Answered step by step

Verified Expert Solution

Question

1 Approved Answer

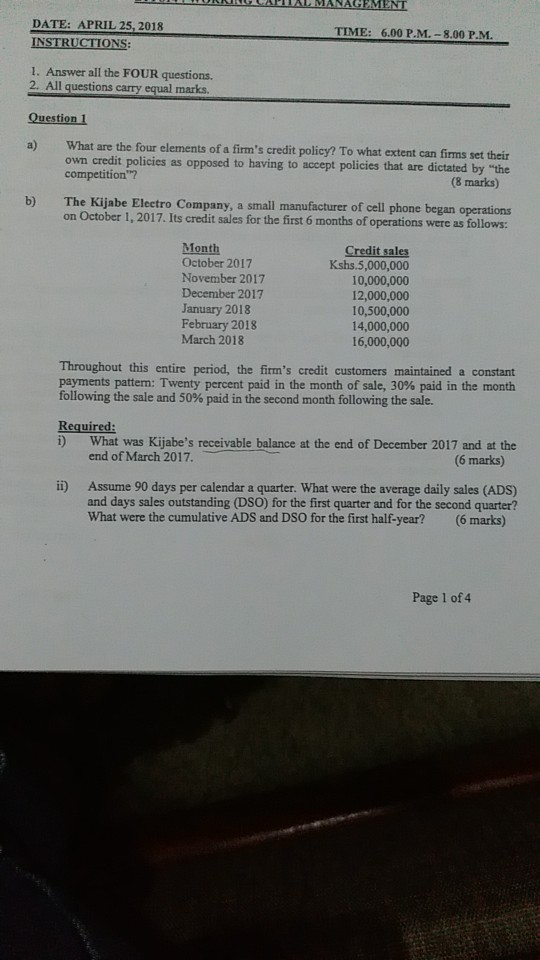

DATE: APRIL 25, 2018 TIME: 6.00 P.M.-8.00 P.M IN ONS 1. Answer all the FOUR questions. 2. All questions carry equal marks. Question 1 a)

DATE: APRIL 25, 2018 TIME: 6.00 P.M.-8.00 P.M IN ONS 1. Answer all the FOUR questions. 2. All questions carry equal marks. Question 1 a) What are the four elements of a firm's credit policy? To what extent can firms set their own credit policies as opposed to having to accept policies that are dictated by "the competition"? (8 marks) The Kijabe Electro Company, a small manufacturer of cell phone began operations on October b) 1, 2017. Its credit sales for the first 6 months of operations were as follows: ont October 2017 November 2017 December 2017 January 2018 February 2018 March 2018 Credit sales Kshs.5,000,000 10,000,000 12,000,000 10,500,000 14,000,000 16,000,000 Throughout this entire period, the firm's credit customers maintained a constant payments pattern: Twenty percent paid in the month of sale, 30% paid in the month following the sale and 50% paid in the second month following the sale. Required: i) What was Kijabe's receivable balance at the end of December 2017 and at the end of March 2017. 6 marks) ii) Assume 90 days per calendar a quarter. What were the average daily sales (ADS) and days sales outstanding (DSO) for the first quarter and for the second quarter? What were the cumulative ADS and DSO for the first half-year? (6 marks) Page 1 of 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started