Answered step by step

Verified Expert Solution

Question

1 Approved Answer

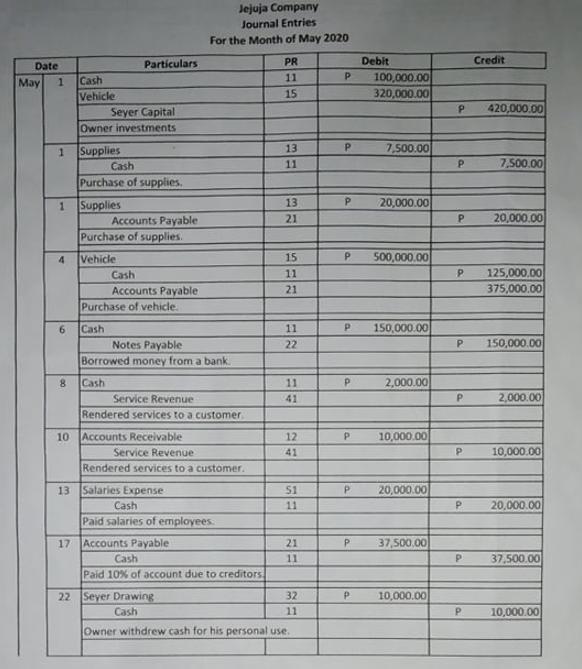

Date May 1 1 4 6 Cash Vehicle 1 Supplies 8 Particulars Seyer Capital Owner investments Supplies Cash Purchase of supplies. Accounts Payable Purchase

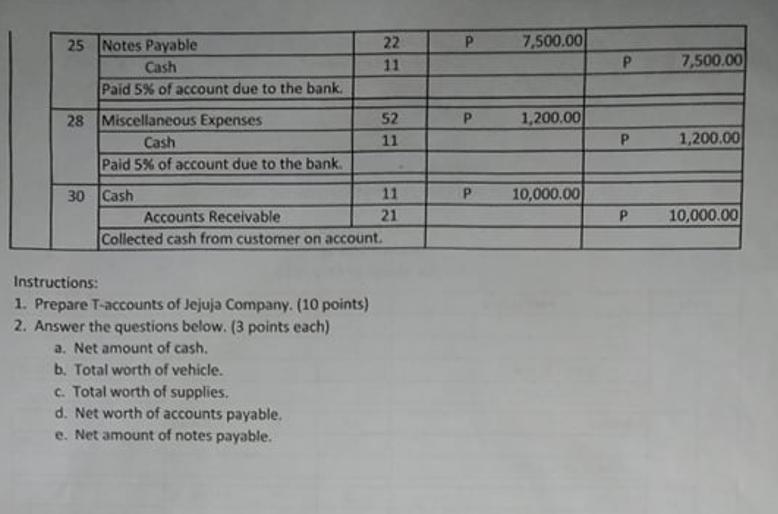

Date May 1 1 4 6 Cash Vehicle 1 Supplies 8 Particulars Seyer Capital Owner investments Supplies Cash Purchase of supplies. Accounts Payable Purchase of supplies. Vehicle Cash Accounts Payable Purchase of vehicle. Cash Notes Payable Borrowed money from a bank. Cash Service Revenue Rendered services to a customer. 10 Accounts Receivable Jejuja Company Journal Entries For the Month of May 2020 Service Revenue Rendered services to a customer. 13 Salaries Expense Cash Paid salaries of employees. 17 Accounts Payable Cash Paid 10% of account due to creditors 22 Seyer Drawing Cash PR 11 15 13 11 13 21 15 11 21 11 22 11 41 12 41 51 11 21 11 32 11 Owner withdrew cash for his personal use. P P la P P P P P 500,000.00 P Debit 100,000.00 320,000.00 P 7,500.00 20,000.00 150,000.00 2,000.00 10,000.00 20,000.00 P 37,500,00 10,000.00 P 420,000.00 P P P 20,000.00 P P P Credit P 7,500.00 P 125,000.00 375,000.00 150,000.00 2,000.00 P 20,000.00 10,000.00 37,500.00 10,000.00 25 Notes Payable Cash Paid 5% of account due to the bank. 28 Miscellaneous Expenses Cash Paid 5% of account due to the bank. 30 Cash 22 11 Instructions: 1. Prepare T-accounts of Jejuja Company. (10 points) 2. Answer the questions below. (3 points each) a. Net amount of cash. b. Total worth of vehicle. c. Total worth of supplies. d. Net worth of accounts payable. e. Net amount of notes payable. 52 11 11 21 Accounts Receivable Collected cash from customer on account. P P 7,500.00 1,200.00 10,000.00 P P 7,500.00 1,200.00 P 10,000.00

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started