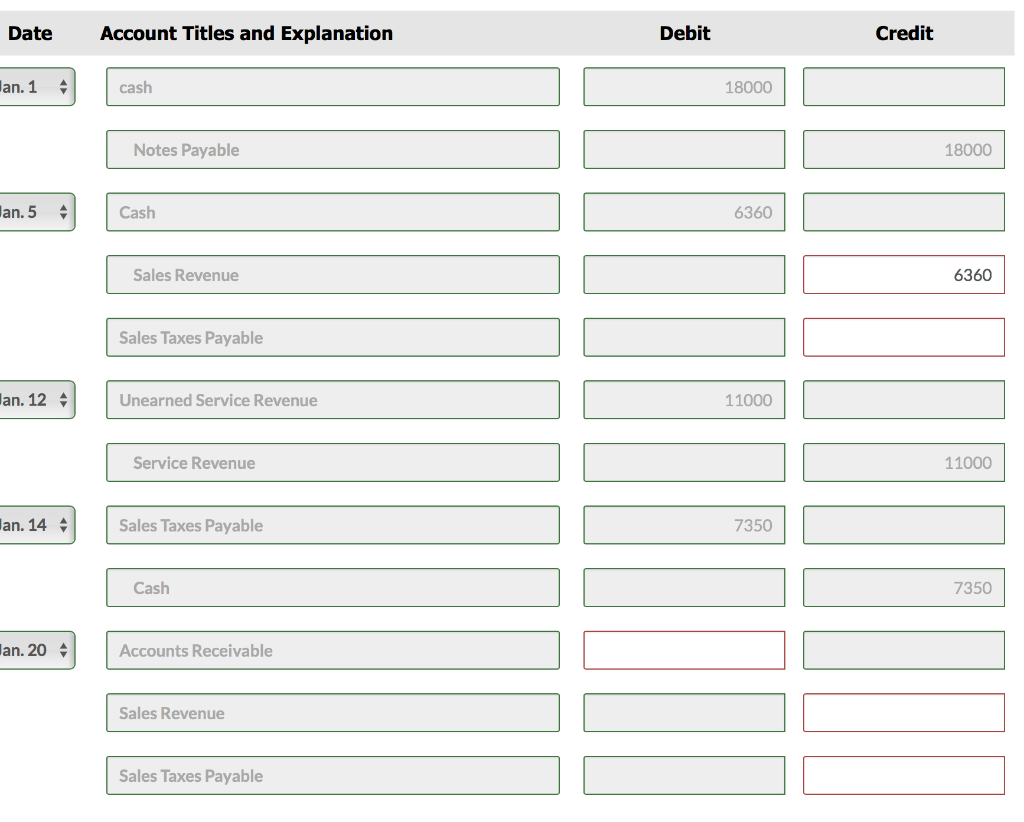

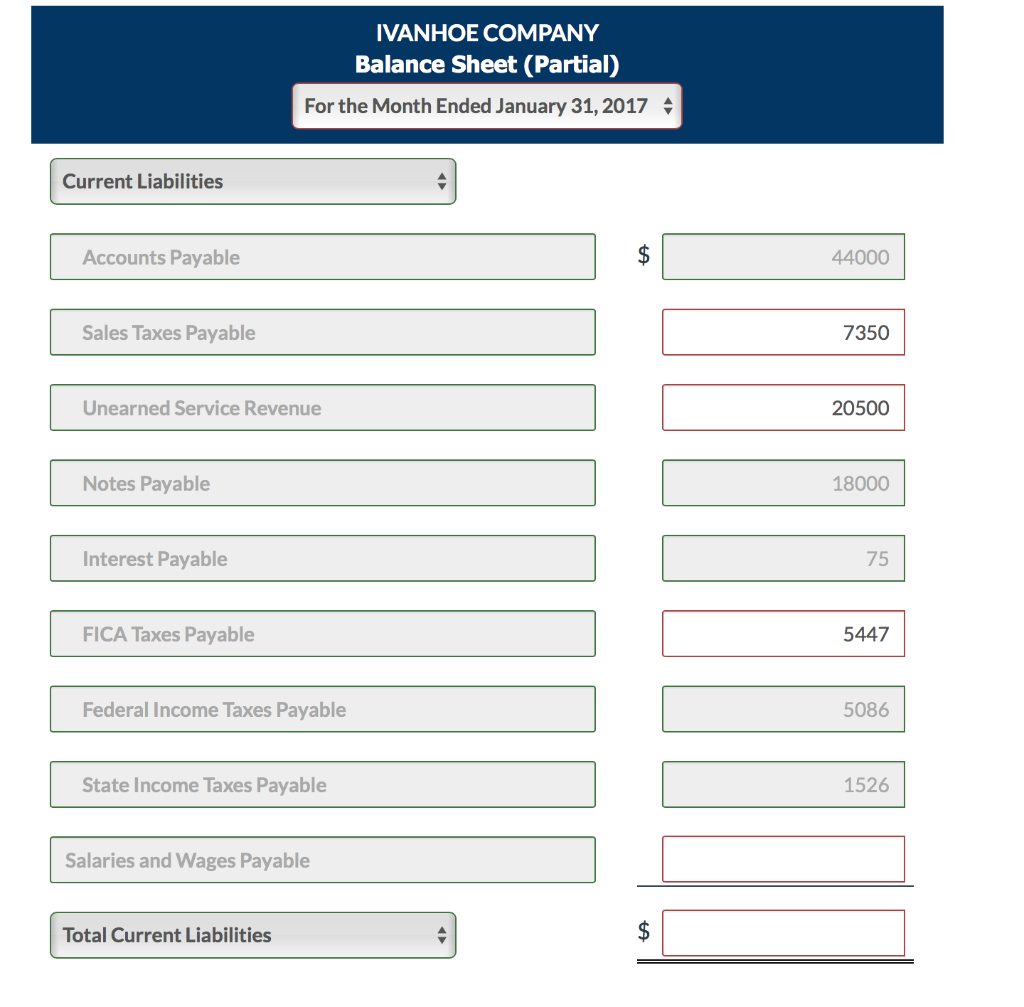

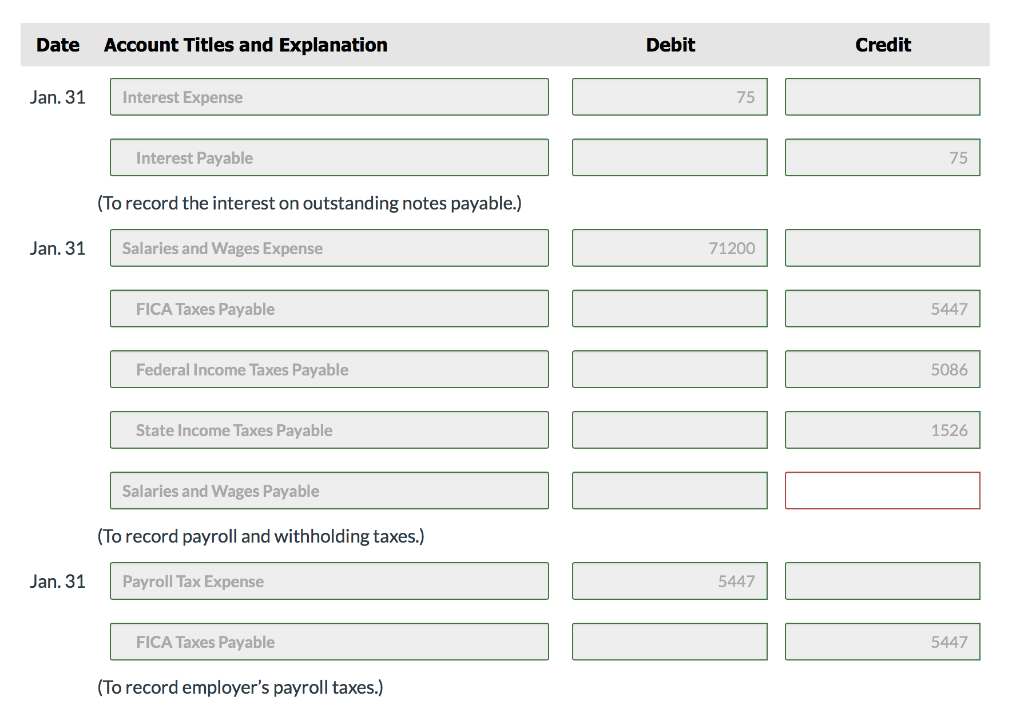

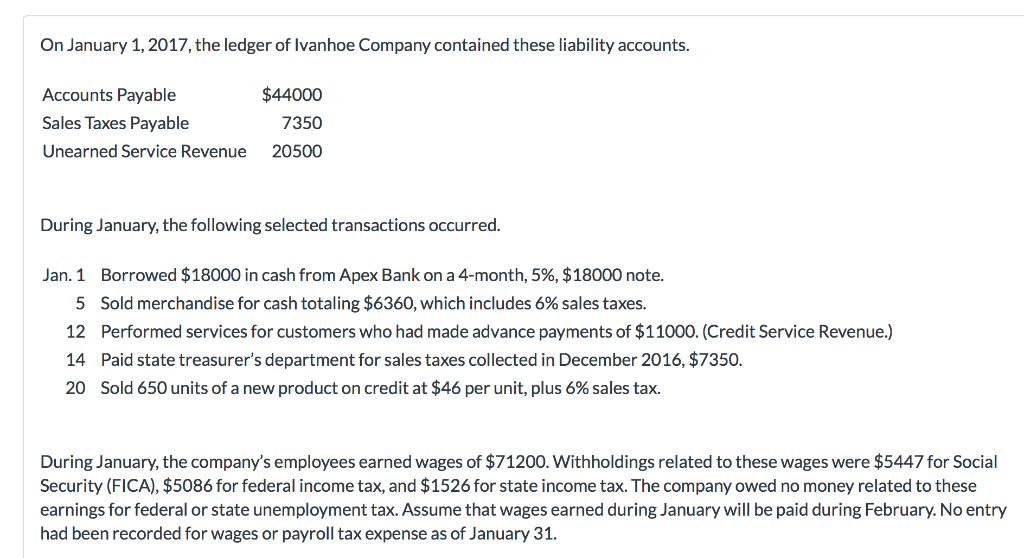

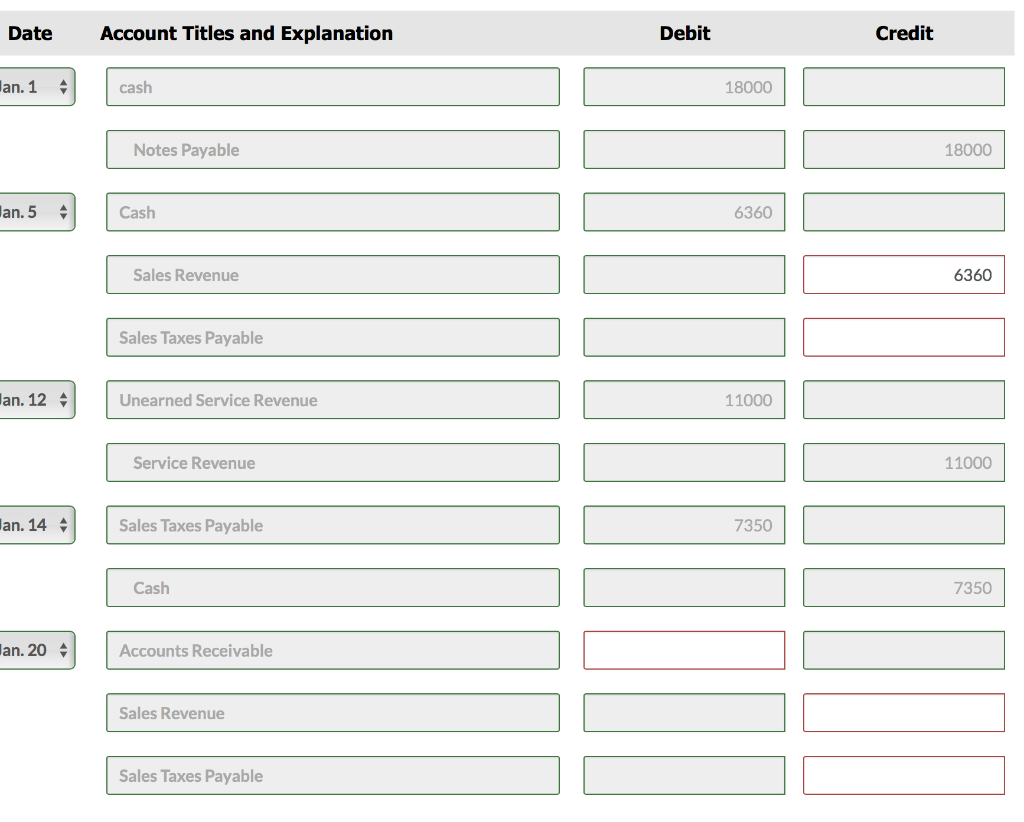

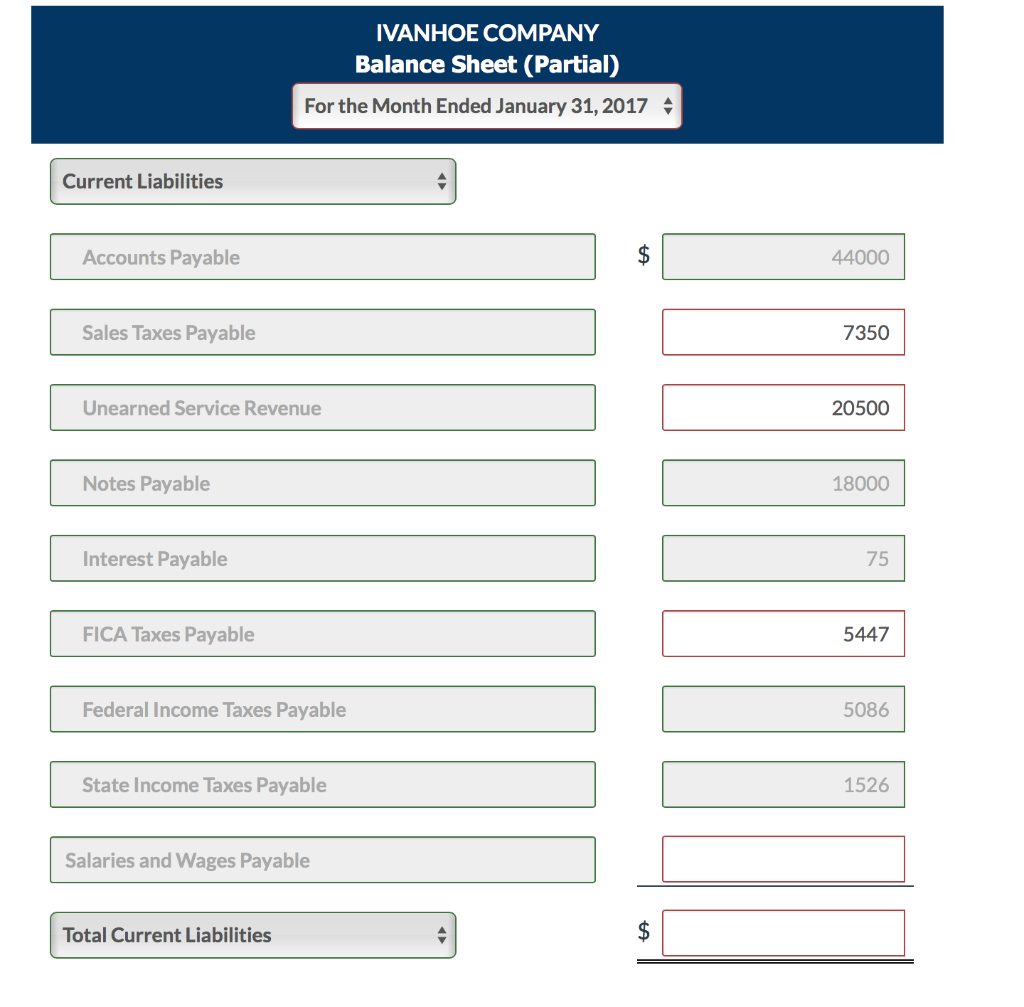

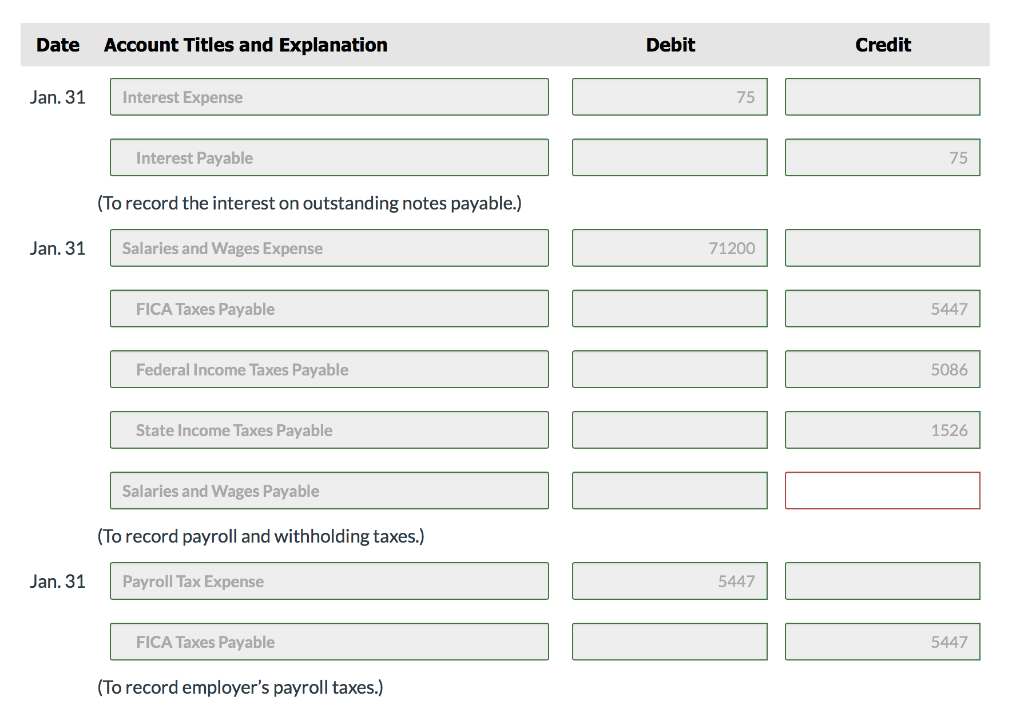

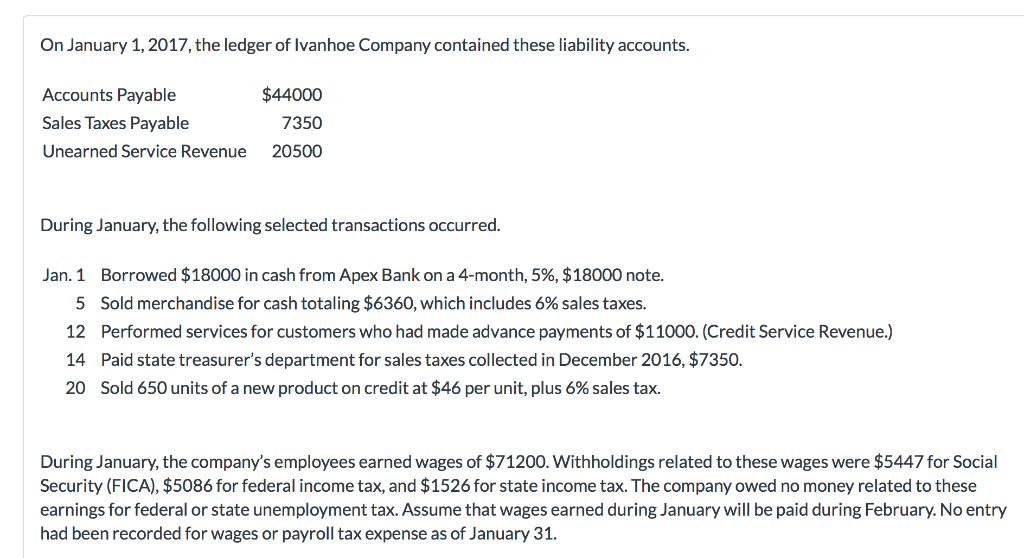

Date Debit Credit Account Titles and Explanation 18000 cash an. 1 4 18000 Notes Payable Cash 6360 an. 5 4 Sales Revenue 6360 Sales Taxes Payable