross profit using the LIFO inventory costing method Gros, prof. is $ Requirement 3. Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold Enter any number in the edit felds and then continue to the next question using the LIFO inventory costing method Exercise world began Jdy with merchandise rwert ry of 95 crates of venus Ful costa wai of $3.800 Dng more, Exerase word purchased and sold merchandise on account as follows III (Cick the icon to view the transactions Read the requirements Requirement 2. Prepare a perpetual inventory recond, using the LiFO inventory costing method and delermine the company's cost of goods sold, ending merchandise inventory, and gross profit Begin by computing the cost of goods sold and cost of drg mwehandse mw LFO mentory coshg method Enter te transactors r calculate te quantty and total cost of merchandise rwertory pundased sold ontw d the end af te peod (Enter the oldest inventory layers first.) Cest of Goods Sold Unit Total Date QuantityCstCost Quantity Cst Cest Quantity Cost Cost Jul. 1 155 0005 55 22 Determine the company's gross profit using the LIFO inventory costing method Gross profit is using the LIFO inventory costing mmethod Requirernent 3. Prepare a perpetual invortory record, usig te we ghtedo ending merchandise inventory, and gross proft -g-od. and ommine the company's cost of goods sold. n Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted-average inventory costing method. Enter the transactions in chronologcal order, calculating new mortory on hand balances each tasador Oon ae of transactons have been entered rto the perpetual record, calculate the quanity and total cost of merchandise inventory purchased, sold and on hand at the end of the perod. (Round weighted-average cost per unit to the nearest cent and ail other amounts to the nearest dolar) Cost of Goods Sold Unit Total Unit Unit Total Date QuantityCostCostQuantity CostCostQuantity Cost Jul, 1 Determine the company's gross pedi g the weightedavetage mert oosing Gross profit is Requirement 4 " the busness warted to pay he least arout of mone "es posst" wid method would If the business wanted to pay the least amount of income taxes possible, ey would choose Enter any number in the edit fields and then continue to the next question [usngthe weighted.veragementory costg "tod choose