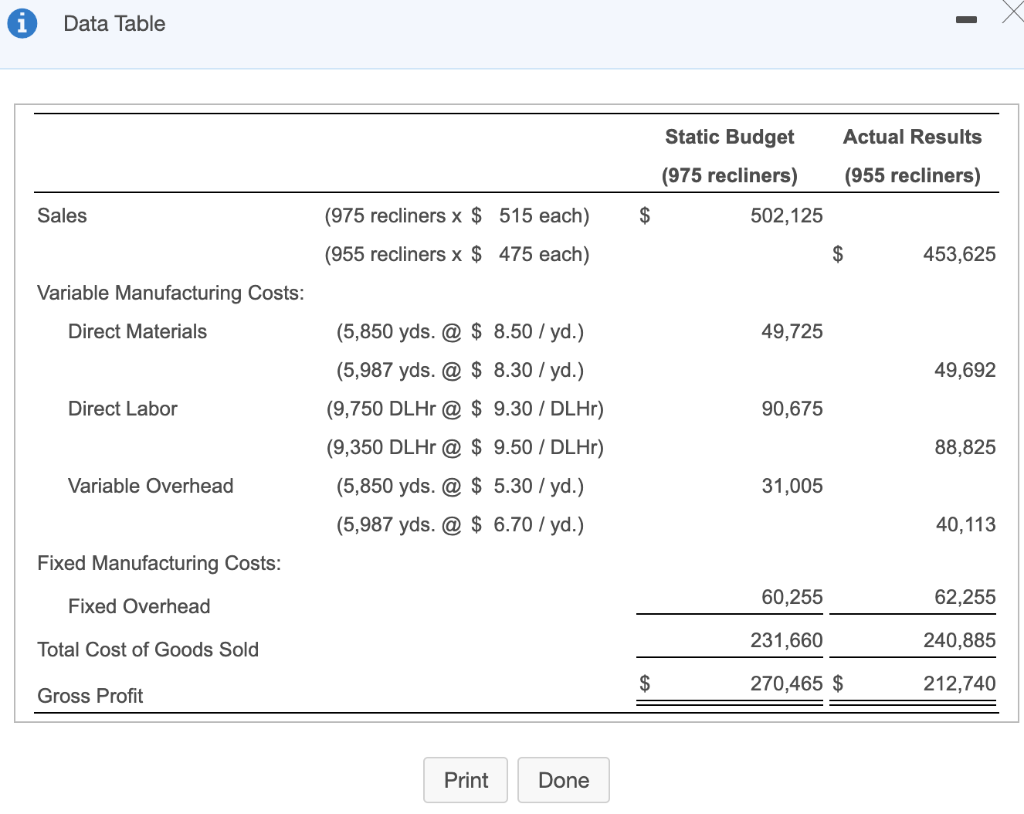

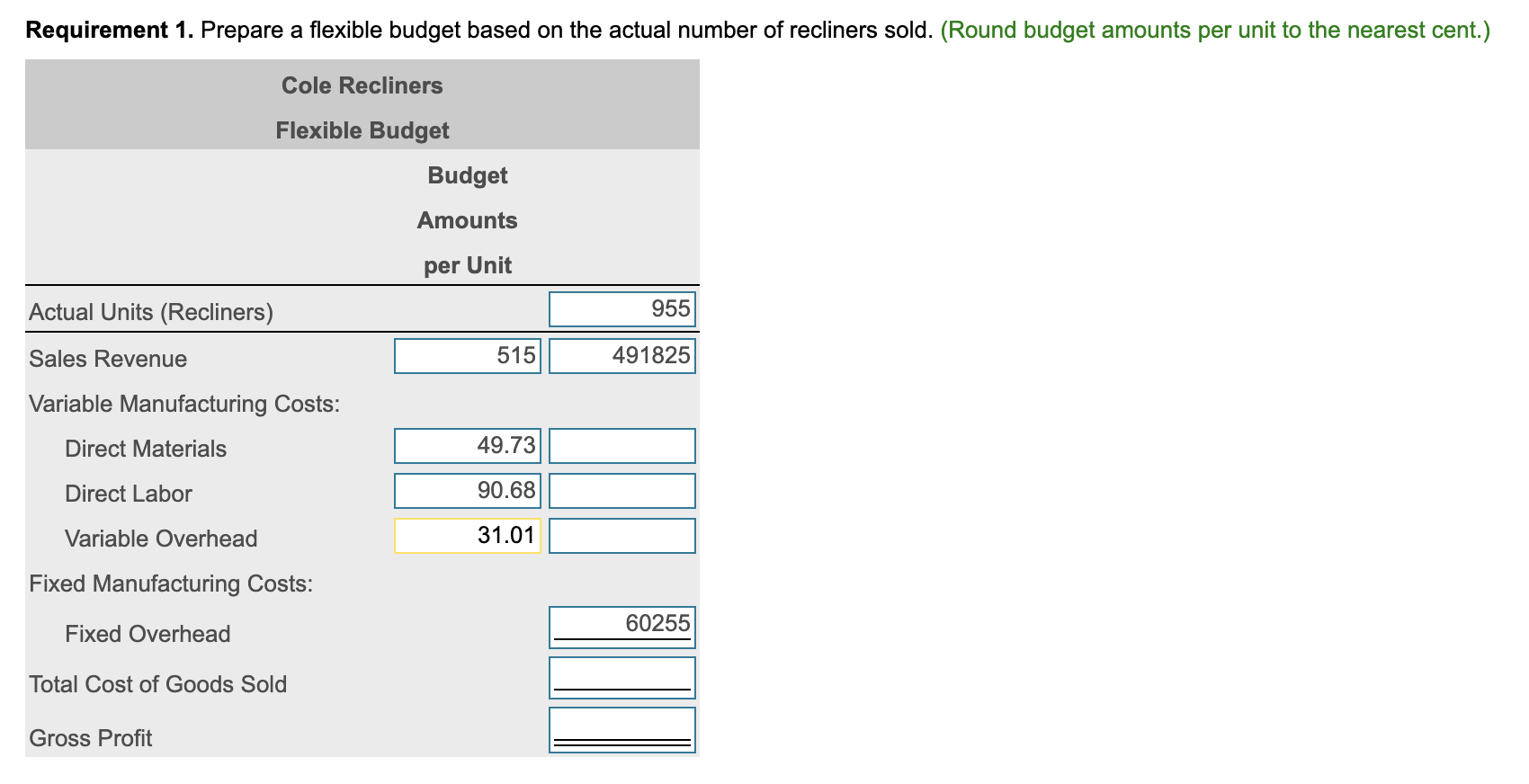

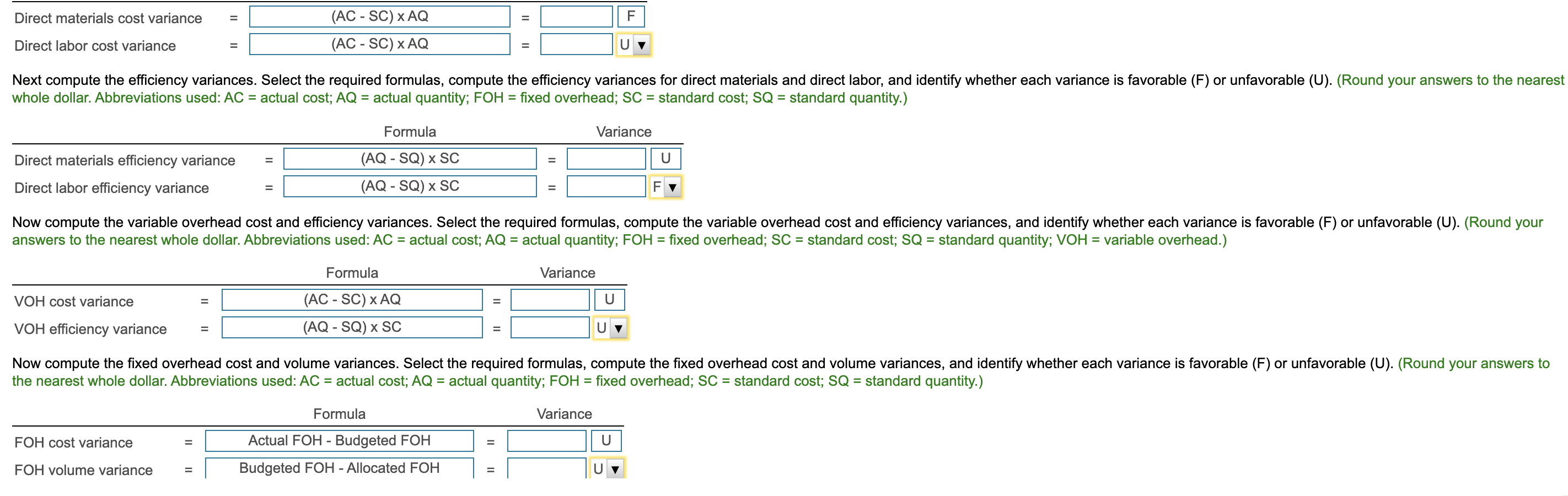

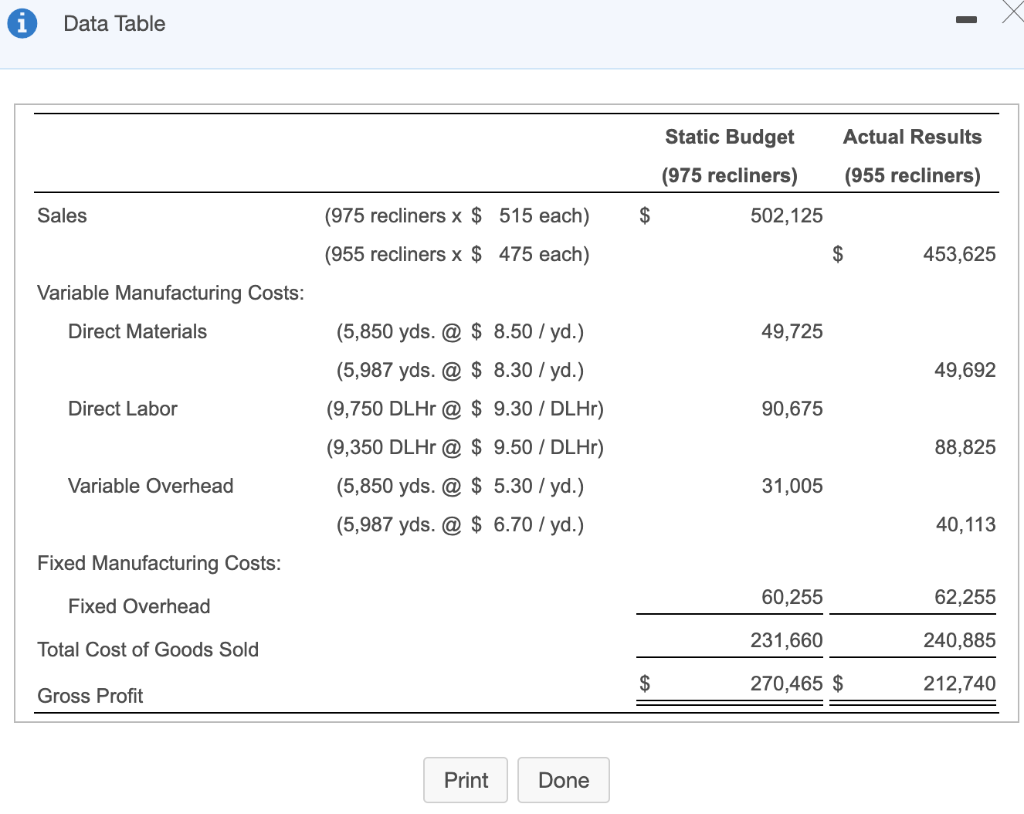

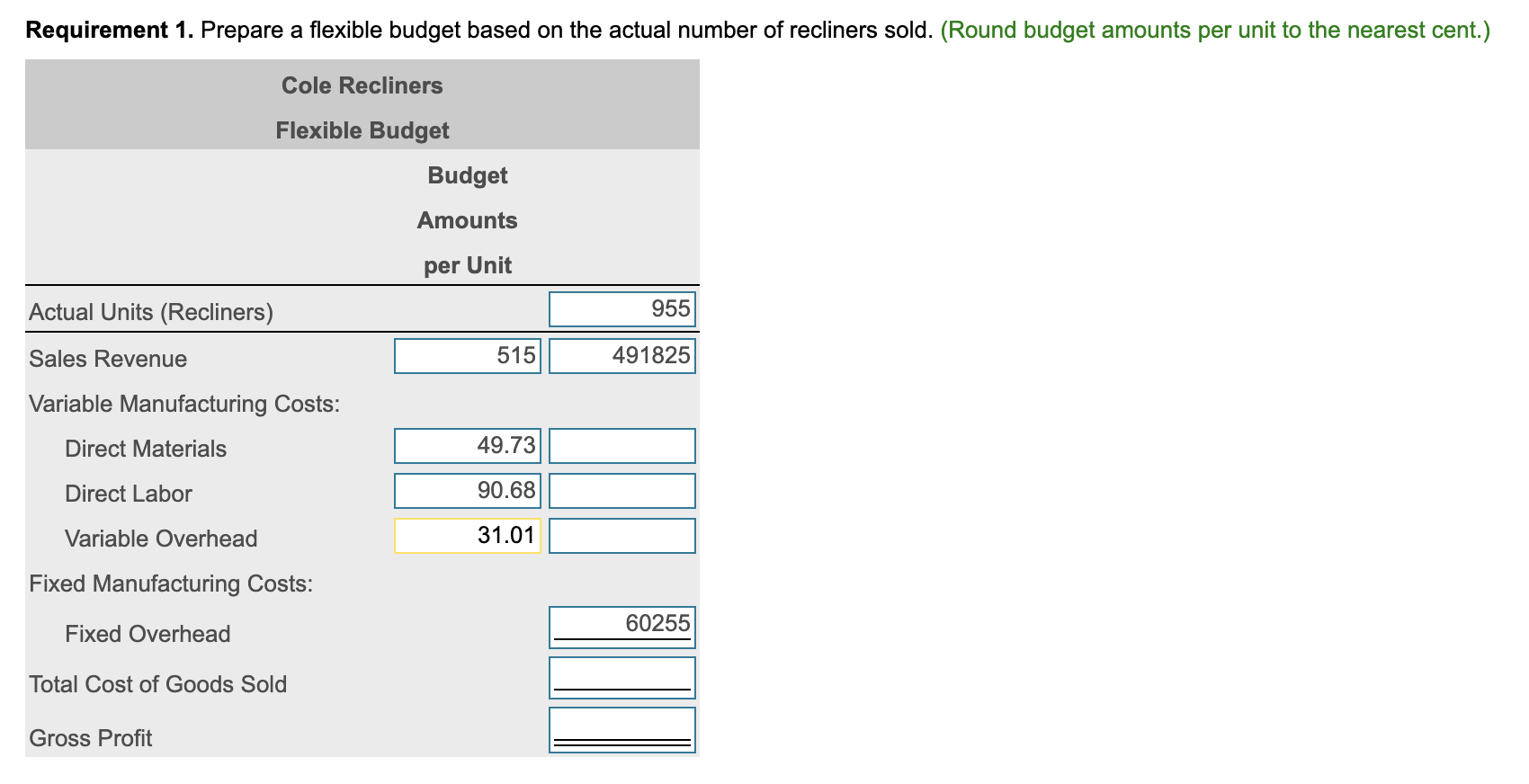

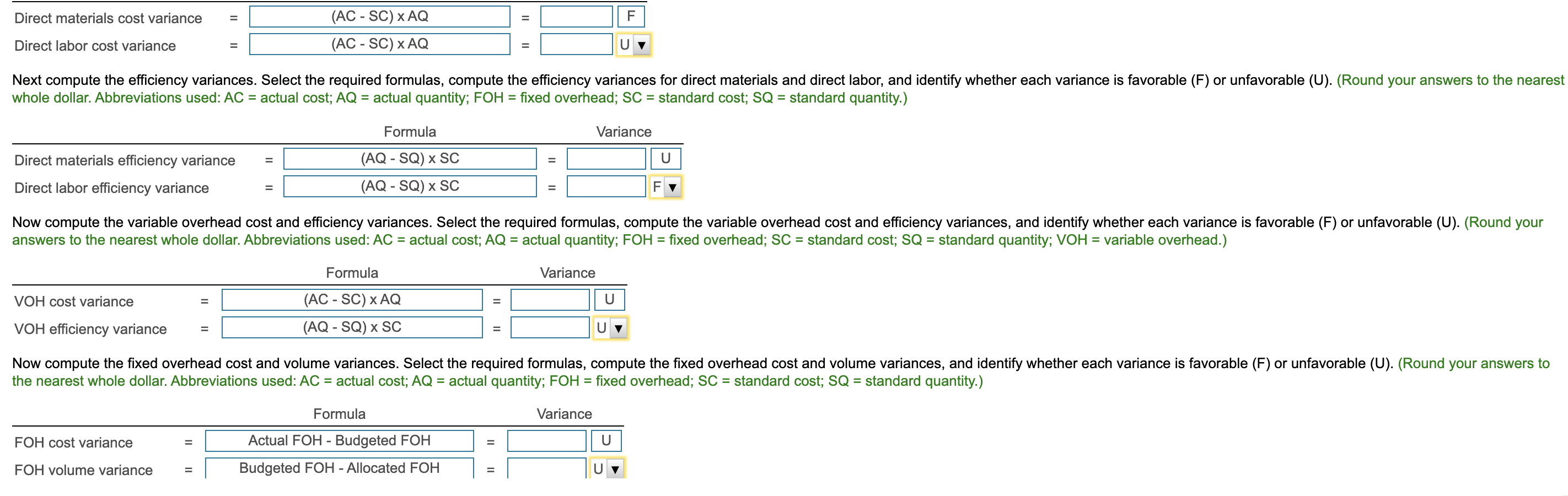

Data Table Static Budget Actual Results (955 recliners) (975 recliners) 502,125 Sales $ (975 recliners x $ 515 each) (955 recliners x $ 475 