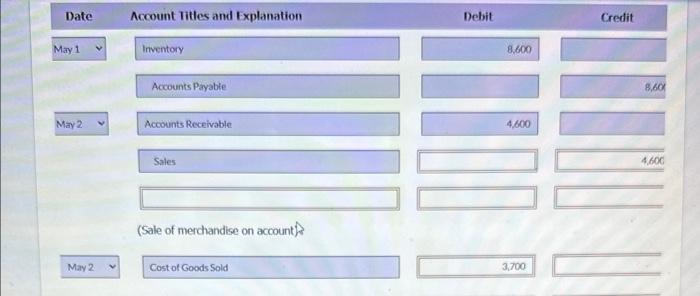

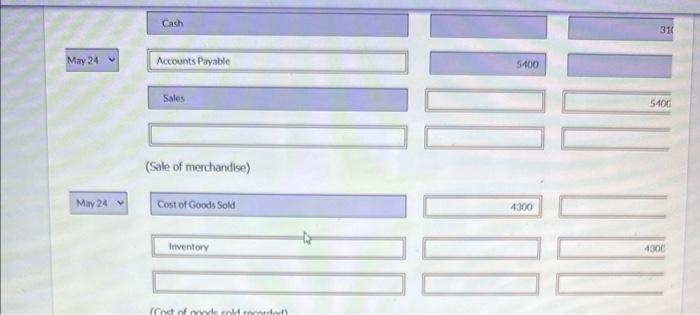

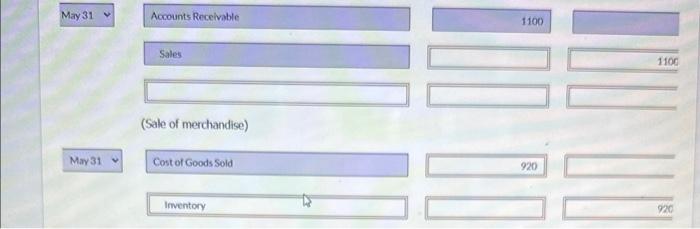

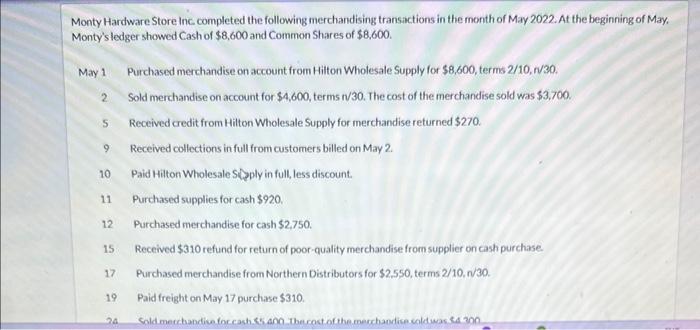

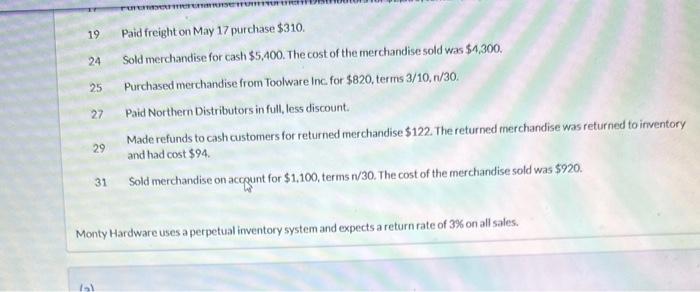

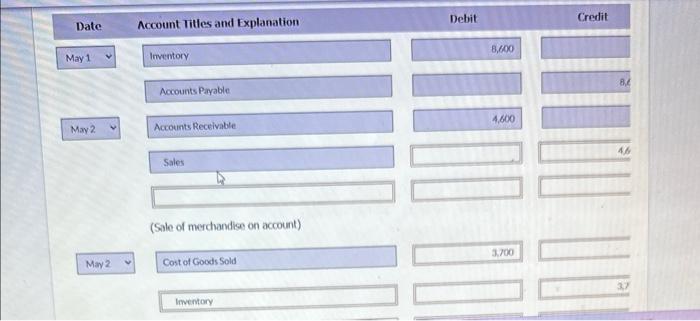

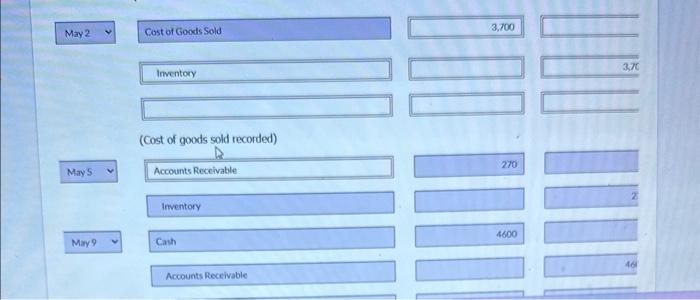

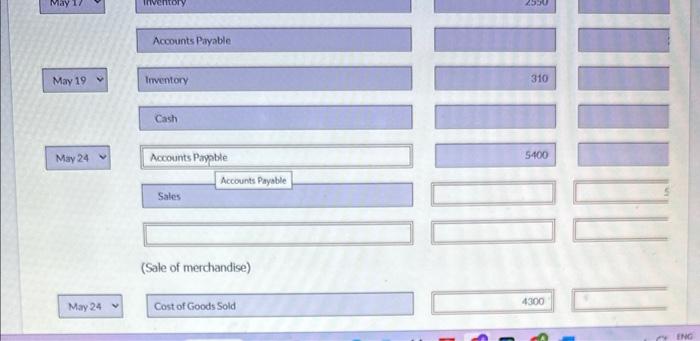

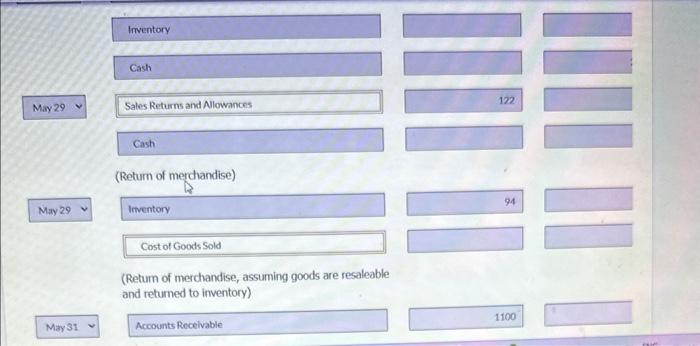

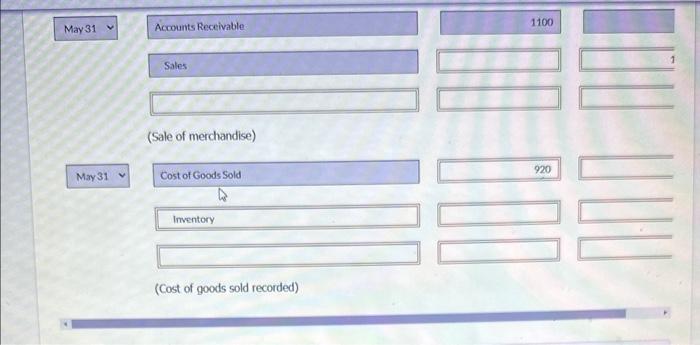

Date Account Titles and Explanation Inventory Accounts Payable May 2 Accounts Receivable 4,000 \begin{tabular}{|l|l|} \hline Sales & \\ \hline \end{tabular} (Sale of merchandise on account)s? May 2 Cost ot Goods Sold 3,700 Cash May 24 (Sale of merchandise) May 24 Cost of Goods Sold 4300 Inventory May 31 Acrounts Recelvable 1100 (Sale of merchandise) Cost of Goods Sold 920 Imventory Monty Hardware Store inc completed the following merchandising transactions in the month of May 2022 . At the beginning of May. Monty's ledger showed Cash of $8,600 and Common Shares of $8,600. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $8,600, terms 2/10, n/30. 2. Sold merchandise on account for $4,600, terms N/30. The cost of the merchandise sold was $3,700. 5 Received credit from Hilton Wholesale Supply for merchandise returned $270. 9 Received collections in full from customers billed on May 2. 10 Paid Hilton Wholesale SDpply in full, less discount. 