Answered step by step

Verified Expert Solution

Question

1 Approved Answer

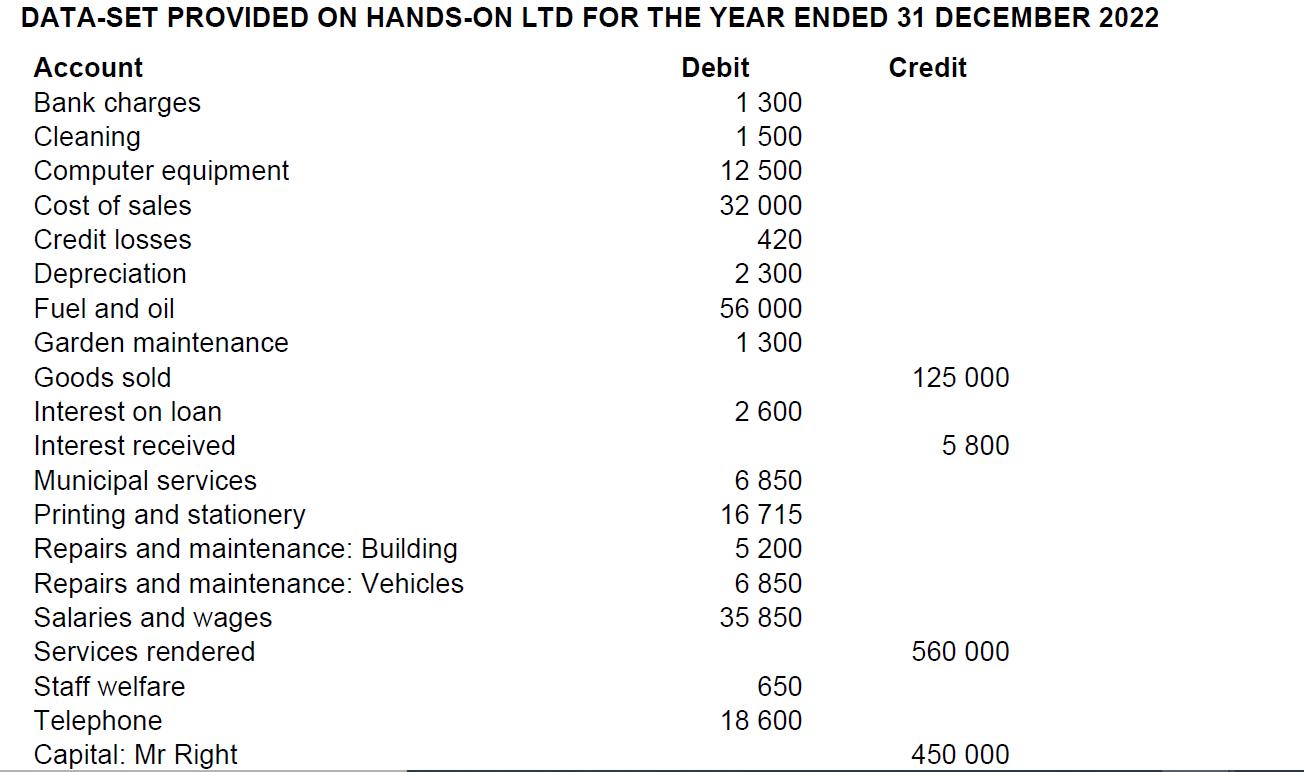

DATA-SET PROVIDED ON HANDS-ON LTD FOR THE YEAR ENDED 31 DECEMBER 2022 Account Credit Bank charges Cleaning Computer equipment Cost of sales Credit losses

