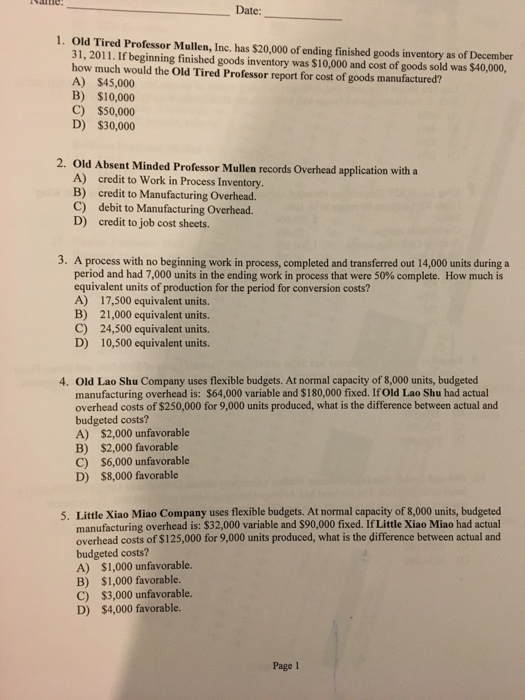

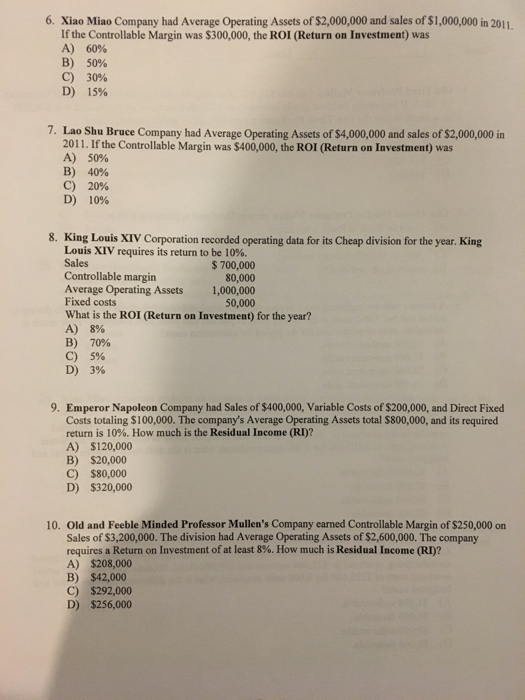

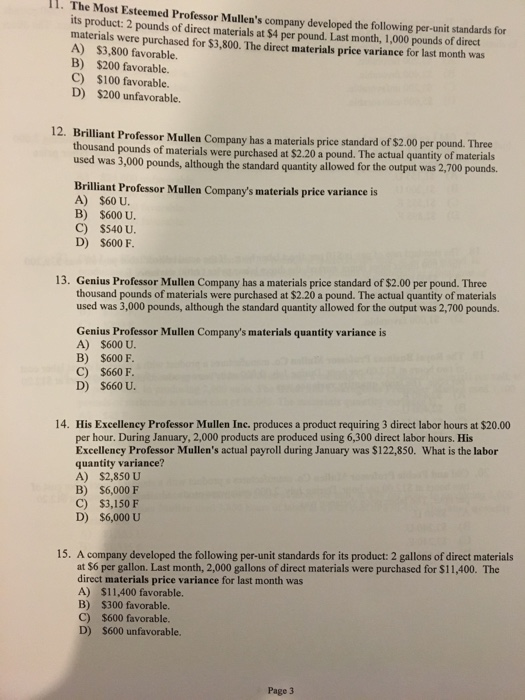

Date: 1. Old Tired Professor Mullen, Inc. has $20,000 of ending finished goods inventory as of December 31, 2011. If beginning finished goods inventory was $10,000 and cost of goods sold was $40,000, how much would the Old Tired Professor report for cost of goods manufactured? A) $45,000 B) $10,000 C) $50,000 D) $30,000 2. Old Absent Minded Professor Mullen records Overhead application with a A) credit to Work in Process Inventory B) credit to Manufacturing Overhead. C) debit to Manufacturing Overhead D) credit to job cost sheets. 3. A process with no beginning work in process, completed and transferred out 14,000 units during a period and had 7,000 units in the ending work in process that were 50% complete. How much is equivalent units of production for the period for conversion costs? A) 17,500 equivalent units. B) 21,000 equivalent units. C) 24,500 equivalent units. D) 10,500 equivalent units. 4. Old Lao Shu Company uses flexible budgets. At normal capacity of 8,000 units, budgeted manufacturing overhead is: $64,000 variable and $180,000 fixed. If Old Lao Shu had actual overhead costs of $250,000 for 9,000 units produced, what is the difference between actual and budgeted costs? A) $2,000 unfavorable B) $2,000 favorable C) $6,000 unfavorable D) $8,000 favorable 5. Little Xiao Miao Company uses flexible budgets. At normal capacity of 8,000 units, budgeted manufacturing overhead is: $32,000 variable and $90,000 fixed. If Little Xiao Miao had actual overhead costs of $125,000 for 9,000 units produced, what is the difference between actual and budgeted costs? A) $1,000 unfavorable. B) $1,000 favorable. C) $3,000 unfavorable. D) $4,000 favorable. Page 1 6. Xiao Miao Company had Average Operating Assets of $2,000,000 and sales of $1,000,000 in 2011. If the Controllable Margin was $300,000, the ROI (Return on Investment) was A)60% B) 50% c) 30% D) 15% 7. Lao Shu Bruce Company had Average Operating Assets of $4,000,000 and sales of $2,000,000 in 2011. If the Controllable Margin was $400,000, the ROI (Return on Investment) was A) 50% B) 40% C) 20% D) 10% 8. King Louis XIV Corporation recorded operating data for its Cheap division for the year. King Louis XIV requires its return to be 10%. Sales Controllable margin Average Operating Assets $ 700,000 80,000 1,000,000 50,000 Fixed costs What is the ROI (Return on