Answered step by step

Verified Expert Solution

Question

1 Approved Answer

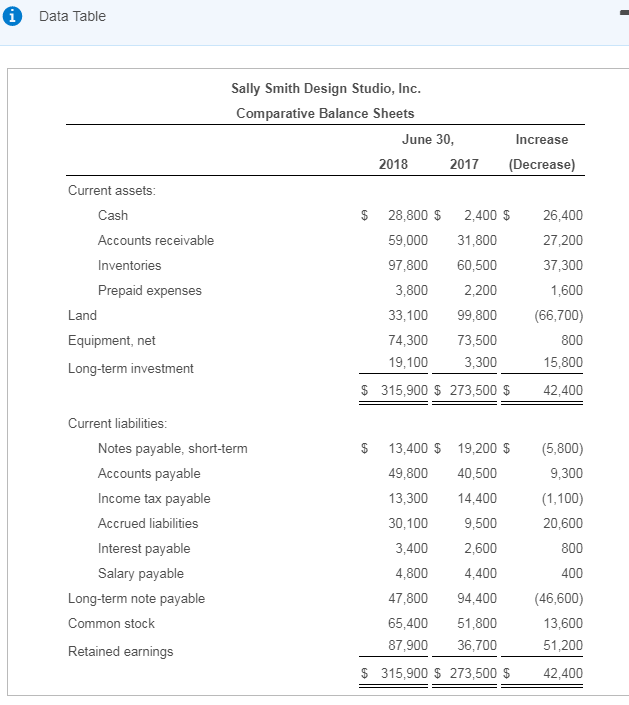

Data Table Sally Smith Design Studio, Inc Comparative Balance Sheets June 30, Increase 2018 2017 (Decrease) Current assets Cash Accounts receivable Inventories Prepaid expenses $

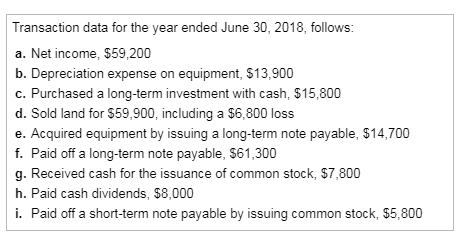

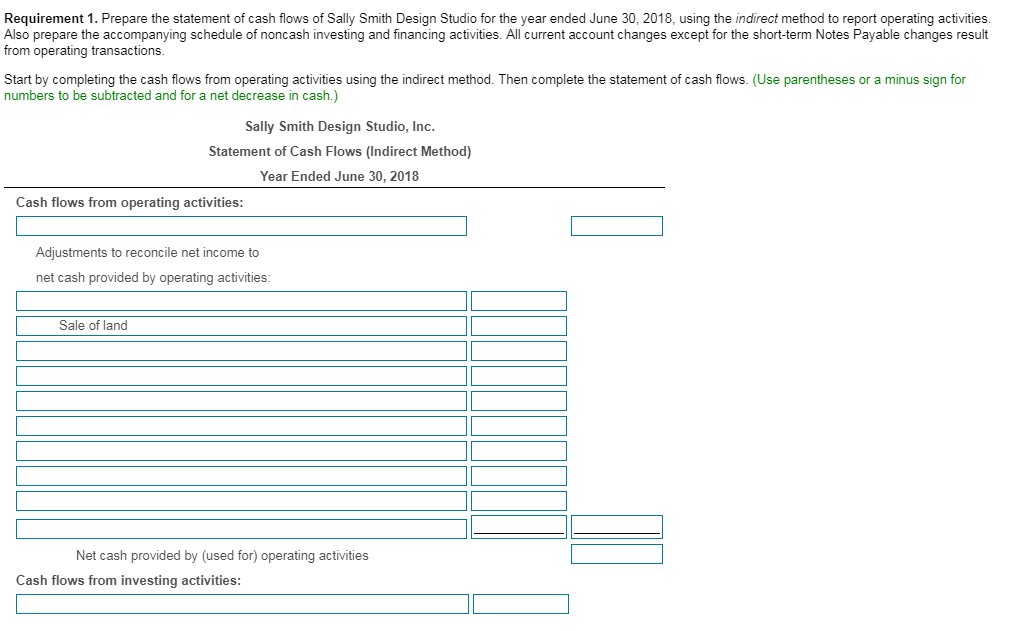

Data Table Sally Smith Design Studio, Inc Comparative Balance Sheets June 30, Increase 2018 2017 (Decrease) Current assets Cash Accounts receivable Inventories Prepaid expenses $ 28,800 $ 2,400 $26,400 27,200 37,300 1,600 33,100 99,800 (66,700) 800 15,800 $ 315,900 $ 273,500 $42,400 59,000 31,800 97,800 60,500 3,800 2,200 Land Equipment, net Long-term investment 74,300 73,500 19,100 3,300 Current liabilities Notes payable, short-term Accounts payable Income tax payable Accrued liabilities Interest payable Salary payable S 13,400 $ 19,200 $(5,800) 9,300 (1,100) 20,600 800 400 7,800 94,400 (46,600) 13,600 51,200 $ 315,900 $ 273,500 $42,400 49,800 40,500 13,300 14,400 9,500 ,400 2,600 4,400 30,100 4,800 Long-term note payable Common stock Retained earnings 65,400 51,800 87.900 36,700 Transaction data for the year ended June 30, 2018, follows a. Net income, $59,200 b. Depreciation expense on equipment, $13,900 c. Purchased a long-term investment with cash, $15,800 d. Sold land for $59,900, including a $6,800 loss 14710 by issuing a long-term note f. Paid off a long-term note payable, $61,300 g. Received cash for the issuance of common stock, $7,800 h. Paid cash dividends, $8,000 i. Paid off a short-term note payable by issuing common stock, $5,800 Requirement 1. Prepare the statement of cash flows of Sally Smith Design Studio for the year ended June 30, 2018, using the indirect method to report operating activities Also prepare the accompanying schedule of noncash investing and financing activities. All current account changes except for the short-term Notes Payable changes result from operating transactions. Start by completing the cash flows from operating activities using the indirect method. Then complete the statement of cash flows. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in cash.) Sally Smith Design Studio, Inc. Statement of Cash Flows (Indirect Method) Year Ended June 30, 2018 Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activities: Sale of land Net cash provided by (used for) operating activities Cash flows from investing activities: Cash flows from financing activities: Net cash provided by (used for) financing activities Net increase (decrease) in cash Noncash investing and financing activities Total noncash investing and financing activities Requirement 2. Prepare a supplementary schedule showing cash flows from operations by the direct method. The accounting records provide the following: collections from customers, $231,600; interest received, $1,400; payments to suppliers, $134,800; payments to employees, $36,900, payments for income tax, $12,200; and payment of interest, $5,300. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in cash.) Sally Smith Design Studio, Inc. Partial Statement of Cash Flows (Direct Method) Year Ended June 30, 2018 Cash flows from operating activities: Receipts Total cash receipts Payments: Total cash payments Net cash provided by (used for) operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started