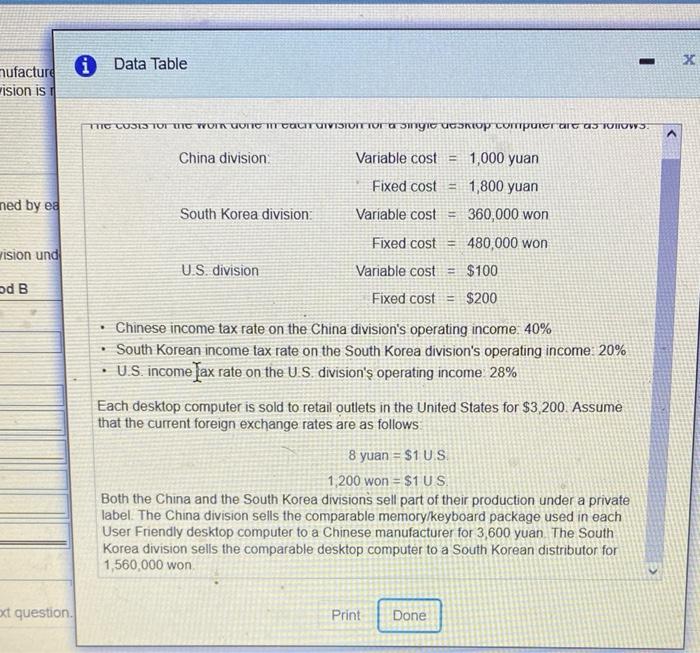

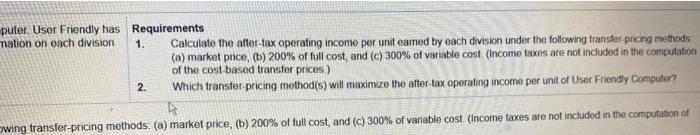

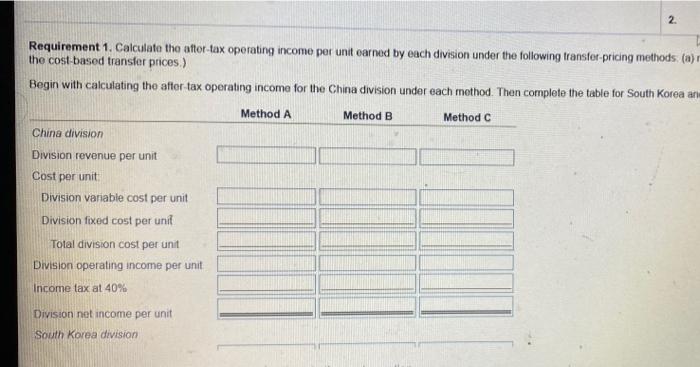

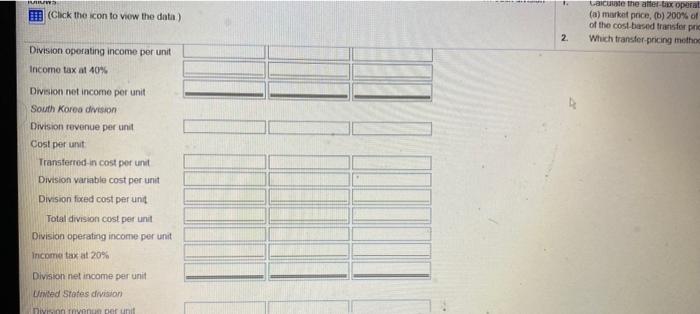

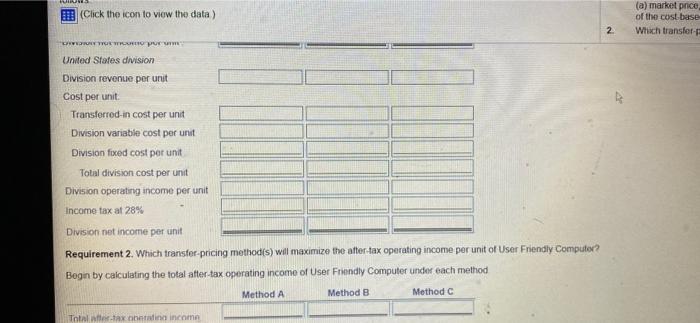

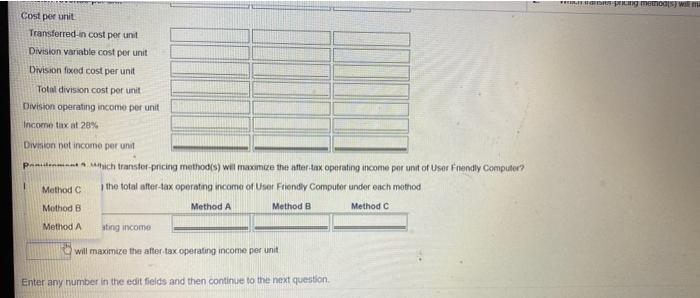

Data Table x nufacture vision is i TIC COSIS TOT WC YOITUOTTC HTCOITUIVISIONTOR Umgic Ustop computer AC OS TONOWS. ned by ea wision und odB China division Variable cost = 1,000 yuan Fixed cost = 1,800 yuan South Korea division Variable cost = 360,000 won Fixed cost = 480,000 won U.S. division Variable cost = $100 Fixed cost = $200 Chinese income tax rate on the China division's operating income: 40% South Korean income tax rate on the South Korea division's operating income: 20% U.S. income Tax rate on the US division's operating income 28% Each desktop computer is sold to retail outlets in the United States for $3,200. Assume that the current foreign exchange rates are as follows 8 yuan = $1 US 1,200 won = $1 US Both the China and the South Korea divisions sell part of their production under a private label. The China division sells the comparable memory/keyboard package used in each User Friendly desktop computer to a Chinese manufacturer for 3,600 yuan The South Korea division sells the comparable desktop computer to a South Korean distributor for 1,560,000 won xt question. Print Done puter. User Friendly has Requirements mation on each division 1. Calculate the after-tax operating income per unit eamed by each division under the following transfer pricing methods (a) market price, (b) 200% of full cost, and (c) 300% of variable cost (Income taxes are not included in the computation of the cost-based transfer prices) 2. Which transfer pricing method(s) will maximize the after tax operating income per unit of Uset Friendly Computer? wing transfer pricing methods: (a) market price. (6) 200% of full cost, and (c) 300% of variable cost (Income taxes are not included in the computation of 2 Requirement 1. Calculate the after tax operating income per unit earned by each division under the