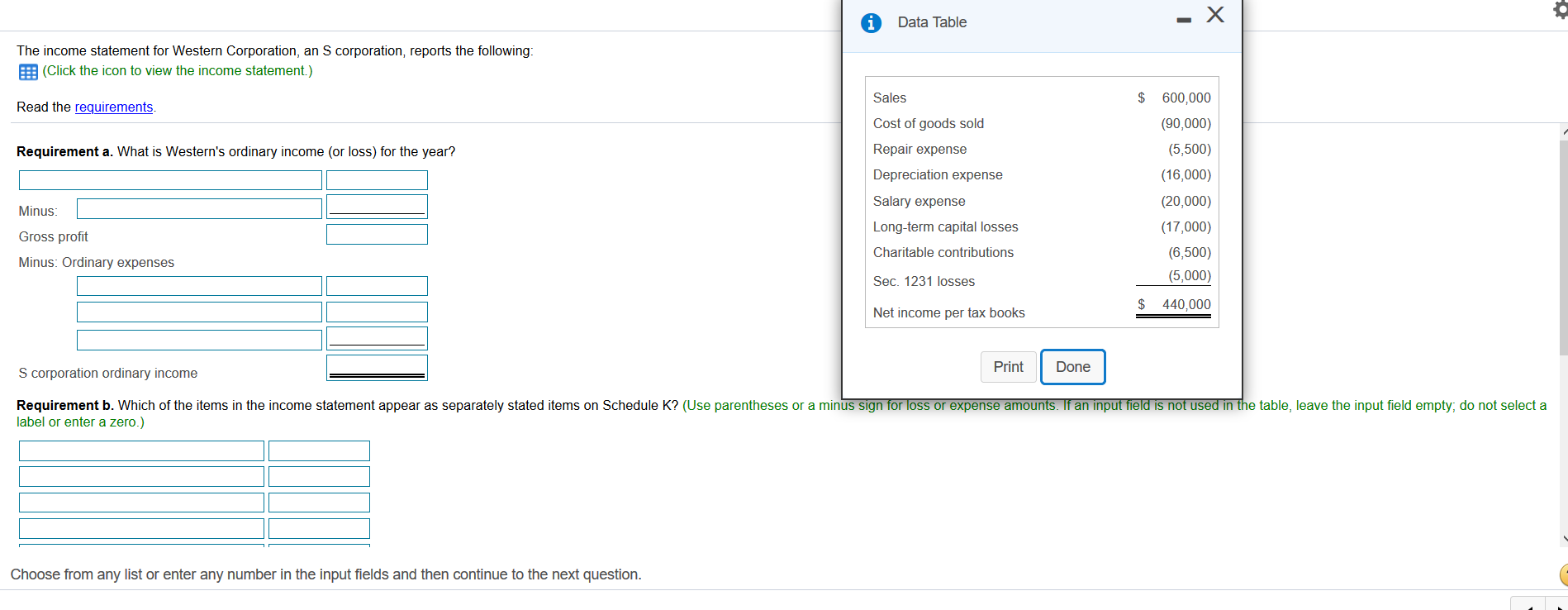

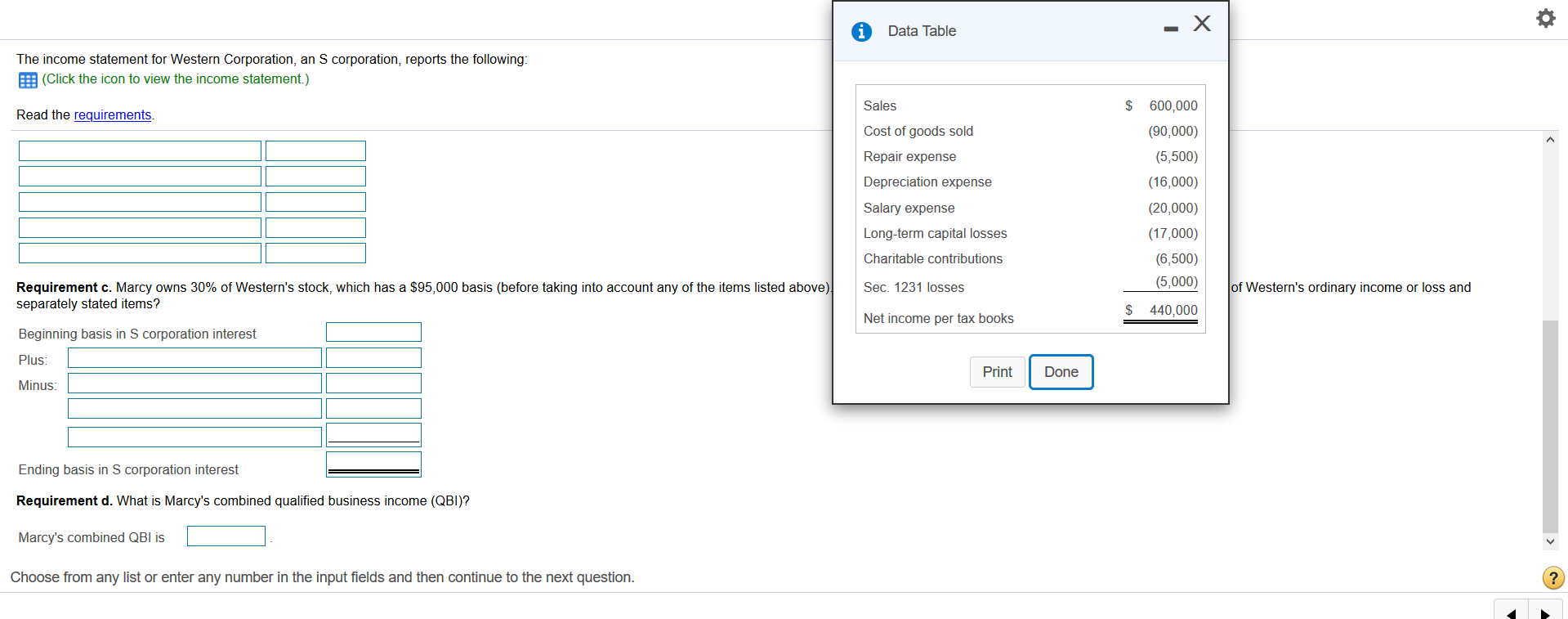

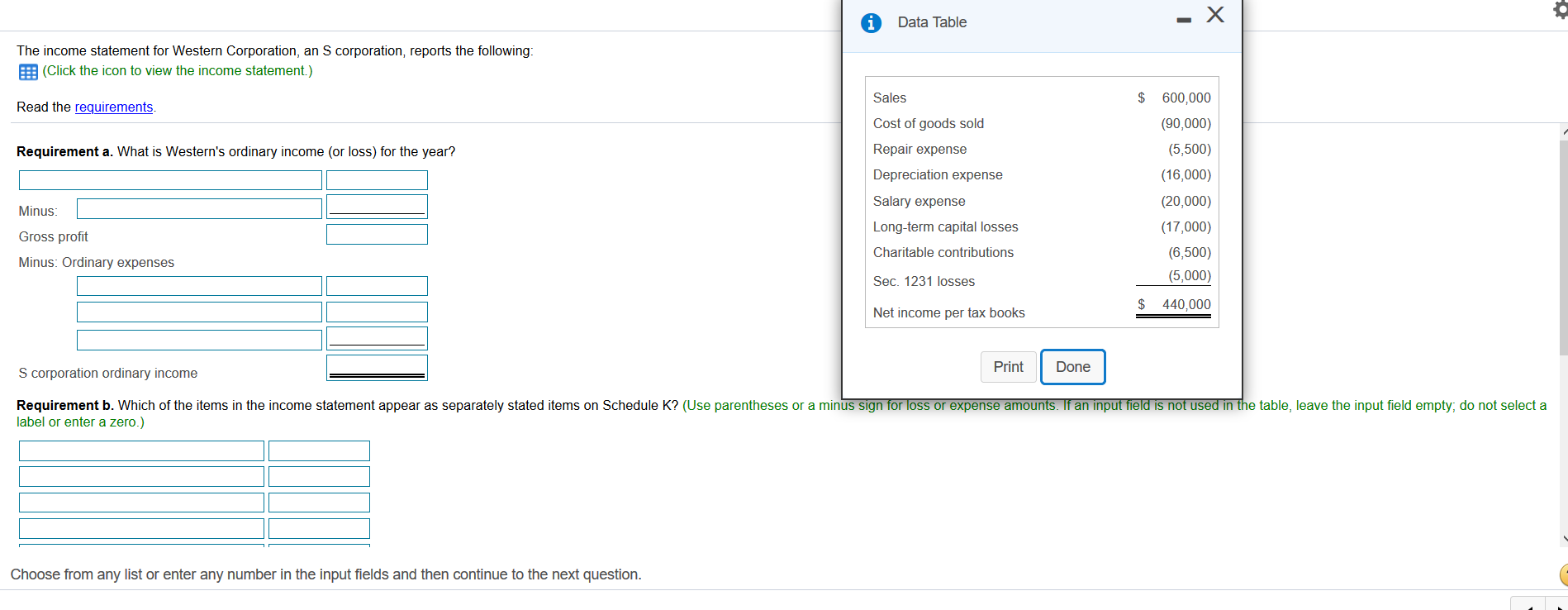

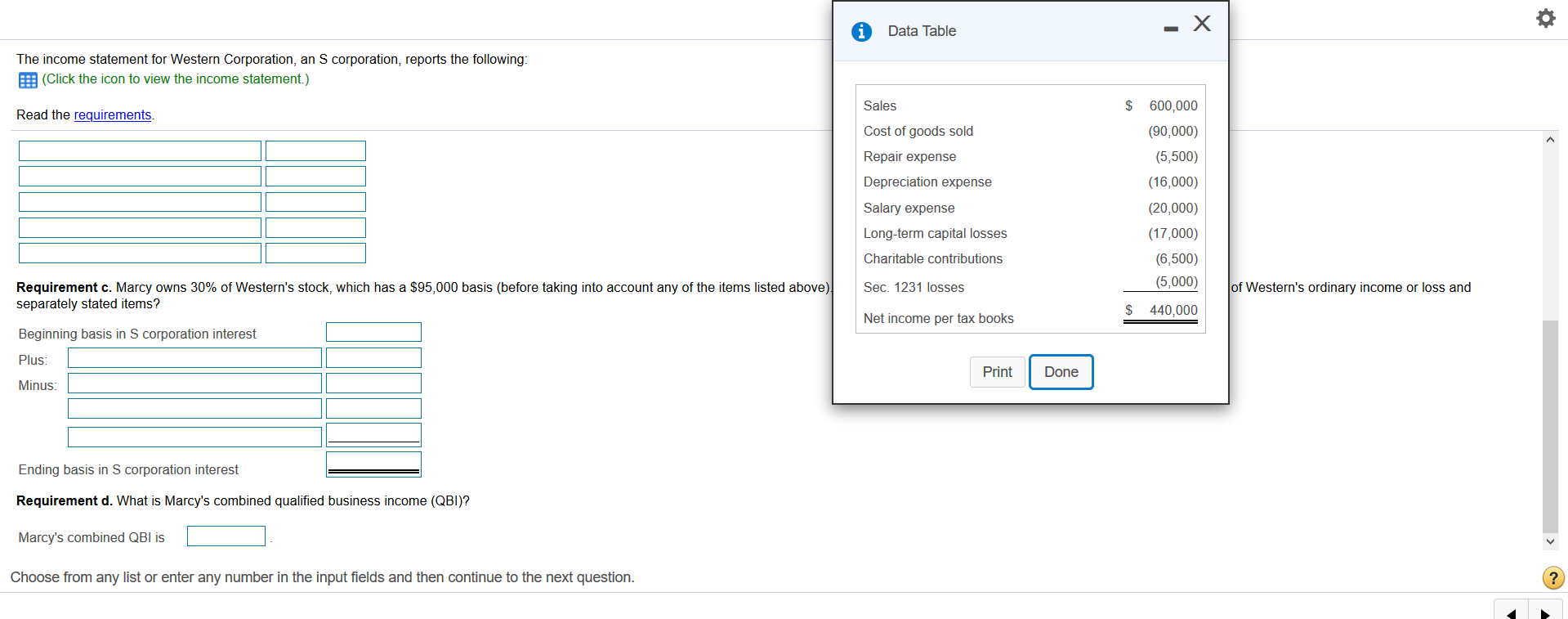

* Data Table The income statement for Western Corporation, an S corporation, reports the following: (Click the icon to view the income statement.) Sales $ Read the requirements. Cost of goods sold Repair expense Requirement a. What is Western's ordinary income (or loss) for the year? Depreciation expense 600,000 (90,000) (5,500) (16,000) (20,000) (17,000) (6,500) (5,000) Minus: D Gross profit Minus: Ordinary expenses Salary expense Long-term capital losses Charitable contributions Sec. 1231 losses $ 440,000 Net income per tax books S corporation ordinary income Print Done Requirement b. Which of the items in the income statement appear as separately stated items on Schedule K? (Use parentheses or a minus sign for loss or expense amounts. If an input field is not used in the table, leave the input field empty, do not select a label or enter a zero.) Choose from any list or enter any number in the input fields and then continue to the next question. 