Answered step by step

Verified Expert Solution

Question

1 Approved Answer

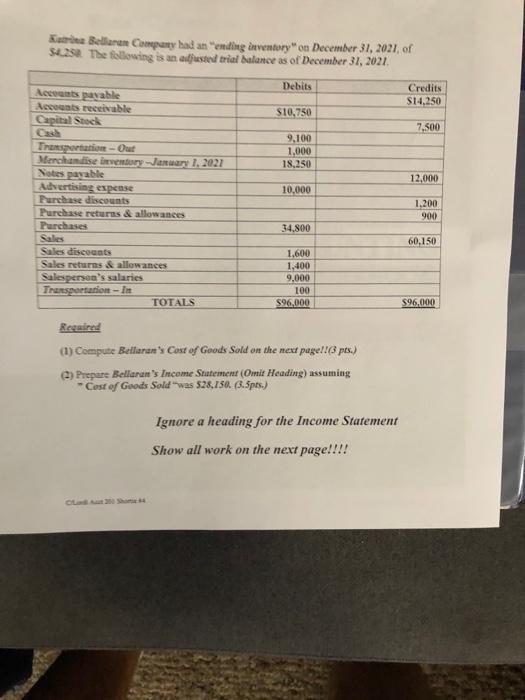

Katrina Bellaran Company had an ending inventory on December 31, 2021, of $4,258 The following is an adjusted trial balance as of December 31,

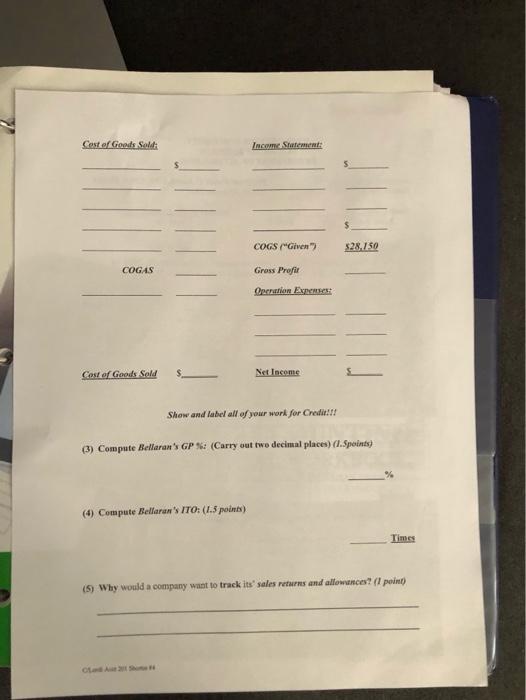

Katrina Bellaran Company had an "ending inventory" on December 31, 2021, of $4,258 The following is an adjusted trial balance as of December 31, 2021. Debits $10,750 Accounts payable Accounts receivable Capital Stock Transportation-Out Merchandise inventory-January 1, 2021 Notes payable Advertising expense Purchase discounts Purchase returns & allowances Purchases Sales Sales discounts Sales returns & allowances Salesperson's salaries Transportation-In TOTALS 9,100 1,000 18,250 10,000 34,800 1,600 1,400 9,000 100 $96,000 Required (1) Compute Bellaran's Cost of Goods Sold on the next page!!(3 pts.) (2) Prepare Bellaran's Income Statement (Omit Heading) assuming "Cost of Goods Sold "was $28,150. (3.5pts.) Ignore a heading for the Income Statement Show all work on the next page!!!! Credits $14,250 7,500 12,000 1,200 900 60,150 $96,000 Cost of Goods Sold COGAS Cost of Goods Sold (4) Compute Bellaran's ITO: (1.5 points) Income Statement: COGS ("Given") CLand A 21 Sho Gross Profit Operation Expenses Net Income Show and label all of your work for Credit!!! (3) Compute Bellaran's GP %: (Carry out two decimal places) (1.Spoints) $28.150 Times (5) Why would a company want to track its' sales returns and allowances? (1 point)

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Cost of Goods Sold Beginning Inventory 18250 Purchases 34800 Available for sale 18250 34...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started