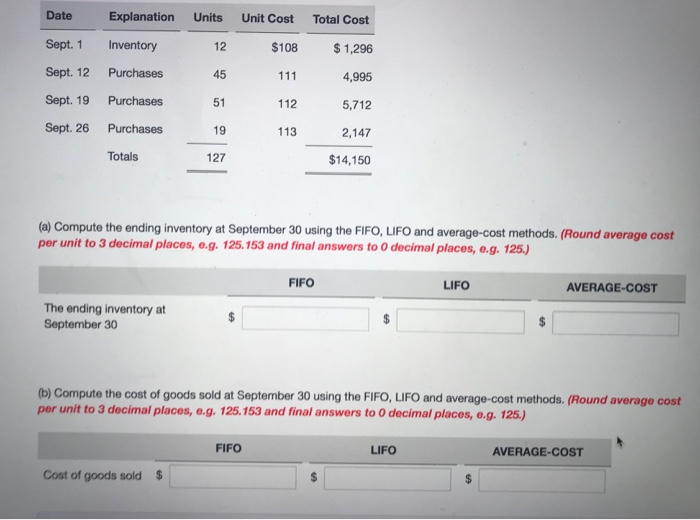

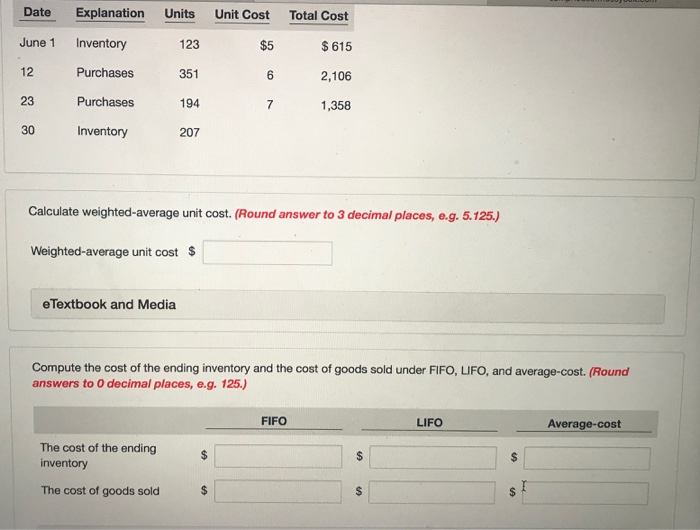

Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 12 $108 $1,296 Sept. 12 Purchases 45 111 4,995 Sept. 19 Purchases 51 112 5,712 Sept. 26 Purchases 19 113 2,147 Totals 127 $14,150 (a) Compute the ending inventory at September 30 using the FIFO, LIFO and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST The ending inventory at September 30 $ (b) Compute the cost of goods sold at September 30 using the FIFO, LIFO and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125) FIFO LIFO AVERAGE-COST Cost of goods sold Date Explanation Units Unit Cost Total Cost June 1 Inventory 123 $5 $615 12 Purchases 351 6 2,106 23 Purchases 194 7 1,358 30 Inventory 207 Calculate weighted-average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) Weighted-average unit cost $ eTextbook and Media Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round answers to 0 decimal places, e.g. 125.) FIFO LIFO Average-cost The cost of the ending inventory The cost of goods sold Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 12 $108 $1,296 Sept. 12 Purchases 45 111 4,995 Sept. 19 Purchases 51 112 5,712 Sept. 26 Purchases 19 113 2,147 Totals 127 $14,150 (a) Compute the ending inventory at September 30 using the FIFO, LIFO and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST The ending inventory at September 30 $ (b) Compute the cost of goods sold at September 30 using the FIFO, LIFO and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125) FIFO LIFO AVERAGE-COST Cost of goods sold Date Explanation Units Unit Cost Total Cost June 1 Inventory 123 $5 $615 12 Purchases 351 6 2,106 23 Purchases 194 7 1,358 30 Inventory 207 Calculate weighted-average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) Weighted-average unit cost $ eTextbook and Media Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round answers to 0 decimal places, e.g. 125.) FIFO LIFO Average-cost The cost of the ending inventory The cost of goods sold