1 Data Table - X The income statement for Western Corporation, an S corporation, reports the following: E (Click the icon to view the income statement.) Read the requirements. Sales Cost of goods sold Repair expense Depreciation expense Salary expense Long-term capital losses Charitable contributions $ 600,000 (90,000) (5,500) (16,000) (20,000) (17,000) (6,500) (5,000) $ 440,000 Sec. 1231 losses of Western's ordinary income or loss and Requirement c. Marcy owns 30% of Western's stock, which has a $95,000 basis (before taking into account any of the items listed above) separately stated items? Net income per tax books Beginning basis in S corporation interest Plus: Minus: Print Done Ending basis in S corporation interest Requirement d. What is Marcy's combined qualified business income (QBI)? Marcy's combined QBI is Choose from any list or enter any number in the input fields and then continue to the next question. * Data Table The income statement for Western Corporation, an S corporation, reports the following: (Click the icon to view the income statement.) Sales $ Read the requirements. Cost of goods sold Repair expense Requirement a. What is Western's ordinary income (or loss) for the year? Depreciation expense 600,000 (90,000) (5,500) (16,000) (20,000) (17,000) (6,500) (5,000) Minus: D Gross profit Minus: Ordinary expenses Salary expense Long-term capital losses Charitable contributions Sec. 1231 losses $ 440,000 Net income per tax books S corporation ordinary income Print Done Requirement b. Which of the items in the income statement appear as separately stated items on Schedule K? (Use parentheses or a minus sign for loss or expense amounts. If an input field is not used in the table, leave the input field empty, do not select a label or enter a zero.) Choose from any list or enter any number in the input fields and then continue to the next question. 1 Data Table - X The income statement for Western Corporation, an S corporation, reports the following: E (Click the icon to view the income statement.) Read the requirements. Sales Cost of goods sold Repair expense Depreciation expense Salary expense Long-term capital losses Charitable contributions $ 600,000 (90,000) (5,500) (16,000) (20,000) (17,000) (6,500) (5,000) $ 440,000 Sec. 1231 losses of Western's ordinary income or loss and Requirement c. Marcy owns 30% of Western's stock, which has a $95,000 basis (before taking into account any of the items listed above) separately stated items? Net income per tax books Beginning basis in S corporation interest Plus: Minus: Print Done Ending basis in S corporation interest Requirement d. What is Marcy's combined qualified business income (QBI)? Marcy's combined QBI is Choose from any list or enter any number in the input fields and then continue to the next