Answered step by step

Verified Expert Solution

Question

1 Approved Answer

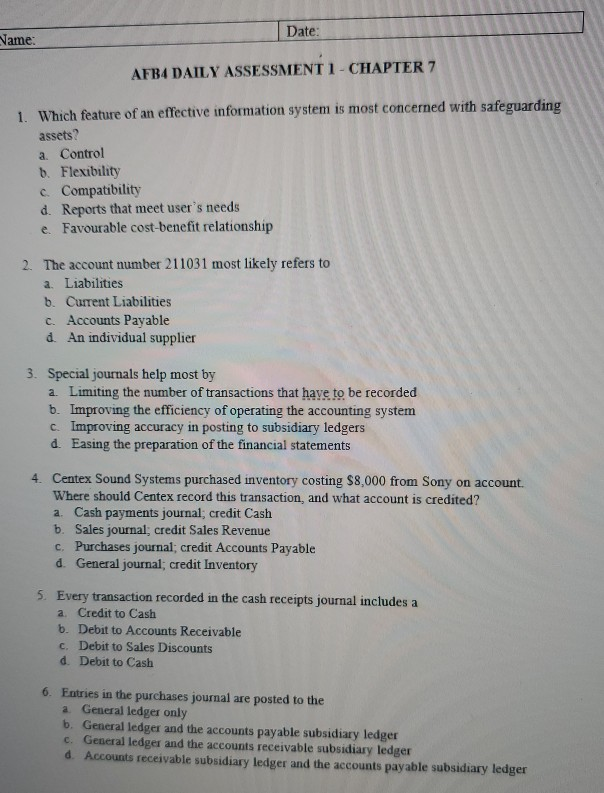

Date: Name: AFB4 DAILY ASSESSMENT 1 - CHAPTER 7 1. Which feature of an effective information system is most concerned with safeguarding assets? a Control

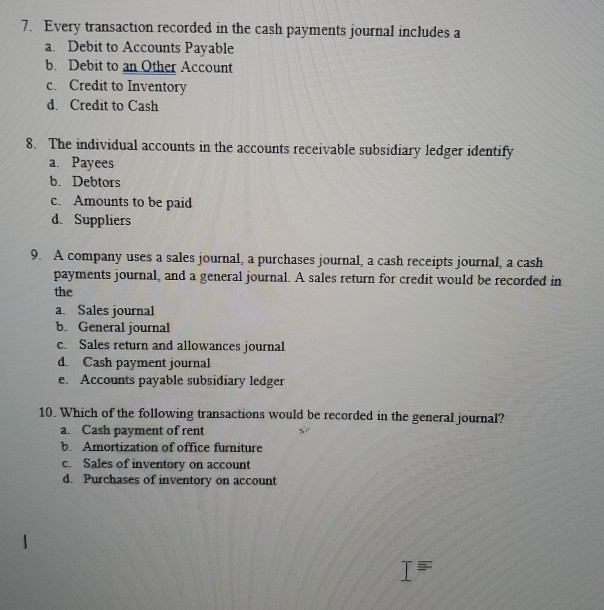

Date: Name: AFB4 DAILY ASSESSMENT 1 - CHAPTER 7 1. Which feature of an effective information system is most concerned with safeguarding assets? a Control 6. Flexibility c. Compatibility d. Reports that meet user's needs e. Favourable cost-benefit relationship 2. The account number 211031 most likely refers to a. Liabilities b. Current Liabilities c. Accounts Payable d. An individual supplier 3. Special journals help most by a Limiting the number of transactions that have to be recorded . Improving the efficiency of operating the accounting system c. Improving accuracy in posting to subsidiary ledgers d Easing the preparation of the financial statements 4. Centex Sound Systems purchased inventory costing $8,000 from Sony on account. Where should Centex record this transaction, and what account is credited? a. Cash payments journal, credit Cash b. Sales journal, credit Sales Revenue c. Purchases journal: credit Accounts Payable d. General journal: credit Inventory 5. Every transaction recorded in the cash receipts journal includes a a. Credit to Cash . Debit to Accounts Receivable c. Debit to Sales Discounts d. Debit to Cash 6. Entries in the purchases journal are posted to the a General ledger only b. General ledger and the accounts payable subsidiary ledger c. General ledger and the accounts receivable subsidiary ledger d. Accounts receivable subsidiary ledger and the accounts payable subsidiary ledger 7. Every transaction recorded in the cash payments journal includes a a. Debit to Accounts Payable b. Debit to an Other Account c. Credit to Inventory d. Credit to Cash 8. The individual accounts in the accounts receivable subsidiary ledger identify a. Payees b. Debtors C. Amounts to be paid d. Suppliers 9. A company uses a sales journal, a purchases journal, a cash receipts journal, a cash payments journal and a general journal. A sales return for credit would be recorded in the a. Sales journal b. General journal c. Sales return and allowances journal d. Cash payment journal e. Accounts payable subsidiary ledger 10. Which of the following transactions would be recorded in the general journal? a. Cash payment of rent b. Amortization of office furniture c. Sales of inventory on account d. Purchases of inventory on account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started