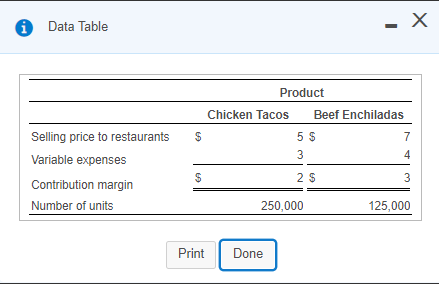

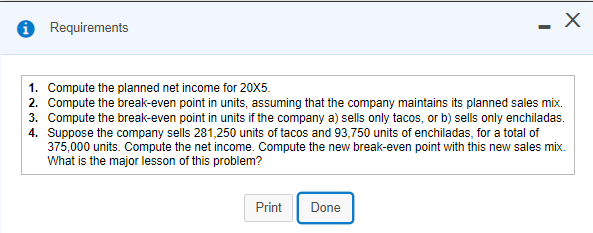

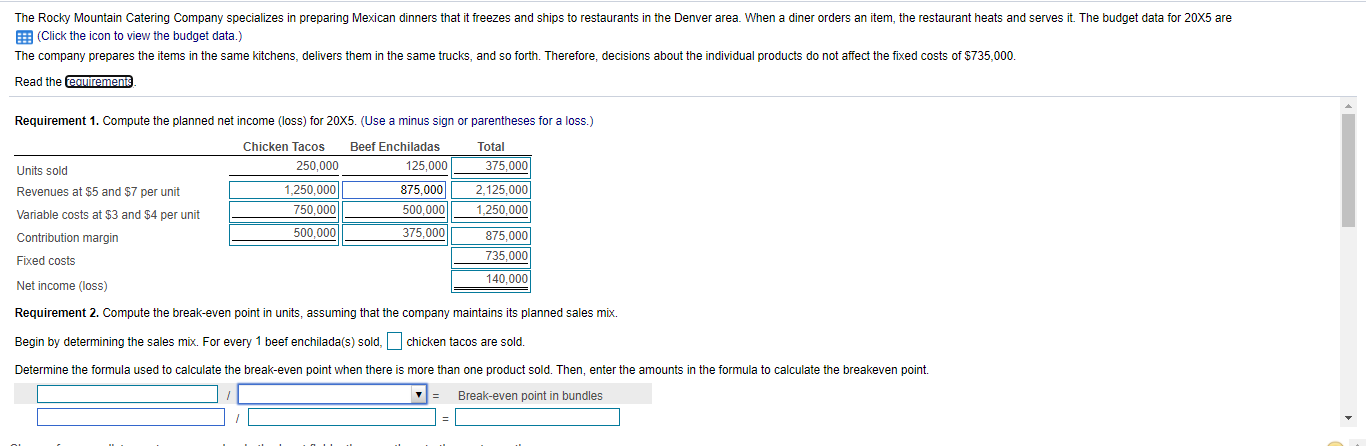

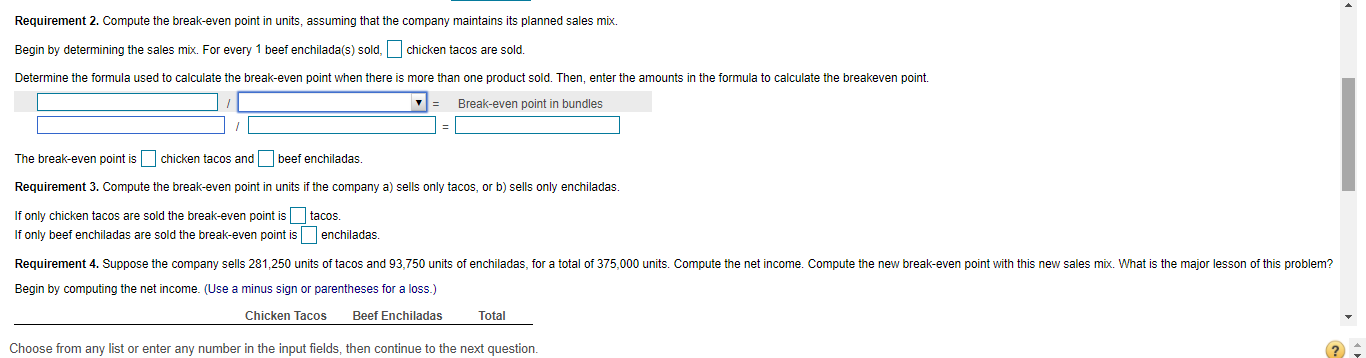

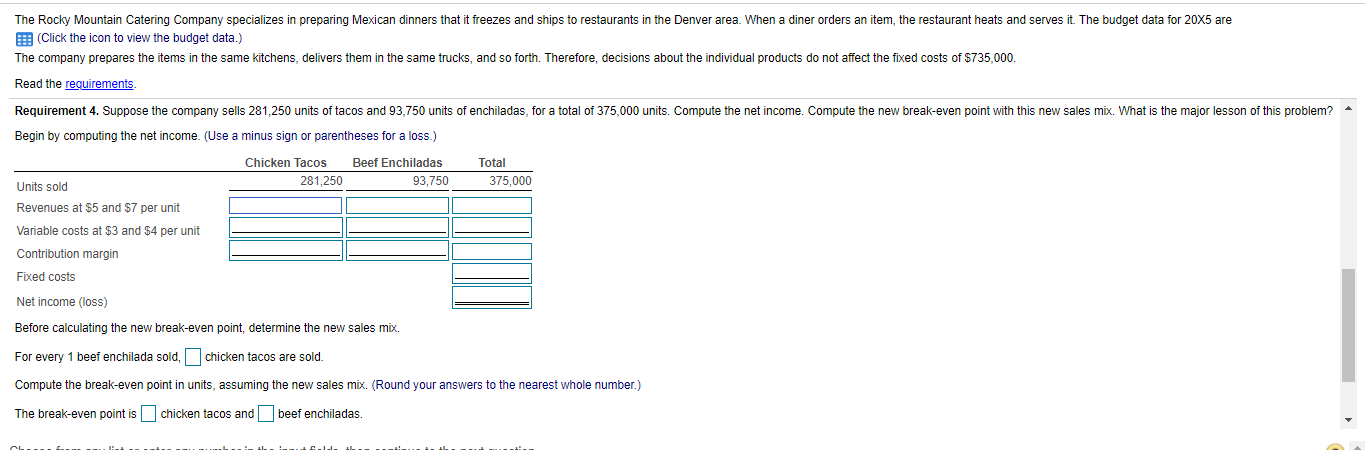

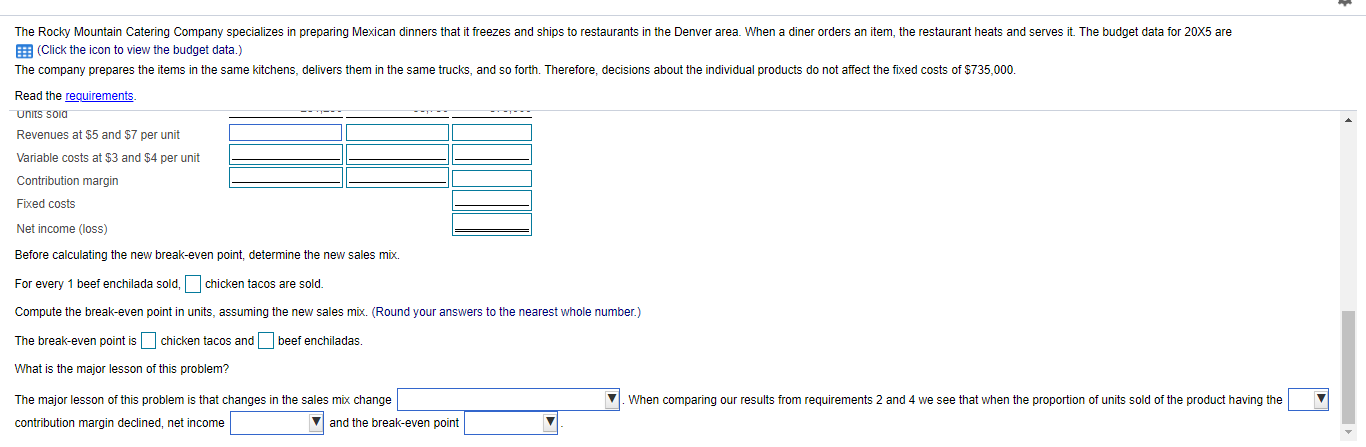

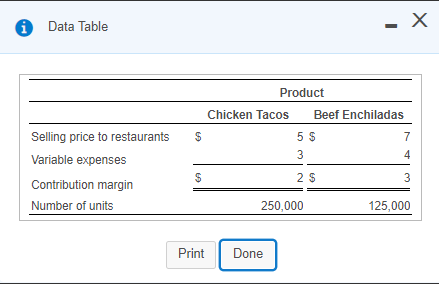

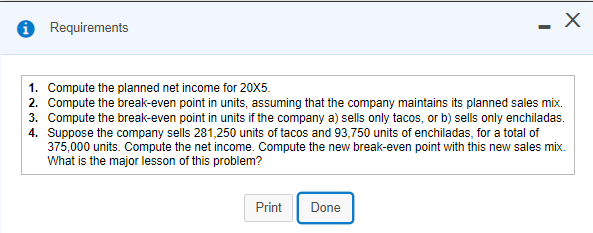

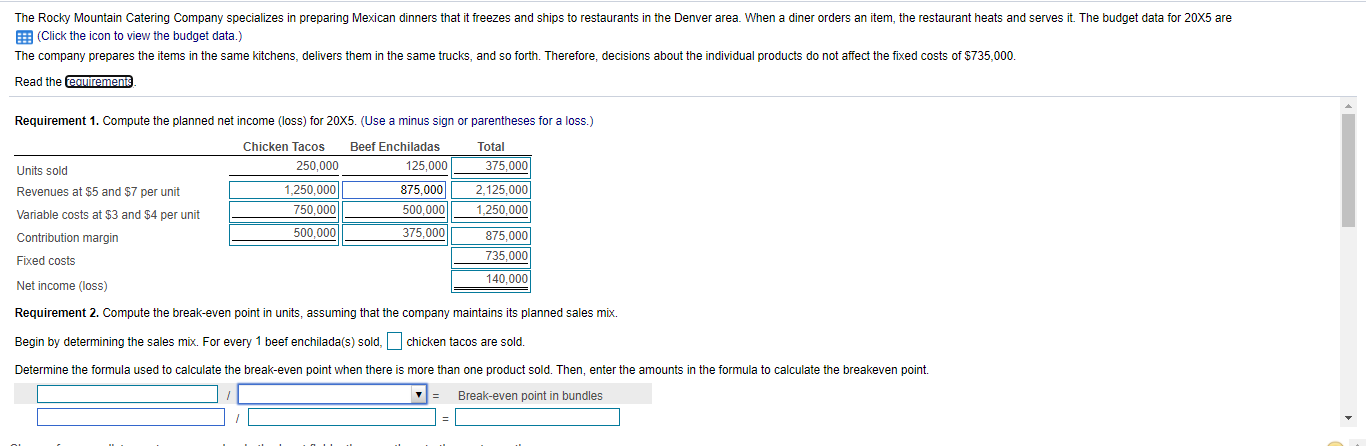

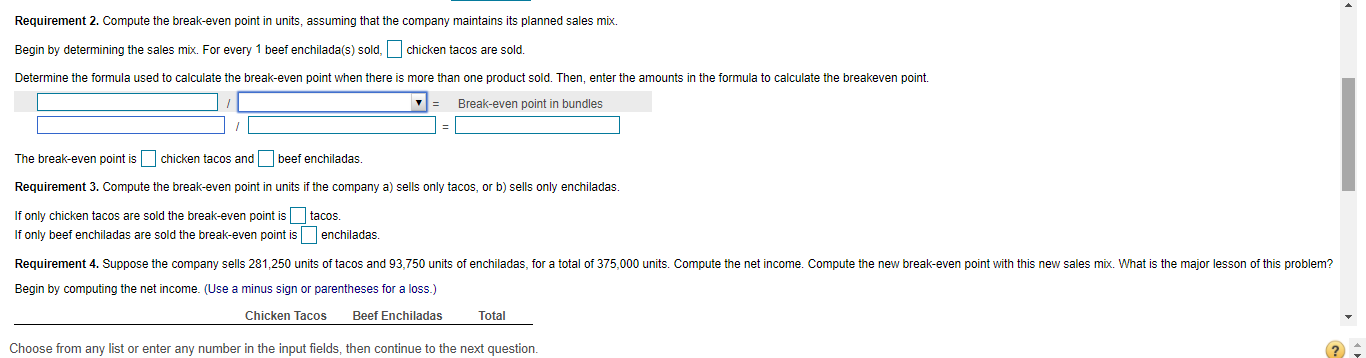

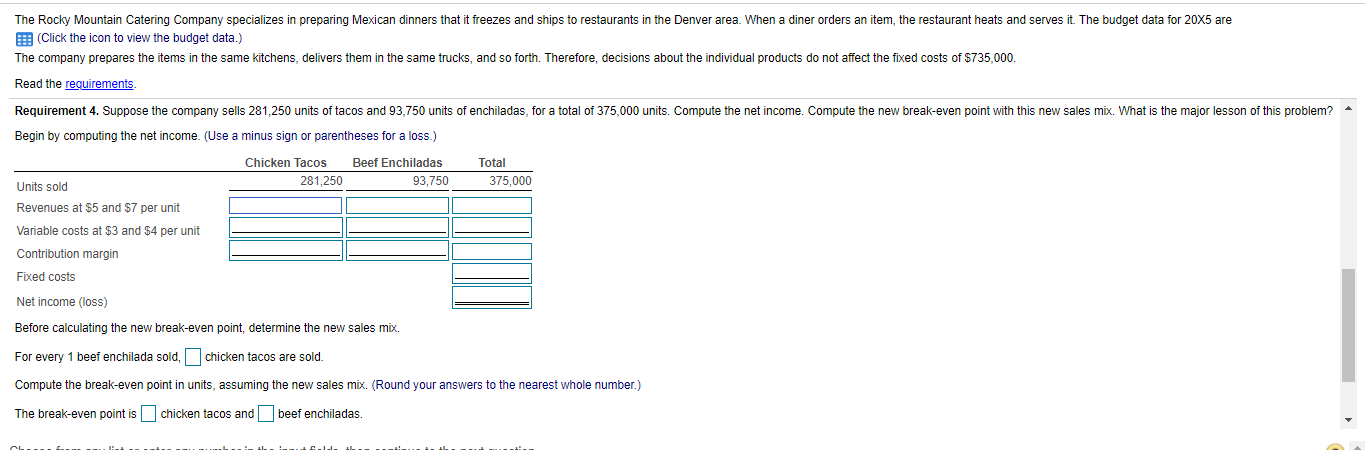

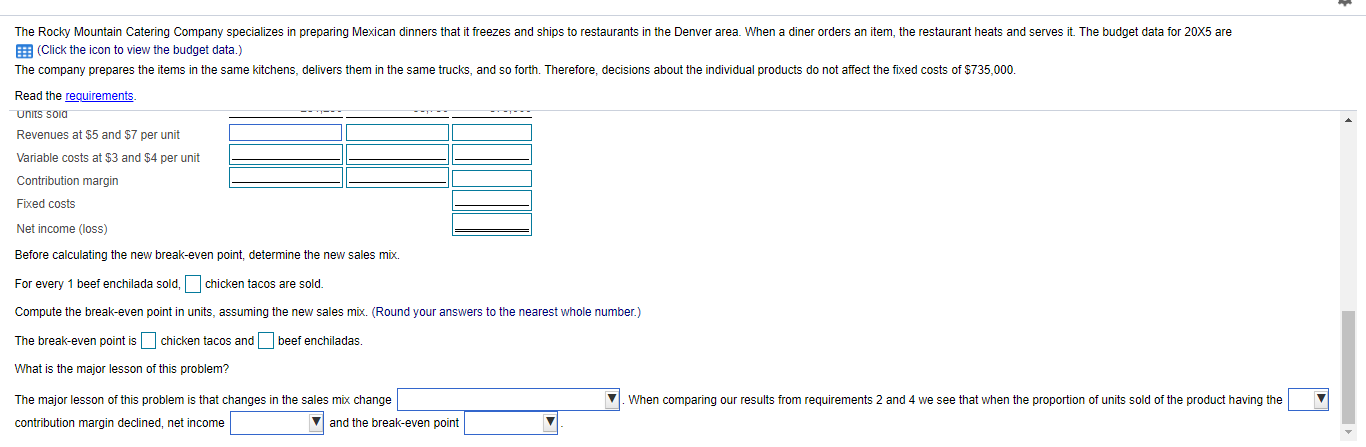

* Data Table Product Chicken Tacos Beef Enchiladas 5 $ 7 3 4 $ Selling price to restaurants Variable expenses Contribution margin Number of units $ 2$ 3 250,000 125,000 Print Done - X Requirements 1. Compute the planned net income for 20X5. 2. Compute the break-even point in units, assuming that the company maintains its planned sales mix. 3. Compute the break-even point in units if the company a) sells only tacos, or b) sells only enchiladas. 4. Suppose the company sells 281,250 units of tacos and 93,750 units of enchiladas, for a total of 375,000 units. Compute the net income. Compute the new break-even point with this new sales mix. What is the major lesson of this problem? Print Done The Rocky Mountain Catering Company specializes