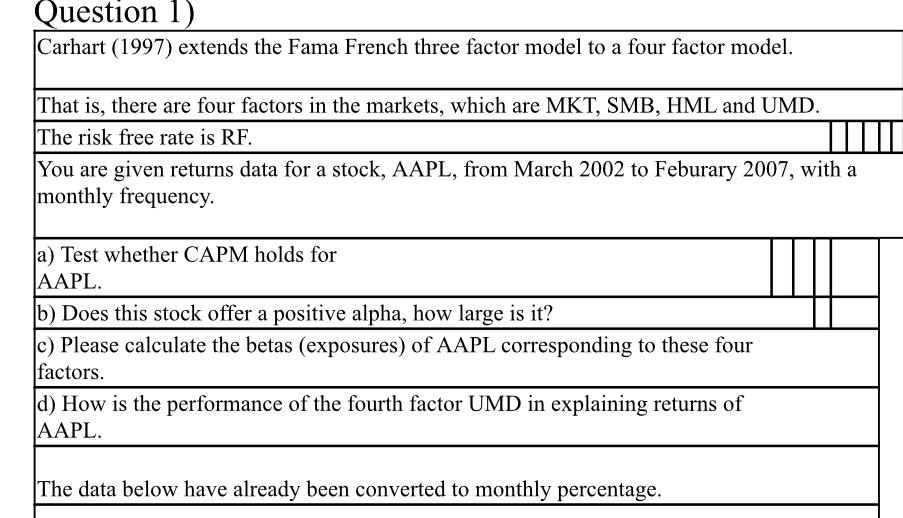

Question

DATA TO COPY AAPL MKT SMB HML UMD RF 200203 9.124424 4.47 4.35 1.09 -1.7 0.13 200204 2.533784 -4.96 5.78 4.23 7.92 0.15 200205 -4.03624

