Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Date 1 Jan Prepaid $100,000 of office rent for the period from 1 January to 28 February 2022. 10 Jan Performed services for customers

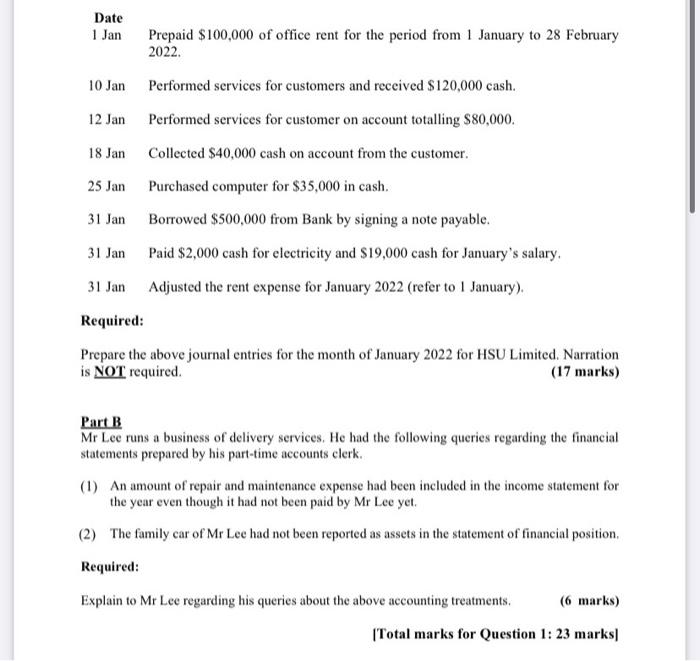

Date 1 Jan Prepaid $100,000 of office rent for the period from 1 January to 28 February 2022. 10 Jan Performed services for customers and received $120,000 cash. 12 Jan Performed services for customer on account totalling S80,000. 18 Jan Collected $40,000 cash on account from the customer. 25 Jan Purchased computer for $35,000 in cash. 31 Jan Borrowed $500,000 from Bank by signing a note payable. 31 Jan Paid $2,000 cash for electricity and S19,000 cash for January's salary. 31 Jan Adjusted the rent expense for January 2022 (refer to 1 January). Required: Prepare the above journal entries for the month of January 2022 for HSU Limited. Narration is NOT required. (17 marks) Part B Mr Lee runs a business of delivery services. He had the following queries regarding the financial statements prepared by his part-time accounts clerk. (1) An amount of repair and maintenance expense had been included in the income statement for the year even though it had not been paid by Mr Lee yet. (2) The family car of Mr Lee had not been reported as assets in the statement of financial position. Required: Explain to Mr Lee regarding his queries about the above accounting treatments. (6 marks) (Total marks for Question 1: 23 marks]

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

HSU Limited Journal for the period ended January 31 2022 Date Accoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started