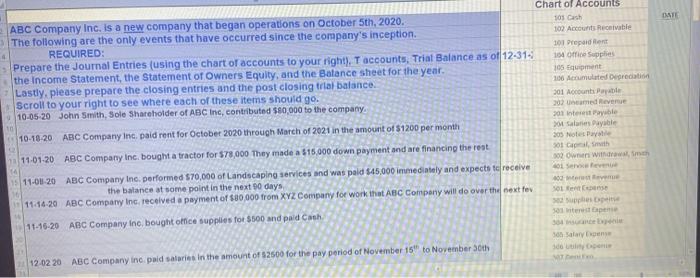

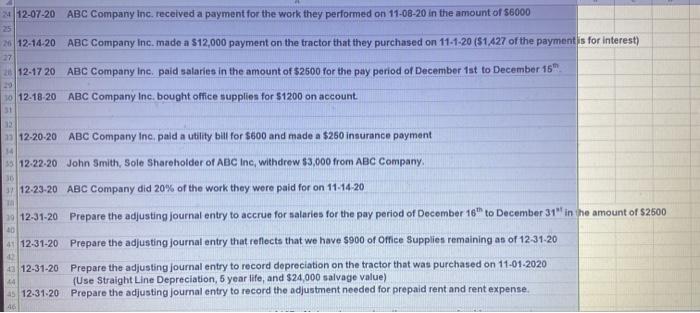

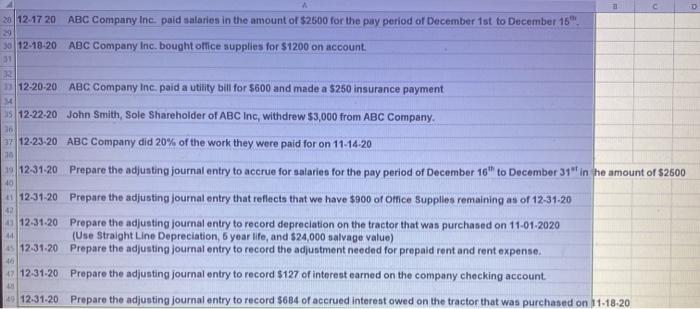

DATE Chart of Accounts ABC Company Inc. is a new company that began operations on October 5th, 2020. 101 Cash The following are the only events that have occurred since the company's inception 102 Accounts Receivable REQUIRED: 101 Prepaid Rent Prepare the Journal Entries (using the chart of accounts to your right), T accounts, Trial Balance as of 12-31 154 Supplies the Income Statement, the Statement of Owners Equity, and the Balance sheet for the year. 105 Equipment Lastly, please prepare the closing entries and the post closing trial balance 106 Accumulated Deprecat Scroll to your right to see where each of these items should go. 201 Accounts Payable 10-05-20 John Smith, Sole Shareholder of ABC Inc, contributed 580,000 to the company 202 med revenue 2011 estable 10-18-20 ABC Companying paid rent for October 2020 through March of 2021 in the amount of $1200 per month 04 Salaries able 205 Notepavali 10 11-01-20 ABC Company Inc. bought a tractor for $78,000 They made a $15.000 down payment and are financing the rest 2 Owner with 15 11-01-20 ABC Company Inc, performed $70,000 of Landscaping services and was paid $45,000 immediately and expects to receive Seve the balance at some point in the next 90 days Soute 11-14-20 ABC Company Inc received a payment of $80,000 from XYZ Company for work that ABC Company will do over the next few 01 mpen 11-16-20 ABC Company Inc, bought office supplies for $500 and paid Cash 30 Salary 300 12.02 20 ABC Company in paid salaries in the amount of $2500 for the pay period of November 15" to November 30th 24 12-07-20 ABC Company Inc. received a payment for the work they performed on 11-08-20 in the amount of 56000 2012-14-20 ABC Company Inc. made a $12,000 payment on the tractor that they purchased on 11-1-20 (51427 of the payment is for interest) 27 2012-17 20 ABC Company Inc. paid salaries in the amount of $2600 for the pay period of December 1st to December 15" 10 12-18-20 ABC Company Inc. bought office supplies for $1200 on account 31 13 12-20-20 ABC Company Inc, paid a utility bill for $600 and made a $250 insurance payment 12.22.20 John Smith, Sole Shareholder of ABC Inc withdrew $3,000 from ABC Company B 12-23-20 ABC Company did 20% of the work they were paid for on 11-14.20 12-31-20 Prepare the adjusting Journal entry to accrue for salaries for the pay period of December 16" to December 31" in the amount of $2600 412-31-20 Prepare the adjusting journal entry that reflects that we have $900 of Office Supplies remaining an of 12-31-20 14 TA 10 12-31-20 Prepare the adjusting journal entry to record depreciation on the tractor that was purchased on 11-01-2020 (Use Straight Line Depreciation, 5 year life, and $24,000 salvage value) AS 12-31.20 Prepare the adjusting journal entry to record the adjustment needed for prepaid rent and rent expense. 2012-17 20 ABC Company Inc. paid salaries in the amount of $2500 for the pay period of December 1st to December 15". 36 12-18-20 ABC Company Inc. bought office supplies for $1200 on account 31 32 36 10 40 12-20-20 ABC Company Inc. paid a utility bill for $600 and made a $250 insurance payment 15 12-22-20 John Smith, Sole Shareholder of ABC Inc, withdrew $3,000 from ABC Company 37 12-23-20 ABC Company did 20% of the work they were paid for on 11-14-20 12-31-20 Prepare the adjunting journal entry to accrue for salaries for the pay period of December 16" to December 31" in the amount of $2500 12-31-20 Prepare the adjusting journal entry that reflects that we have $900 of Office Supplies remaining as of 12-31-20 12-31-20 Prepare the adjusting journal entry to record depreciation on the tractor that was purchased on 11-01-2020 (Use Straight Line Depreciation, 5 year life, and $24,000 salvage value) 12.31.20 Prepare the adjusting journal entry to record the adjustment needed for prepaid rent and rent expense. 12-31-20 Prepare the adjusting journal entry to record $127 of interest earned on the company checking account 912-31-20 Prepare the adjusting journal entry to record $684 of accrued interest owed on the tractor that was purchased on 11-18-20 14