following transfer pricing methods (a) the cost-based transfer prices) Begin with calculating the after tax operating income for the China division under each method. Then complete the table for South Korea an Method A Method B Method C China division Division revenue per unit Cost per unit Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit Income tax at 40% Division net income per unit South Korea division Click the icon to view the data) Laicute the after-tax operat (a) market price. () 200% of of the cost-based transfer pre Which transfer pricing method 2. Division operating income per unit Income tax at 40% Division net income per unit South Korea division Division revenue per unit Cost per unit Transferred-in cost per unit Division variable cost per unit Division foxed cost per unit Total division cost per unit Division operating income per unit income tax al 20% Division net income per unit United States division Diviso Triyonun per unit (Click the icon to view the data) (a) market price of the cost base Which transfers 2 WWW pur United States division Division revenue per unit Cost per unit Transferred-in cost per unit Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit Income tax al 28% Division net income per unit Requirement 2. Which transfer pricing method(s) will maximize the after tax operating income per unit of User Friendly Computer? Begin by calculating the total after-tax operating income of User Friendly Computer under each method Method A Method B Method C Totalitaxin incom Geng methods will Cost per unit Transferred-in cost per unit Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit Income tax al 28% Division net income per unit Podmanich transfer pricing method(s) will maximce the after tax operating income per unit of User Friendly Computer? Method the total alter-tax operating income of User Friendly Computer under each method Method B Method A Method B Method C Method A ating income will maximize the after tax operating income per unit Enter any number in the edit fields and then continue to the next