Answered step by step

Verified Expert Solution

Question

1 Approved Answer

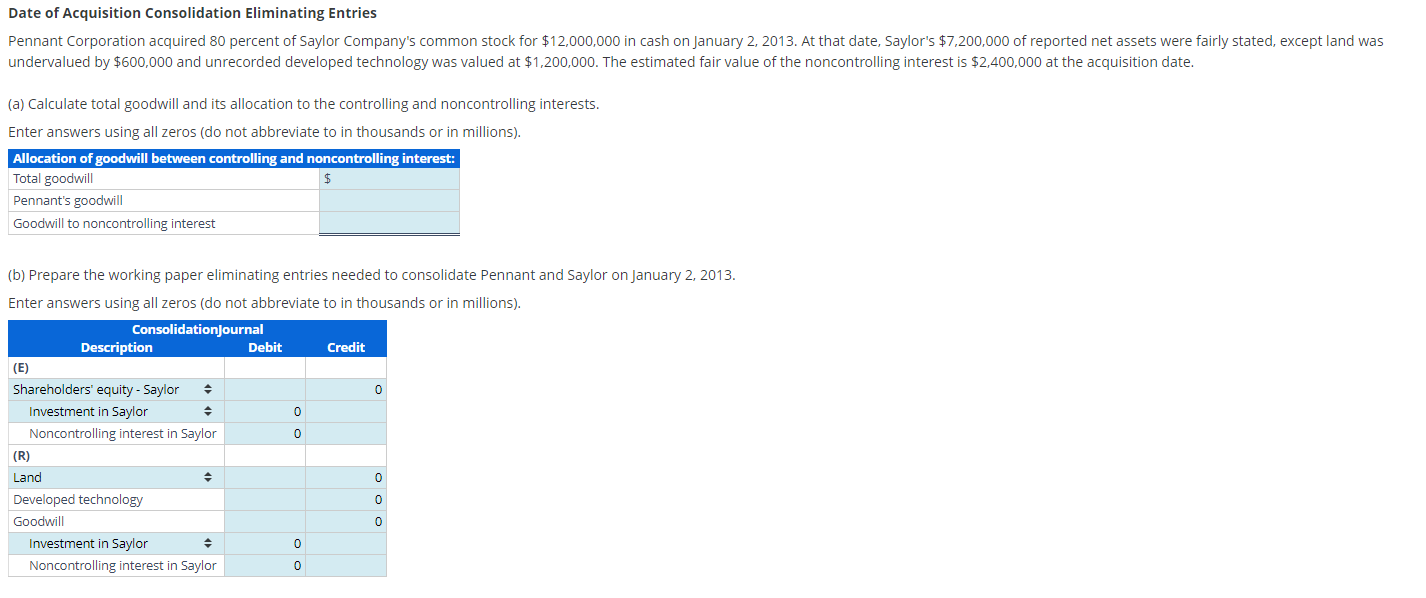

Date of Acquisition Consolidation Eliminating Entries undervalued by $600,000 and unrecorded developed technology was valued at $1,200,000. The estimated fair value of the noncontrolling interest

Date of Acquisition Consolidation Eliminating Entries undervalued by $600,000 and unrecorded developed technology was valued at $1,200,000. The estimated fair value of the noncontrolling interest is $2,400,000 at the acquisition date. (a) Calculate total goodwill and its allocation to the controlling and noncontrolling interests. Enter answers using all zeros (do not abbreviate to in thousands or in millions). (b) Prepare the working paper eliminating entries needed to consolidate Pennant and Saylor on January 2, 2013. Enter answers using all zeros (do not abbreviate to in thousands or in millions)

Date of Acquisition Consolidation Eliminating Entries undervalued by $600,000 and unrecorded developed technology was valued at $1,200,000. The estimated fair value of the noncontrolling interest is $2,400,000 at the acquisition date. (a) Calculate total goodwill and its allocation to the controlling and noncontrolling interests. Enter answers using all zeros (do not abbreviate to in thousands or in millions). (b) Prepare the working paper eliminating entries needed to consolidate Pennant and Saylor on January 2, 2013. Enter answers using all zeros (do not abbreviate to in thousands or in millions) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started