Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DataTsunami Corp. is considering investing in a new data warehouse equipment that has an estimated life of three years. The cost of the equipment is

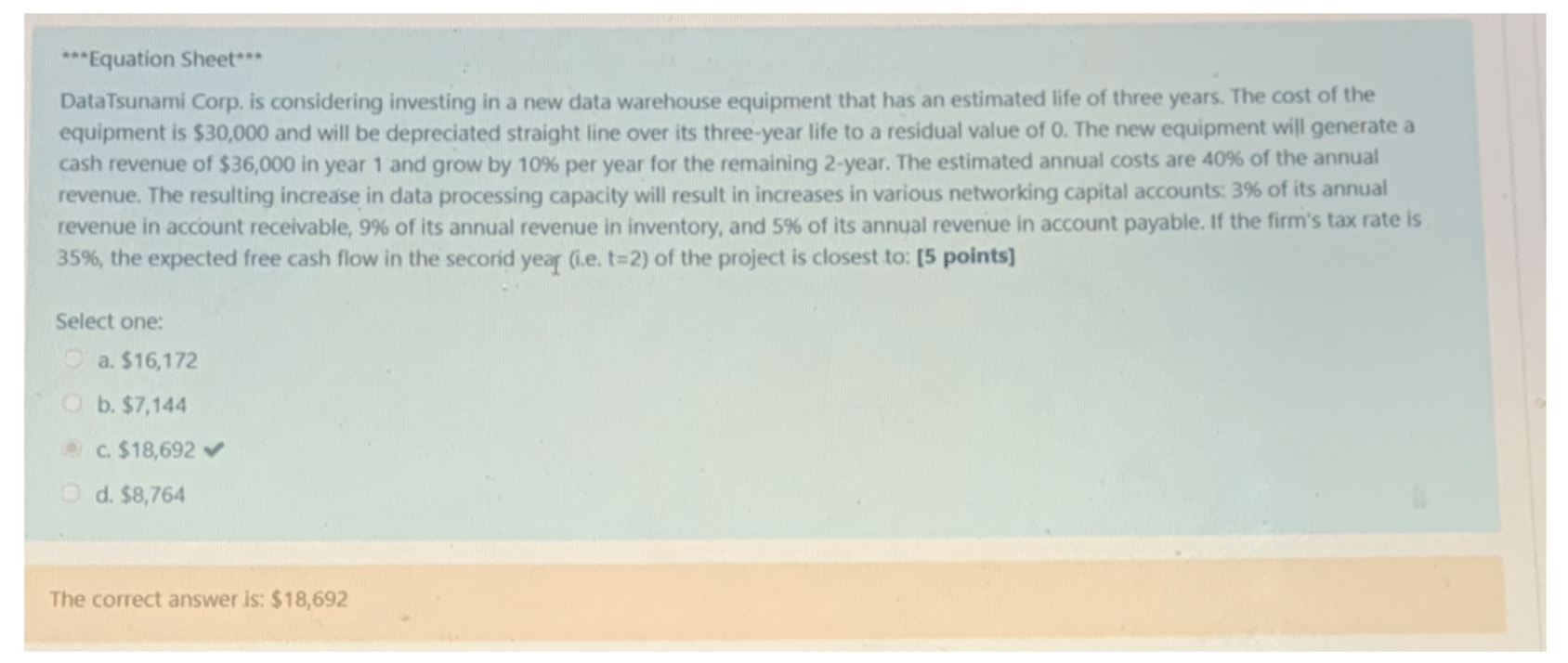

DataTsunami Corp. is considering investing in a new data warehouse equipment that has an estimated life of three years. The cost of the equipment is $30,000 and will be depreciated straight line over its three-year life to a residual value of 0 . The new equipment will generate a cash revenue of $36,000 in year 1 and grow by 10% per year for the remaining 2 -year. The estimated annual costs are 40% of the annual revenue. The resulting increase in data processing capacity will result in increases in various networking capital accounts: 3% of its annual revenue in account receivable, 9% of its annual revenue in inventory, and 5% of its annual revenue in account payable. If the firm's tax rate is 35%, the expected free cash flow in the secorid year (i.e. t=2 ) of the project is closest to: [5 points] Select one: a. $16,172 b. $7,144 C. $18,692 d. $8,764 The correct answer is: $18,692

DataTsunami Corp. is considering investing in a new data warehouse equipment that has an estimated life of three years. The cost of the equipment is $30,000 and will be depreciated straight line over its three-year life to a residual value of 0 . The new equipment will generate a cash revenue of $36,000 in year 1 and grow by 10% per year for the remaining 2 -year. The estimated annual costs are 40% of the annual revenue. The resulting increase in data processing capacity will result in increases in various networking capital accounts: 3% of its annual revenue in account receivable, 9% of its annual revenue in inventory, and 5% of its annual revenue in account payable. If the firm's tax rate is 35%, the expected free cash flow in the secorid year (i.e. t=2 ) of the project is closest to: [5 points] Select one: a. $16,172 b. $7,144 C. $18,692 d. $8,764 The correct answer is: $18,692 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started