11 Purchased supplies for cash $920. 12 Purchased merchandise for cash $2.750. 15. Received $310 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2.550, terms 2/10,n/30. 19 Paid freight on May 17 purchase $310. 19 Paid freight on May 17 purchase $310. 24 Sold merchandise for cash $5,400. The cost of the merchandise sold was $4,300. 25 Purchased merchandise from Toolware Inc for $820, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $122. The returned merchandise was returned to inventory and had cost $94. 31 Sold merchandise on acopunt for $1,100, terms n/30. The cost of the merchandise sold was $920. Monty Hardware uses a perpetual inventory system and expects a return rate of 3% on all sales. Date Account Titles and Explanation Imentory Accounts Payable May 2% Accounts Receivable (Sale of merchandise on account) 3700 Cost of Goods Sold leventory Inventory (Cost of goods sold recorded) Accounts Receivable inventory May 9 Cath 4600 Accounts Receivable Accounts Payable (Sale of merchandise) Cost of Goods Sold Imventory Cash (Return of merdiandise) (Retum of merchandise, assuming goods are resaleable and returned to inventory) 1100 Accounts Recelvable Accounts Receivable 1100 Sales (Sale of merchandise) Cost of Goods Sold \begin{tabular}{|r|} \hline 920 \\ \hline \end{tabular} Imventory (Cost of goods sold recorded)