each) $ 453,625 Variable Manufacturing Costs: Direct Materials 49,725 49,692 Direct Labor 90,675 (5,850 yds. @ $ 8.50 / yd.) (5,987 yds. @ $ 8.30 / yd.) (9,750 DLHr @ $ 9.30 / DLHr) (9,350 DLHr @ $ 9.50 / DLHr) (5,850 yds. @ $ 5.30 / yd.) (5,987 yds. @ $ 6.70 / yd.) 88,825 Variable Overhead 31,005 40,113 Fixed Manufacturing Costs: Fixed Overhead 60,255 62,255 Total Cost of Goods Sold 231,660 240,885 $ 270,465 $ 212,740 Gross Profit Print Done Requirement 1. Prepare a flexible budget based on the actual number of recliners sold. (Round budget amounts per unit to the nearest cent.) Cole Recliners Flexible Budget Budget Amounts per Unit Actual Units (Recliners) 955 Sales Revenue 515 491825 Variable Manufacturing Costs: Direct Materials 49.73 Direct Labor 90.68 Variable Overhead 31.01 Fixed Manufacturing Costs: 60255 Fixed Overhead Total Cost of Goods Sold Gross Profit Direct materials cost variance F (AC - SC) XAQ (AC - SC) XAQ Direct labor cost variance Next compute the efficiency variances. Select the required formulas, compute the efficiency variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance U Direct materials efficiency variance Direct labor efficiency variance (AQ - SQ) x SC (AQ - SQ) x SC Now compute the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity; VOH = variable overhead.) Formula Variance VOH cost variance = = U (AC - SC) XAQ (AQ - SQ) x SC VOH efficiency variance U Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance FOH cost variance = U Actual FOH - Budgeted FOH Budgeted FOH - Allocated FOH FOH volume variance U