DATA TO COPY

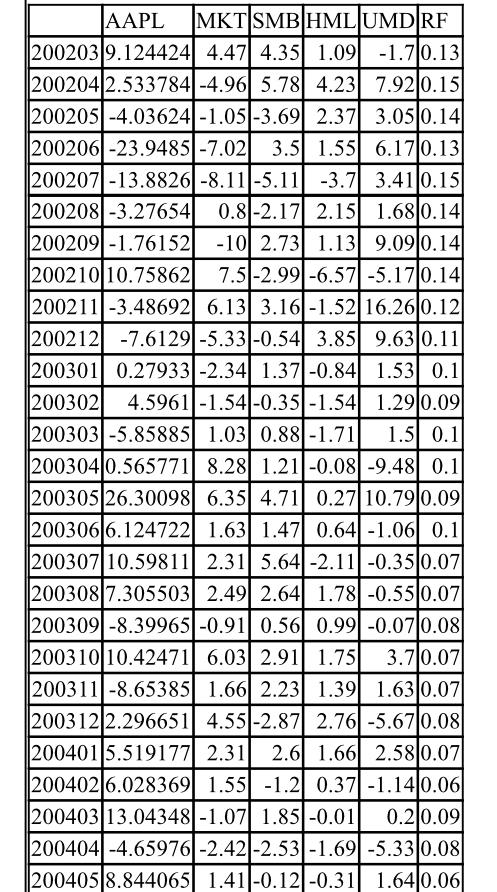

|

| AAPL | MKT | SMB | HML | UMD | RF |

| 200203 | 9.124424 | 4.47 | 4.35 | 1.09 | -1.7 | 0.13 |

| 200204 | 2.533784 | -4.96 | 5.78 | 4.23 | 7.92 | 0.15 |

| 200205 | -4.03624 | -1.05 | -3.69 | 2.37 | 3.05 | 0.14 |

| 200206 | -23.9485 | -7.02 | 3.5 | 1.55 | 6.17 | 0.13 |

| 200207 | -13.8826 | -8.11 | -5.11 | -3.7 | 3.41 | 0.15 |

| 200208 | -3.27654 | 0.8 | -2.17 | 2.15 | 1.68 | 0.14 |

| 200209 | -1.76152 | -10 | 2.73 | 1.13 | 9.09 | 0.14 |

| 200210 | 10.75862 | 7.5 | -2.99 | -6.57 | -5.17 | 0.14 |

| 200211 | -3.48692 | 6.13 | 3.16 | -1.52 | 16.26 | 0.12 |

| 200212 | -7.6129 | -5.33 | -0.54 | 3.85 | 9.63 | 0.11 |

| 200301 | 0.27933 | -2.34 | 1.37 | -0.84 | 1.53 | 0.1 |

| 200302 | 4.5961 | -1.54 | -0.35 | -1.54 | 1.29 | 0.09 |

| 200303 | -5.85885 | 1.03 | 0.88 | -1.71 | 1.5 | 0.1 |

| 200304 | 0.565771 | 8.28 | 1.21 | -0.08 | -9.48 | 0.1 |

| 200305 | 26.30098 | 6.35 | 4.71 | 0.27 | 10.79 | 0.09 |

| 200306 | 6.124722 | 1.63 | 1.47 | 0.64 | -1.06 | 0.1 |

| 200307 | 10.59811 | 2.31 | 5.64 | -2.11 | -0.35 | 0.07 |

| 200308 | 7.305503 | 2.49 | 2.64 | 1.78 | -0.55 | 0.07 |

| 200309 | -8.39965 | -0.91 | 0.56 | 0.99 | -0.07 | 0.08 |

| 200310 | 10.42471 | 6.03 | 2.91 | 1.75 | 3.7 | 0.07 |

| 200311 | -8.65385 | 1.66 | 2.23 | 1.39 | 1.63 | 0.07 |

| 200312 | 2.296651 | 4.55 | -2.87 | 2.76 | -5.67 | 0.08 |

| 200401 | 5.519177 | 2.31 | 2.6 | 1.66 | 2.58 | 0.07 |

| 200402 | 6.028369 | 1.55 | -1.2 | 0.37 | -1.14 | 0.06 |

| 200403 | 13.04348 | -1.07 | 1.85 | -0.01 | 0.2 | 0.09 |

| 200404 | -4.65976 | -2.42 | -2.53 | -1.69 | -5.33 | 0.08 |

| 200405 | 8.844065 | 1.41 | -0.12 | -0.31 | 1.64 | 0.06 |

| 200406 | 15.96579 | 2.16 | 2.25 | 1.72 | 2.08 | 0.08 |

| 200407 | -0.61463 | -3.77 | -3.82 | 4.42 | -2.32 | 0.1 |

| 200408 | 6.679035 | 0.27 | -1.56 | 1.13 | -1.54 | 0.11 |