in preparing Mexican dinners that it freezes and ships to restaurants in the Denver area. When a diner orders an item, the restaurant heats and serves it. The budget data for 20x5 are (Click the icon to view the budget data.) The company prepares the items in the same kitchens, delivers them in the same trucks, and so forth. Therefore, decisions about the individual products do not affect the fixed costs of $735,000. Read the fequirements Requirement 1. Compute the planned net income (loss) for 20X5. (Use a minus sign parentheses for a loss.) Chicken Tacos 250,000 Beef Enchiladas 125,000 Units sold Revenues at $5 and $7 per unit Variable costs at $3 and $4 per unit Total 375,000 2,125,000 1,250,000 1,250.000 750,000 875,000 500.000 375,000 Contribution margin 500,000 875,000 735,000 Fixed costs 140,000 Net income (loss) Requirement 2. Compute the break-even point in units, assuming that the company maintains its planned sales mix. Begin by determining the sales mix. For every 1 beef enchilada(s) sold, chicken tacos are sold. Determine the formula used to calculate the break-even point when there is more than one product sold. Then, enter the amounts in the formula to calculate the breakeven point. Break-even point in bundles Requirement 2. Compute the break-even point in units, assuming that the company maintains its planned sales mix. Begin by determining the sales mix. For every 1 beef enchilada(s) sold, chicken tacos are sold. Determine the formula used to calculate the break-even point when there is more than one product sold. Then, enter the amounts in the formula to calculate the breakeven point. Break-even point in bundles The break-even point is chicken tacos and beef enchiladas. Requirement 3. Compute the break-even point in units if the company a) sells only tacos, or b) sells only enchiladas. If only chicken tacos are sold the break-even point is tacos. If only beef enchiladas are sold the break-even point is enchiladas. Requirement 4. Suppose the company sells 281,250 units of tacos and 93,750 units of enchiladas, for a total of 375,000 units. Compute the net income. Compute the new break-even point with this new sales mix. What is the major lesson of this problem? Begin by computing the net income. (Use a minus sign or parentheses for a loss.) Chicken Tacos Beef Enchiladas Total Choose from any list or enter any number in the input fields, then continue to the next question. The Rocky Mountain Catering Company specializes in preparing