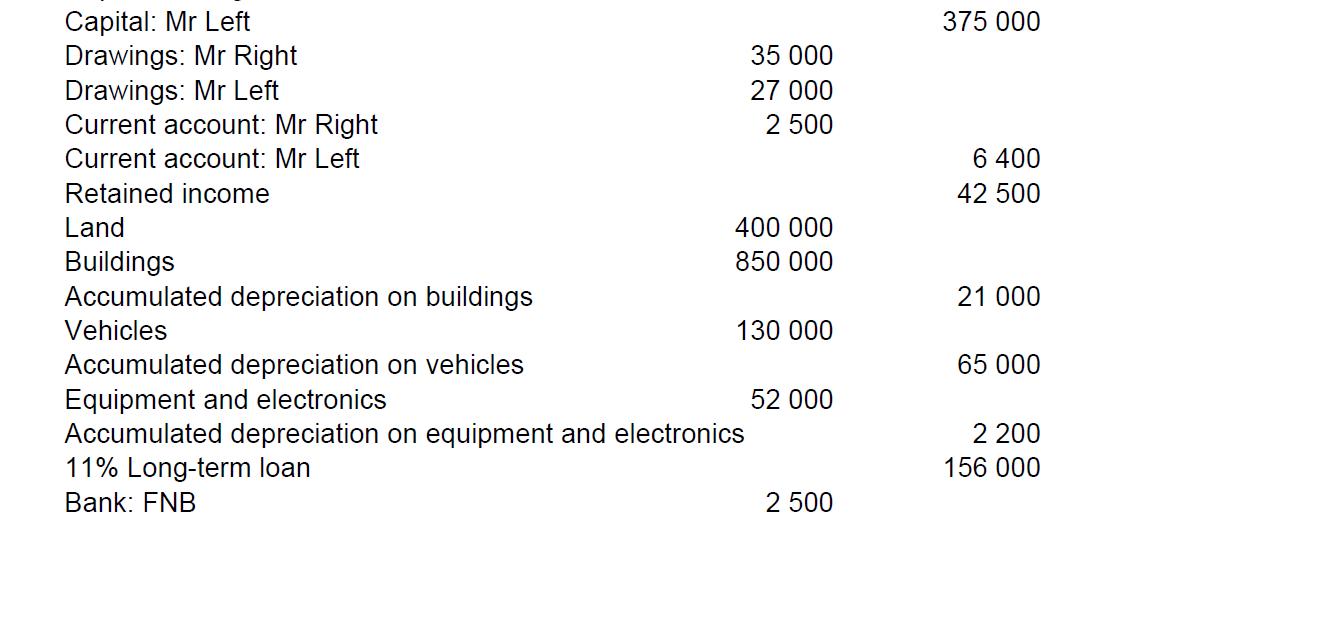

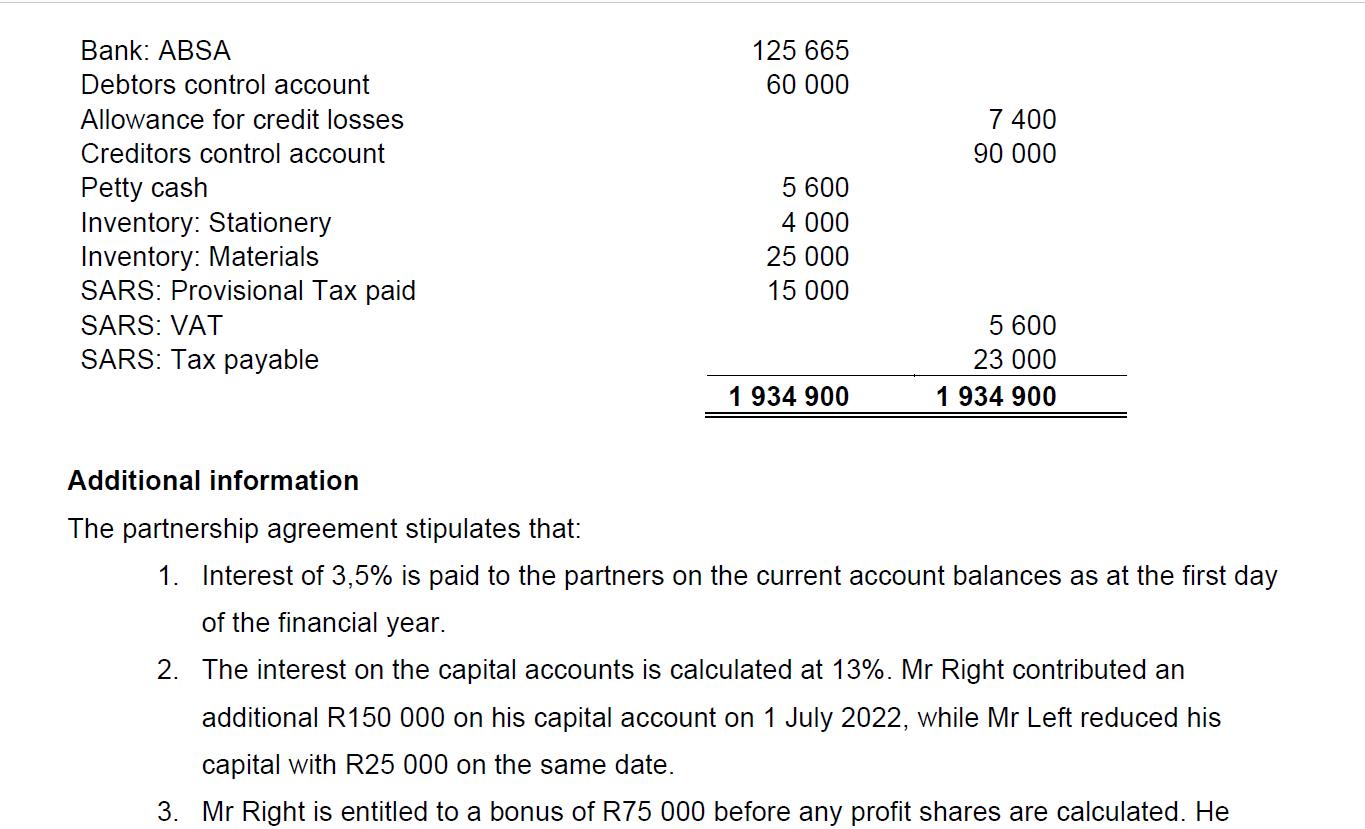

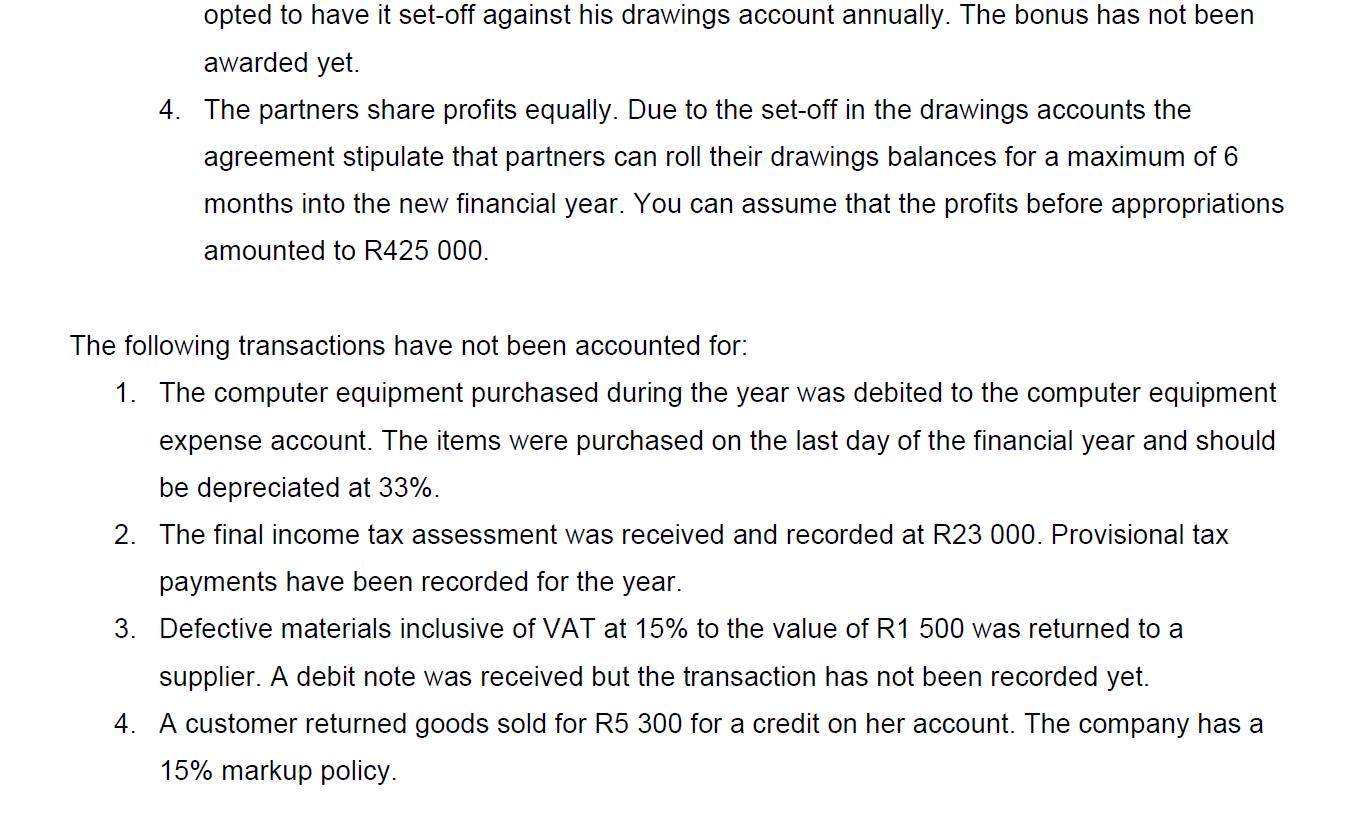

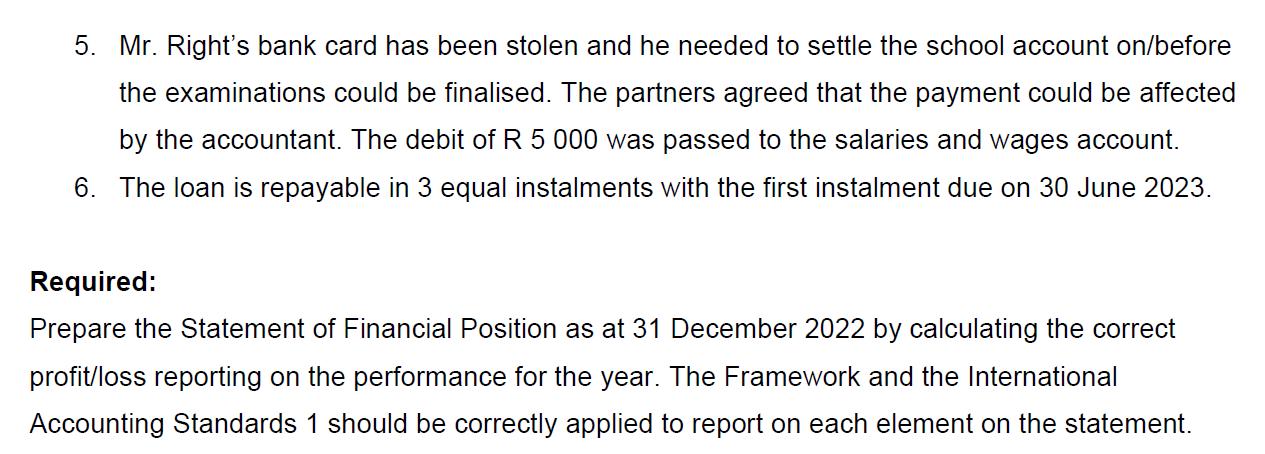

DATA-SET PROVIDED ON HANDS-ON LTD FOR THE YEAR ENDED 31 DECEMBER 2022 Account Credit Bank charges Cleaning Computer equipment Cost of sales Credit losses Depreciation Fuel and oil Garden maintenance Goods sold Interest on loan Interest received Municipal services Printing and stationery Repairs and maintenance: Building Repairs and maintenance: Vehicles Salaries and wages Services rendered Staff welfare Telephone Capital: Mr Right Debit 1 300 1 500 12 500 32 000 420 2 300 56 000 1 300 2 600 6 850 16 715 5 200 6 850 35 850 650 18 600 125 000 5 800 560 000 450 000 Capital: Mr Left Drawings: Mr Right Drawings: Mr Left Current account: Mr Right Current account: Mr Left Retained income Land Buildings Accumulated depreciation on buildings Vehicles 35 000 27 000 2 500 400 000 850 000 130 000 Accumulated depreciation on vehicles Equipment and electronics Accumulated depreciation on equipment and electronics 11% Long-term loan Bank: FNB 52 000 2 500 375 000 6 400 42 500 21 000 65 000 2 200 156 000 Bank: ABSA Debtors control account Allowance for credit losses Creditors control account Petty cash Inventory: Stationery Inventory: Materials