Answered step by step

Verified Expert Solution

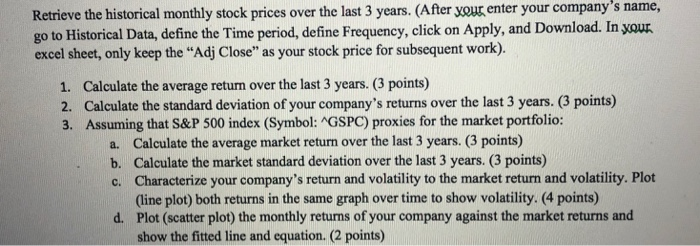

Question

1 Approved Answer

Date Open High Low Close Adj Close Volume 6/30/16 null null null null null null 7/31/16 75.669998 80.690002 71.809998 75.690002 71.212059 6606842 8/31/16 75.089996 75.580002

Date Open High Low Close Adj Close Volume

6/30/16 null null null null null null

7/31/16 75.669998 80.690002 71.809998 75.690002 71.212059 6606842

8/31/16 75.089996 75.580002 69.5 70.32 66.497955 5004121

9/30/16 70.389999 73.059998 63.099998 64.25 60.757874 5946829

10/31/16 64.239998 75 58 67.779999 64.096001 8603843

11/30/16 67.970001 69.199997 61.700001 64.989998 61.457653 4938645

12/31/16 64.989998 66.790001 59.299999 59.450001 56.218769 4544351

1/31/17 59.5 64.160004 52.18 55.700001 52.672592 13513626

2/28/17 55.799999 59.240002 53.200001 58.119999 55.448921 6858382

3/31/17 57.59 62.52 56.849998 61.119999 58.311043 5826693

4/30/17 61 67.050003 56.84 57.470001 54.828793 7581014

5/31/17 57.169998 58.345001 51.900002 52.080002 49.686504 10083185

6/30/17 51.77 58.119999 50.689999 53.310001 50.859974 7717777

7/31/17 53.099998 53.98 39.5 43.150002 41.166912 15151436

8/31/17 43 46.279999 40.049999 45.82 44.155064 10716751

9/30/17 46.07 50.060001 45.029999 46.59 44.897087 9380190

10/31/17 46.299999 48.860001 43.66 47 45.292187 8919501

11/30/17 46.32 47.82 42.360001 46.700001 45.003086 6000703

12/31/17 46.700001 48.389999 44.689999 47.990002 46.24622 5111807

1/31/18 48.189999 49.884998 38.400002 39.389999 37.958706 16197289

2/28/18 39.02 44.43 38.110001 41.73 40.75428 10530431

3/31/18 41.73 43.889999 38.509998 42.169998 41.18399 8084388

4/30/18 42.099998 50 41.43 49.23 48.078915 8084388

5/31/18 50.189999 54.939999 49.720001 52.220001 50.999004 8084388

6/30/18 52.200001 54.099998 46.599998 49.950001 48.782085 8084388

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started