Answered step by step

Verified Expert Solution

Question

1 Approved Answer

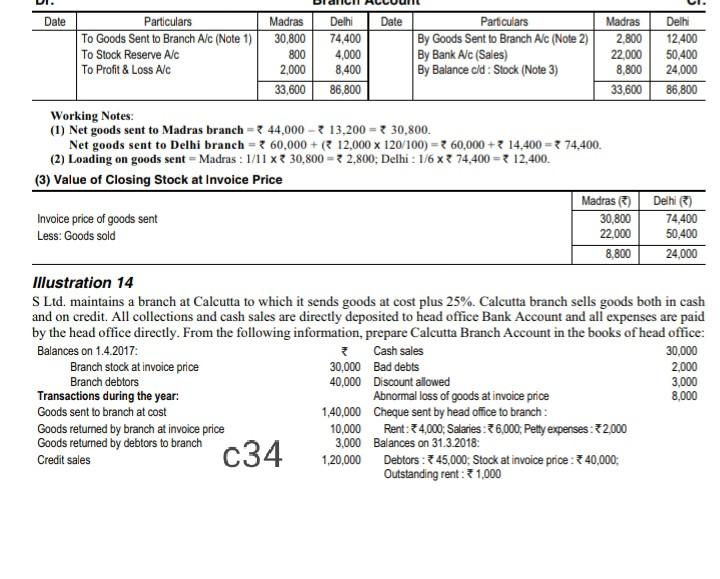

Date Particulars Madras Delhi Date Particulars Madras Delhi To Goods Sent to Branch A/c (Note 1) 30,800 74,400 By Goods Sent to Branch A/c (Note

Date Particulars Madras Delhi Date Particulars Madras Delhi To Goods Sent to Branch A/c (Note 1) 30,800 74,400 By Goods Sent to Branch A/c (Note 2) 2,800 12,400 To Stock Reserve A/C 800 4,000 By Bank A/c (Sales) 22,000 50,400 To Profit & Loss Alc 2,000 8,400 By Balance old: Stock (Note 3) 8,800 24,000 33,600 86,800 33,600 86,800 Working Notes: (1) Net goods sent to Madras branch - 44,000 -13,200 - 30,800. Net goods sent to Delhi branch = 60.000 + ( 12,000 x 120/100) = 60,000 + 3 14.400 = 3 74.400. (2) Loading on goods sent - Madras: 1/11x? 30.800 = 2,800; Delhi : 1/6 x 74,400 = 12,400. (3) Value of Closing Stock at Invoice Price Madras (3) Delhi) Invoice price of goods sent 30,800 74,400 Less: Goods sold 22,000 50,400 8,800 24,000 Illustration 14 S Ltd. maintains a branch at Calcutta to which it sends goods at cost plus 25%. Calcutta branch sells goods both in cash and on credit. All collections and cash sales are directly deposited to head office Bank Account and all expenses are paid by the head office directly. From the following information, prepare Calcutta Branch Account in the books of head office: Balances on 1.4.2017: Cash sales 30,000 Branch stock at invoice price 30,000 Bad debts 2,000 Branch debtors 40,000 Discount allowed 3,000 Transactions during the year: Abnormal loss of goods at invoice price 8,000 Goods sent to branch at cost 1,40,000 Cheque sent by head office to branch: Goods returned by branch at invoice price 10,000 Rent: 34,000, Salaries : 36,000, Petty expenses: 32,000 Goods returned by debtors to branch 3,000 Balances on 31.3.2018: Credit sales c34 1,20,000 Debtors : 345,000; Stock at invoice price : 340,000: Outstanding rent: 1,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started