Investment) for the year? A)8% B) 70% C) 5% D) 3% 9. Emperor Napoleon Company had Sales of $400,000, Variable Costs of $200,000, and Direct Fixed Costs totaling $100,000. The company's Average Operating Assets total $800,000, and its required return is 10%. How much is the Residual Income (RI)? A) $120,000 B) $20,000 C) $80,000 D) $320,000 Old and Feeble Minded Professor Mullen's Company earned Controllable Margin of $250,000 on Sales of $3,200,000. The division had Average Operating Assets of $2,600,000. The company requires a Return on Investment of at least 8%. How much is Residual Income (RI)? A) $208,000 B) $42,000 C) $292,000 D) $256,000 10. II. The Most Esteemed Professor Mullen's company developed the following per-unit standards for its product: 2 pounds of direct materials at $4 per pound. Last month, 1,000 pounds of direct materials were purchased for $3,800. The direct materials price variance for last month was A) $3,800 favorable. B) $200 favorable. C) $100 favorable. D) $200 unfavorable. 12. Brilliant Professor Mullen Company has a materials price standard of $2.00 per pound. Three thousand pounds of materials used was 3,000 pounds, although the standard quantity allowed for the output was 2,700 pounds were purchased at $2.20 a pound. The actual quantity of materials Brilliant Professor Mullen Company's materials price variance is A) $60 U. B) $600 U C) $540 U. D) $600 F Genius Professor Mullen Company has a materials price standard of $2.00 per pound. Three thousand pounds of materials were purchased at $2.20 a pound. The actual quantity of materials used was 3,000 pounds, although the standard quantity allowed for the output was 2,700 pounds. 13. Genius Professor Mullen Company's materials quantity variance is A) $600 U. B) $600F C) $660 F D) $660 U. His Excellency Professor Mullen Ine. produces a product requiring 3 direct labor hours at $20.00 per hour. During January, 2,000 products are produced using 6,300 direct labor hours. His Excellency Professor Mullen's actual payroll during January was $122,850. What is the labor quantity variance? A) $2,850 U B) $6,000 F C) $3,150 F D) $6,000uU 14. A company developed the following per-unit standards for its product: 2 gallons of direct materials at $6 per gallon. Last month, 2,000 gallons of direct materials were purchased for $11,400. The direct materials price variance for last month was A) $11,400 favorable. B) $300 favorable. C) $600 favorable. D) $600 unfavorable. 15. Page 3