SARS: Provisional Tax paid SARS: VAT SARS: Tax payable Additional information 125 665 60 000 5 600 4 000 25 000 15 000 1 934 900 7 400 90 000 5 600 23 000 1 934 900 The partnership agreement stipulates that: 1. Interest of 3,5% is paid to the partners on the current account balances as at the first day of the financial year. 2. The interest on the capital accounts is calculated at 13%. Mr Right contributed an additional R150 000 on his capital account on 1 July 2022, while Mr Left reduced his capital with R25 000 on the same date. 3. Mr Right is entitled to a bonus of R75 000 before any profit shares are calculated. He opted to have it set-off against his drawings account annually. The bonus has not been awarded yet. 4. The partners share profits equally. Due to the set-off in the drawings accounts the agreement stipulate that partners can roll their drawings balances for a maximum of 6 months into the new financial year. You can assume that the profits before appropriations amounted to R425 000. The following transactions have not been accounted for: 1. The computer equipment purchased during the year was debited to the computer equipment expense account. The items were purchased on the last day of the financial year and should be depreciated at 33%. 2. The final income tax assessment was received and recorded at R23 000. Provisional tax payments have been recorded for the year. 3. Defective materials inclusive of VAT at 15% to the value of R1 500 was returned to a supplier. A debit note was received but the transaction has not been recorded yet. 4. A customer returned goods sold for R5 300 for a credit on her account. The company has a 15% markup policy. 5. Mr. Right's bank card has been stolen and he needed to settle the school account on/before the examinations could be finalised. The partners agreed that the payment could be affected by the accountant. The debit of R 5 000 was passed to the salaries and wages account. 6. The loan is repayable in 3 equal instalments with the first instalment due on 30 June 2023. Required: Prepare the Statement of Financial Position as at 31 December 2022 by calculating the correct profit/loss reporting on the performance for the year. The Framework and the International Accounting Standards 1 should be correctly applied to report on each element on the statement.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Statement of Financial Position as of December 31 2022 and calculate the correct profit or loss for the year well need to consider various transactions and adjustments Heres a stepbyste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started