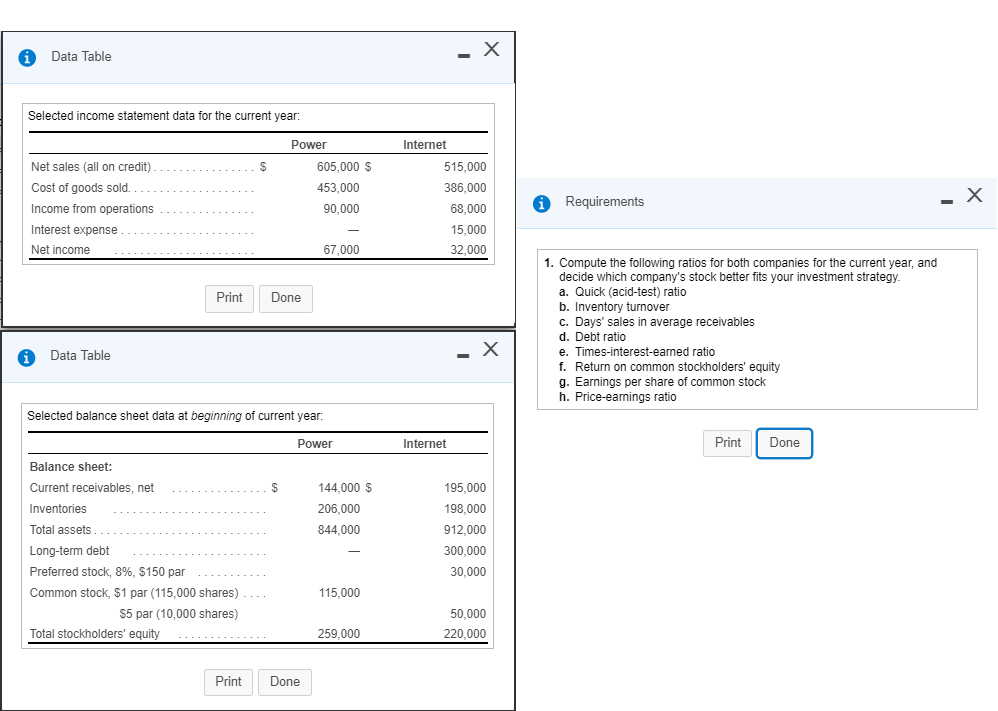

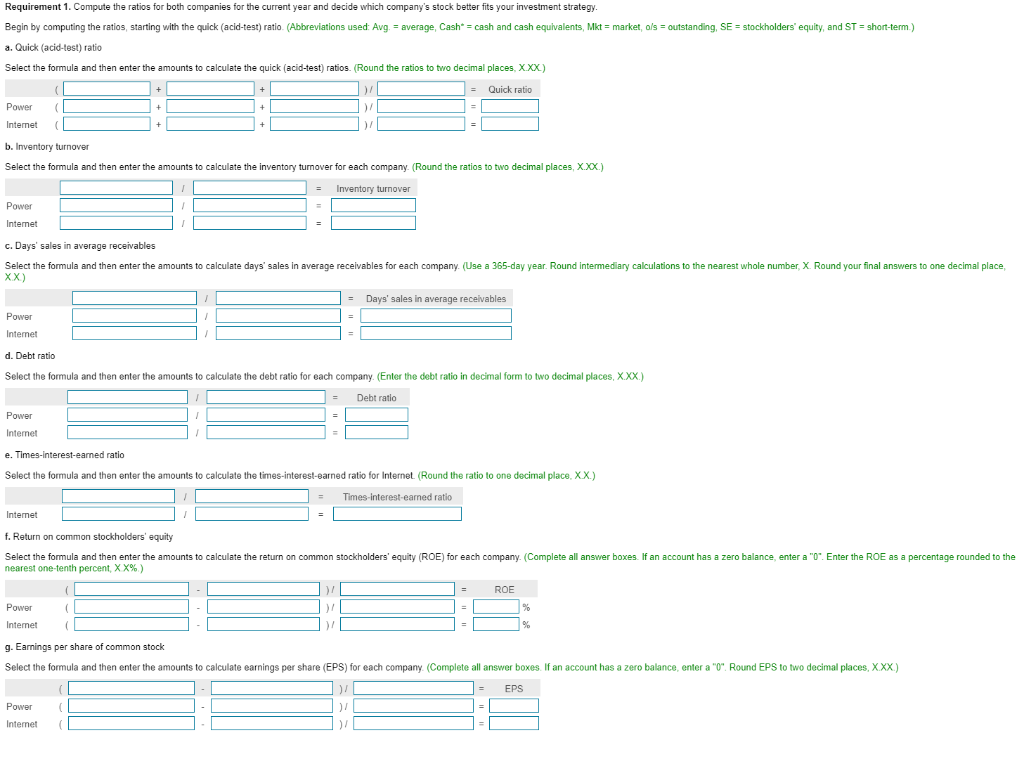

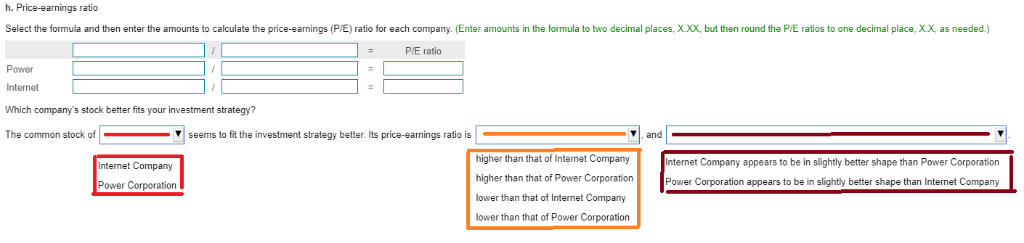

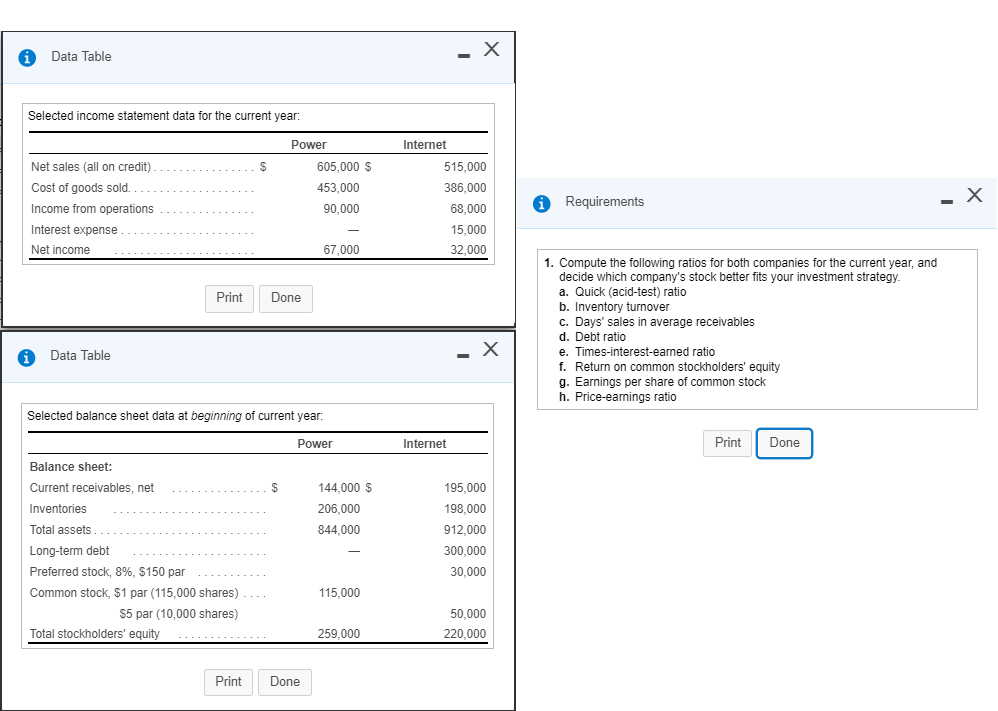

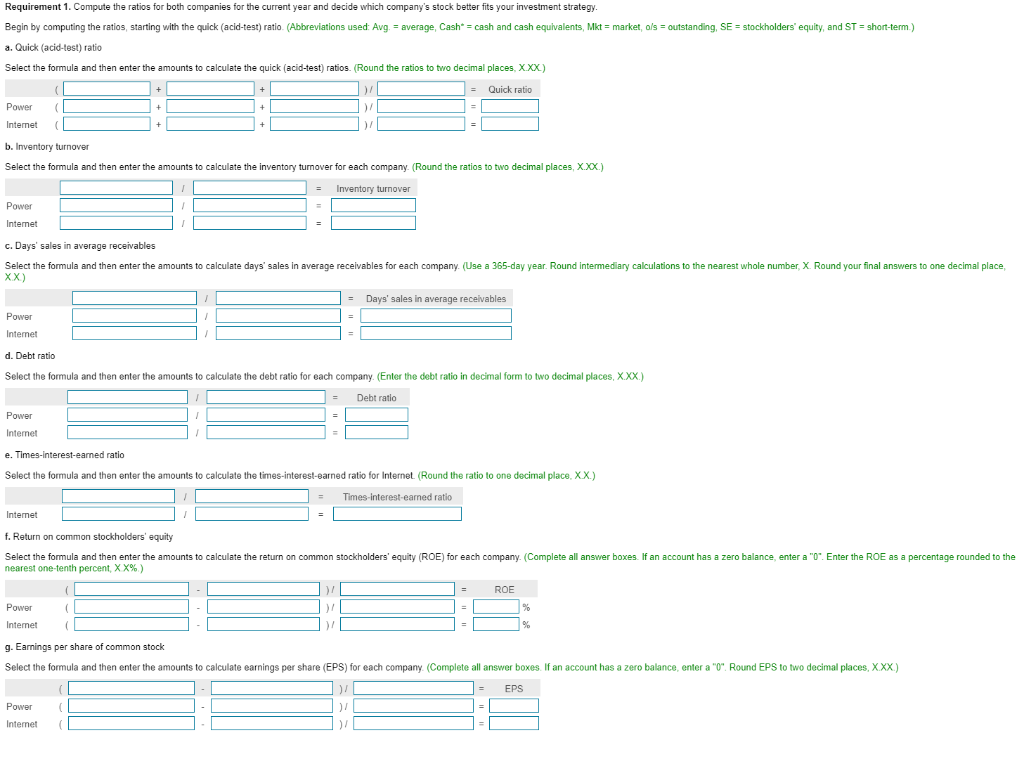

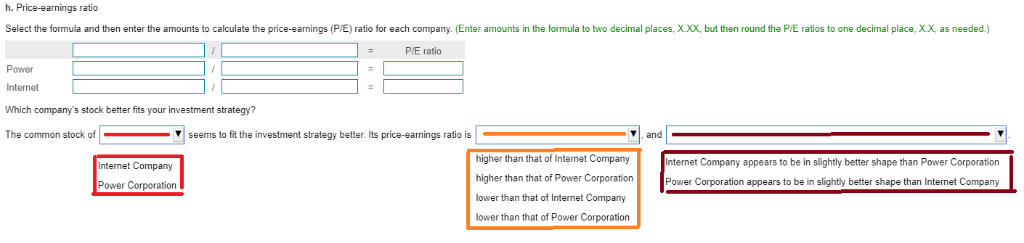

Data Table Selected income statement data for the current year Powe Internet Net sales (all on credit) Cost of goods sold Income from operations Interest expense Net income 605,000 S 453,000 90,000 515,000 386,000 68,000 15,000 32,000 Requirements 67,000 1. Compute the following ratios for both companies for the current year, and decide which company's stock better fits your investment strategy a. Quick (acid-test) ratio b. Inventory turnover c. Days' sales in average receivables d. Debt ratio e. Times-interest-earned ratio f. Return on common stockholders' equity g. Earnings per share of common stock h. Price-earnings ratio PrintDone Data Table Selected balance sheet data at beginning of current year: Power Internet Print Done Balance sheet: Current receivables, net Inventories Total assets Long-term debt Preferred stock, 896, $150 par Common stock, $1 par (115,000 shares) 144,000 $ 206,000 844,000 195,000 198,000 912,000 300,000 30,000 115,000 $5 par (10,000 shares) 50,000 Total stockholders' equity 259,000 220,000 PrintDone Requirement 1. Compute the ratios for both companies for the current year and decide which company's