Mexican dinners that it freezes and ships to restaurants in the Denver area. When a diner orders an item, the restaurant heats and serves it. The budget data for 20x5 are (Click the icon to view the budget data.) The company prepares the items in the same kitchens, delivers them in the same trucks, and so forth. Therefore, decisions about the individual products do not affect the fixed costs of $735,000. Read the requirements Requirement 4. Suppose the company sells 281,250 units of tacos and 93,750 units of enchiladas, for a total of 375,000 units. Compute the net income. Compute the new break-even point with this new sales mix. What is the major lesson of this problem? Begin by computing the net income. (Use a minus sign or parentheses for a loss.) Chicken Tacos 281,250 Beef Enchiladas 93,750 Total 375,000 Units sold Revenues at $5 and $7 per unit Variable costs at $3 and $4 per unit Contribution margin Fixed costs Net income (loss) Before calculating the new break-even point, determine the new sales mix. For every 1 beef enchilada sold, chicken tacos are sold. Compute the break-even point in units, assuming the new sales mix. (Round your answers to the nearest whole number.) The break-even point is chicken tacos and beef enchiladas. The Rocky Mountain Catering Company specializes in preparing Mexican dinners that it freezes and ships to restaurants in the Denver area. When a diner orders an item, the restaurant heats and serves it. The budget data for 20x5 are (Click the icon to view the budget data.) The company prepares the items in the same kitchens, delivers them in the same trucks, and so forth. Therefore, decisions about the individual products do not affect the fixed costs of $735,000. Read the requirements UNITS sold Revenues at $5 and $7 per unit Variable costs at $3 and $4 per unit Contribution margin Fixed costs Net income (loss) Before calculating the new break-even point, determine the new sales mix. For every 1 beef enchilada sold, chicken tacos are sold. Compute the break-even point in units, assuming the new sales mix. (Round your answers to the nearest whole number.) The break-even point is chicken tacos and beef enchiladas. What is the major lesson of this problem? When comparing our results from requirements 2 and 4 we see that when the proportion of units sold of the product having the The major lesson of this problem is that changes in the sales mix change contribution margin declined, net income and the break-even point