Unearned Service Revenue 11000 11000 Service Revenue Ian, 14 7350 Sales Taxes Payable 7350 Cash an 20 Accounts Re Accounts Receivable Sales Revenue Sales Taxes Payable IVANHOE COMPANY Balance Sheet (Partial) For the Month Ended January 31,2017 Current Liabilities 44000 Accounts Payable Sales Taxes Payable 7350 Unearned Service Revenu 20500 Notes Payable 18000 Interest Payable 75 FICA Taxes Payable 5447 Federal Income Taxes Payable 5086 State Income Taxes Payable 1526 Salaries and Wages Payable Total Current Liabilities Debit Credit Account Titles and Explanation Date Jan. 31 Interest Expense 75 Interest Payable 75 (To record the interest on outstanding notes payable.) an. 31Saies and Wages Expense 71200 FICA Taxes Payable 5447 Federal Income Taxes Payable 5086 State Income Taxes Payable 1526 Salaries and Wages Payable To record payroll and withholding taxes.) Jan. 31 Payroll Tax Expense 5447 FICA Taxes Payable 5447 To record employer's payroll taxes.) On January 1,2017, the ledger of Ivanhoe Company contained these liability accounts $44000 7350 20500 Accounts Payable Sales Taxes Payable Unearned Service Revenue During January, the following selected transactions occurred. Borrowed $18000 in cash from Apex Bank on a 4-month, 596, $18000 note. Jan. 1 5 Sold merchandise for cash totaling $6360, which includes 6% sales taxes. 12 Performed services for customers who had made advance payments of $11000. (Credit Service Revenue.) 14 Paid state treasurer's department for sales taxes collected in December 2016, $7350 20 Sold 650 units of a new product on credit at $46 per unit, plus 6% sales tax. During January, the company's employees earned wages of $71200. Withholdings related to these wages were $5447 for Social Security (FICA), $5086 for federal income tax, and $1526 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during February. No entry had been recorded for wages or payroll tax expense as of January 31