stock better fits your investment strategy Begin by computing the ratios starting with the quick acid test ratio Abbreviations used: A g = average, Cash cash and cash equivalents, kt = market, a s-outstanding, SE-stockholders' equity, and ST-short-term a. Quick (acid-test) ratio Select the formula and then enter the amounts to calculate the quick (acid-test) ratios. Round the ratios to two decimal places. XXX) Quick ratio Power ( Intenet( b. Inventory turnover Select the formula and then enter the amounts to calculate the inventory turnover for each company. (Round the ratios to two decimal places, XXX.) )F -Inventory turnover Power Internet c. Days' sales in average receivables Select the formula and then enter the amounts to calculate days' sales in average receivables for each company. (Use a 365-day year. Round intermediary calculations to the nearest whole number, X. Round your final answers to one decimal place, -Days' sales in average recelvables Internet d. Debt ratio Select the formula and then enter the amounts to calculate the debt ratio for each company. (Enter the debt ratio in decimal form to two decimal places, X.XX.) - Debt ratio Power Internet e. Times-interest-earned ratio Select the formula and then enter the amounts to calculate the times-interest-earned ratio for Internet (Round the ratio to one decimal place, X.X.) - Times-interest-earned ratio Internet f. Return on common stockholders' equity Select the formula and then enter the amounts to calculate the return on common stockholders' equity (ROE) for each company. (Complete all answer boxes. If an account has a zero balance, enter a "0". Enter the ROE as a percentage rounded to the nearest one-tenth percent, X X% ) ROE Power Intemet( g. Earnings per share of common stock Select the formula and then enter the amounts to calculate earnings per share (EPS) for each company (Complete all answer boxes. If an account has a zero balance, enter a "0". Round EPS to two decimal places, XXX) - EPS ntenet h. Price-earnings ratio Select the formula and then enter the amounts to calculate the price-earnings (PIE) ratio for each company. (Enter amounts in the formula to two decimal places, X.XX, but then round the P/E ratios to one decimal place, XX, as needed.) PIE ratio Power nternet Which company's stock better fits your investment strategy? The common stock of_Vseems to fit the investment strategy better. Its price-earnings ratio is and higher than that of Internet Company higher than that of Power CorporationPower lower than that of Internet Company lower than that of Power Corporation Internet Company appears to be in slightly better shape than Power Corporation Power Corporation appears to be in slightly better shape than Internet Company Internet Company Power Corporation a