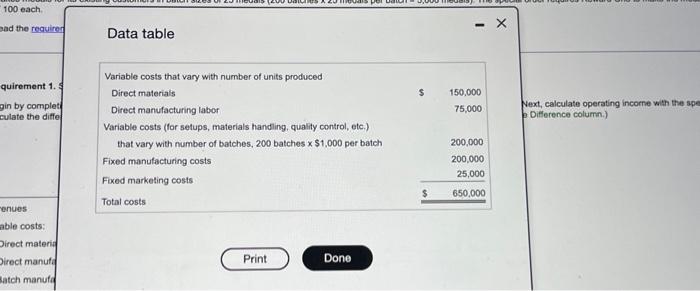

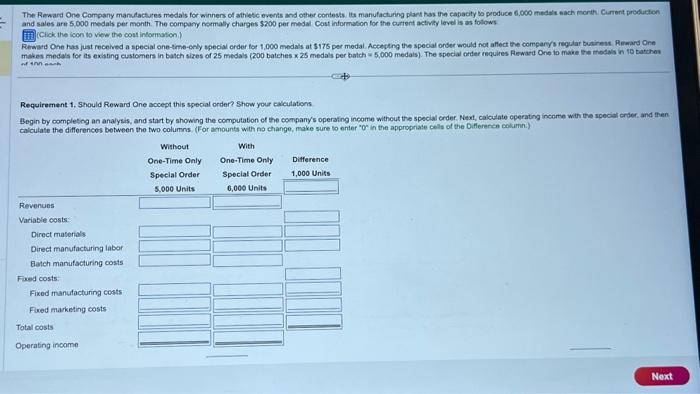

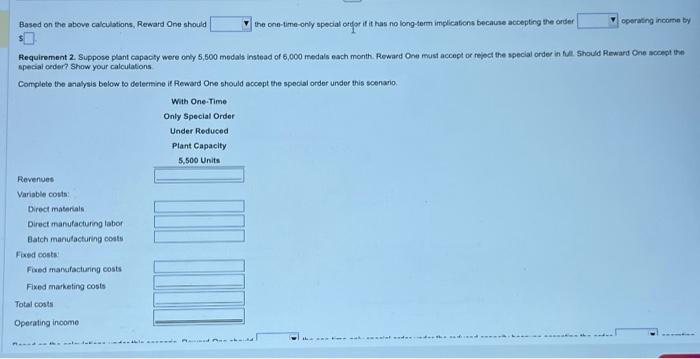

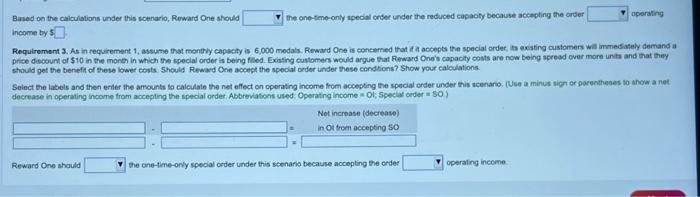

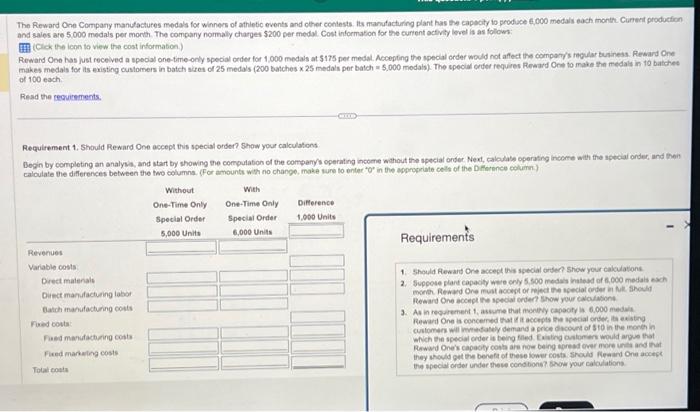

Data table Next, calculate operating incorne with the spe (3 Difference column.) The Reward One Company manulactures medals for winners of athesc events and other contests. lta manufacturing plant has the capacily bo produce 6,000 medali nach morth. Cinent producton and sales arn 5,000 medals per month. The company noemaby charges $200 per medal Cost information for the curtert activiy level is as folow (Cick the icon to view the cout intormation)] makes medals for as exabing customers in batch sizes of 25 medals (200 batches x25 medals per balch =5,000 medals). The special order tequires Reward One to make the modals in fo tatches Requirement 1, Should Reward One accept this special order? Show your calculations Begin by completing an analysis, and start by showing the computation of the company's operating income without the special order, Next, calculate operating incorte with the special arater. and then calculate the differences between the two columns. (For amounts with no change, make sure to enter "O" in the appropriate cels of the Difierence cokumn.) Based on the above calculations, Revard One should the onn-timn-only apecial ordgr if it has no long-serm implications because accepting the order: speciat order? Show your calculations Complete the analysis below to determine if Reward One should occept the spocial ordor undor this scenario. Based on the cilculations under this scenario, Pewward One should the one-time-only special arder under the reduced capacty because accepting the order operaling income by 5 should get the benefit of these lower costs. Should Reward One acoept the special oeder under these condbions? Show your calculations. decrease in operating income from accepting the special order. Abbrevasons used: Operating income in OI; Speclat order in 50 ) Not incroase (decrease) in oi trom accepting 30 Reward One shauld the one-time-only special order under this scenario because aocopting the order operating income The Reward One Company manutactures modals for winnecs of athletic events and oher coniests. its manufacturing plant has the capecity io produce f.000 medals each month. Cirnert producfion and saies are 5,000 medals per month. The company nombaly charges $200 per medal Cost information for the curient octivity level is as follow? FHI (Cick the icon to vew the cost information.) of 100 each Resd the reovitements. Recuirement 1. Should Reward One accept this special order? Show your caiculations Begin by completing an analywis, and start ty showing the compulabion of the comparys operating income wathout the special order Next, calculate operating incore with the apecial order, and theit. calculate the difierences between the two columns. (For amounts wth no change, make wure to enter "or" in the approperiate cels of the Diflorence column?) Requirements 1. Should Hewart Ore acced tis special orter? show your caloulations 2. Suppose plart capacily were only 5.500 medals inategd of 6,000 medais exh Reased One accept the speciat ordert Show your calovasont 3. As in reopenenent 1 , aswume that modryy capooty in 6.000 medwa Rewid One's capeoty coet are now being worest over more urta and that they mould get the benefa of these lower costs. Should Fegand One aocest the apeciar order under thece constions? Bhaw your calolatione