| 200409 | 12.34783 | 2.06 | 2.82 | 0.4 | 5.28 | 0.11 |

| 200410 | 35.19092 | 1.78 | 0.49 | -0.95 | -1.54 | 0.11 |

| 200411 | 27.9771 | 4.82 | 4.11 | 1.96 | 3.24 | 0.15 |

| 200412 | -3.9666 | 3.52 | 0.18 | -0.35 | -2.82 | 0.16 |

| 200501 | 19.40994 | -2.66 | -1.67 | 2.52 | 3.12 | 0.16 |

| 200502 | 16.671 | 2.27 | -0.76 | 2.85 | 3.19 | 0.16 |

| 200503 | -7.11101 | -1.69 | -1.37 | 1.71 | 0.93 | 0.21 |

| 200504 | -13.4629 | -2.52 | -3.95 | -0.49 | -0.84 | 0.21 |

| 200505 | 10.26068 | 3.79 | 3.01 | -1.16 | 0.46 | 0.24 |

| 200506 | -7.41952 | 1.15 | 2.58 | 2.84 | 2.1 | 0.23 |

| 200507 | 15.86525 | 4.33 | 2.77 | -0.47 | 0.05 | 0.24 |

| 200508 | 9.941383 | -0.59 | -0.88 | 1.44 | 2.24 | 0.3 |

| 200509 | 14.33141 | 1.06 | -0.64 | 1.22 | 3.5 | 0.29 |

| 200510 | 7.423988 | -2.08 | -1.05 | -0.74 | -1.37 | 0.27 |

| 200511 | 17.7635 | 4.04 | 0.98 | -1.75 | 0.39 | 0.31 |

| 200512 | 6.00118 | 0.35 | -0.47 | 0.51 | 0.77 | 0.32 |

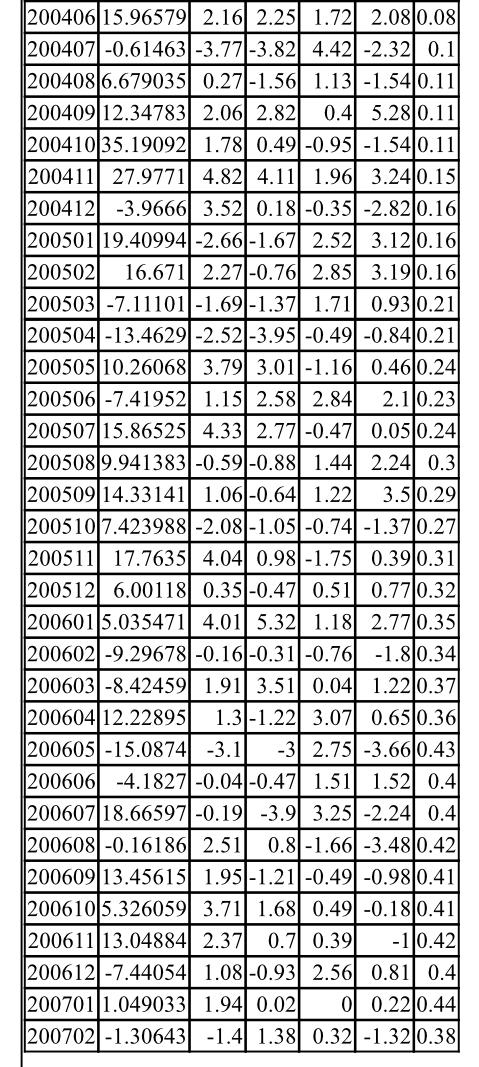

| 200601 | 5.035471 | 4.01 | 5.32 | 1.18 | 2.77 | 0.35 |

| 200602 | -9.29678 | -0.16 | -0.31 | -0.76 | -1.8 | 0.34 |

| 200603 | -8.42459 | 1.91 | 3.51 | 0.04 | 1.22 | 0.37 |

| 200604 | 12.22895 | 1.3 | -1.22 | 3.07 | 0.65 | 0.36 |

| 200605 | -15.0874 | -3.1 | -3 | 2.75 | -3.66 | 0.43 |

| 200606 | -4.1827 | -0.04 | -0.47 | 1.51 | 1.52 | 0.4 |

| 200607 | 18.66597 | -0.19 | -3.9 | 3.25 | -2.24 | 0.4 |

| 200608 | -0.16186 | 2.51 | 0.8 | -1.66 | -3.48 | 0.42 |

| 200609 | 13.45615 | 1.95 | -1.21 | -0.49 | -0.98 | 0.41 |

| 200610 | 5.326059 | 3.71 | 1.68 | 0.49 | -0.18 | 0.41 |

| 200611 | 13.04884 | 2.37 | 0.7 | 0.39 | -1 | 0.42 |

| 200612 | -7.44054 | 1.08 | -0.93 | 2.56 | 0.81 | 0.4 |

| 200701 | 1.049033 | 1.94 | 0.02 | 0 | 0.22 | 0.44 |

| 200702 | -1.30643 | -1.4 | 1.38 | 0.32 | -1.32 | 0.38

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started