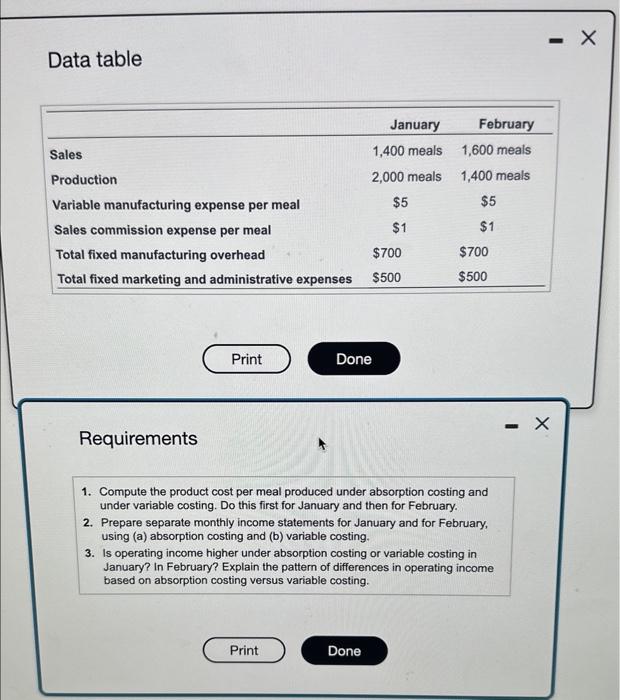

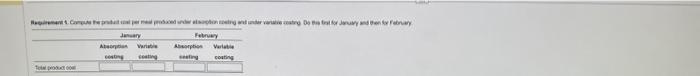

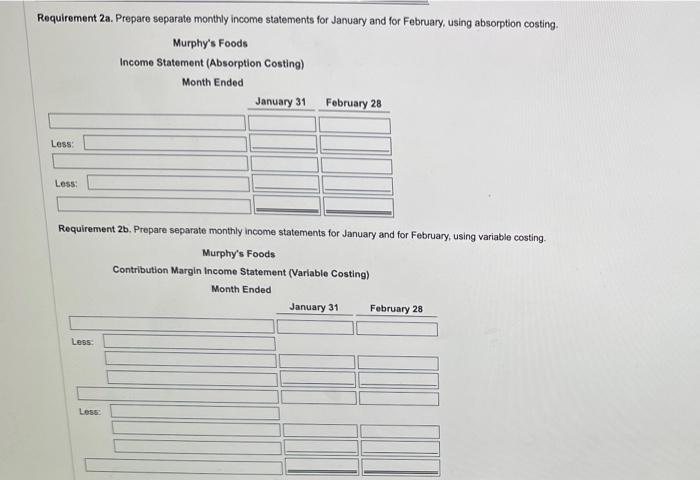

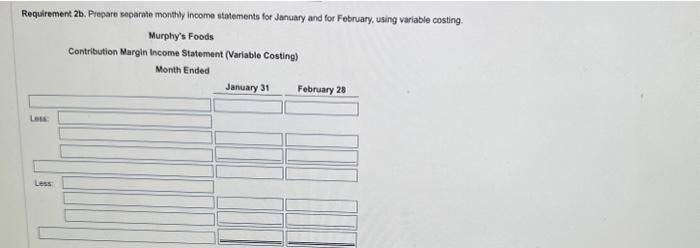

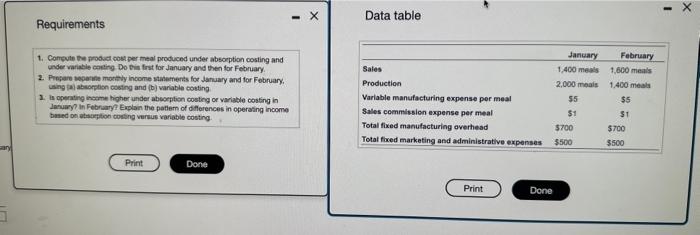

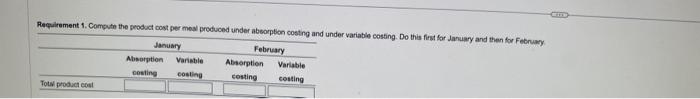

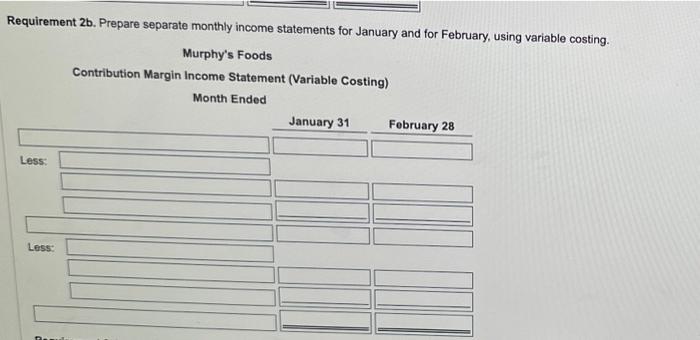

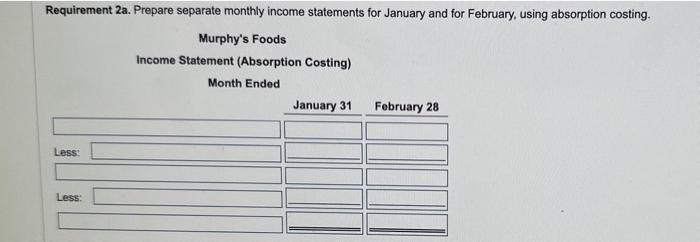

Data table Requirements 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February. 2. Prepare separate monthly income statements for January and for February, using (a) absorption costing and (b) variable costing. 3. Is operating income higher under absorption costing or variable costing in January? In February? Explain the pattern of differences in operating income based on absorption costing versus variable costing. Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing. Murphy's Foods Income Statement (Absorption Costing) Month Ended Requirement 2b. Prepare separate monthly income statements for January and for February, using variable costing. Requirement 2b, Prepare separate monthly income statements for January and for Fobruary, using variable costing Murphy's Foods Contribution Margin Income Statement (Variable Costing) Month Findad Acesgne inatry aras aume it mennen Hi matiof Data table Requirements 1. Consule the frobuct oots per meal produced under absorption costing and under variabie coeting Do bin frst for January and then for February. 2. Pnoqare beperite morthly income stabements foe danuary and for Fobruary. using ( al absoptisn costing and (b) variable cotting 2. Is operating inome higher under aboseption costing or variable costing in daculey? in Febraty? Euplain the patlem of differences in operating income besed on atsatiton coiting vernue varioble costing tameine buint outy Requlrement 1. Compute the prodoct cost per mos produced under abeorption costna and under variable costing. Do this firmt far January and then for Febnuk? Requirement 2b. Prepare separate monthly income statements for January and for February, using variable costing. Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing. Murphy's Foods Income Statement (Absorption Costing) Month Ended January 31 Fobruary 28 Less: in tacken Data table Requirements 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February. 2. Prepare separate monthly income statements for January and for February, using (a) absorption costing and (b) variable costing. 3. Is operating income higher under absorption costing or variable costing in January? In February? Explain the pattern of differences in operating income based on absorption costing versus variable costing. Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing. Murphy's Foods Income Statement (Absorption Costing) Month Ended Requirement 2b. Prepare separate monthly income statements for January and for February, using variable costing. Requirement 2b, Prepare separate monthly income statements for January and for Fobruary, using variable costing Murphy's Foods Contribution Margin Income Statement (Variable Costing) Month Findad Acesgne inatry aras aume it mennen Hi matiof Data table Requirements 1. Consule the frobuct oots per meal produced under absorption costing and under variabie coeting Do bin frst for January and then for February. 2. Pnoqare beperite morthly income stabements foe danuary and for Fobruary. using ( al absoptisn costing and (b) variable cotting 2. Is operating inome higher under aboseption costing or variable costing in daculey? in Febraty? Euplain the patlem of differences in operating income besed on atsatiton coiting vernue varioble costing tameine buint outy Requlrement 1. Compute the prodoct cost per mos produced under abeorption costna and under variable costing. Do this firmt far January and then for Febnuk? Requirement 2b. Prepare separate monthly income statements for January and for February, using variable costing. Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing. Murphy's Foods Income Statement (Absorption Costing) Month Ended January 31 Fobruary 28 Less: in tacken