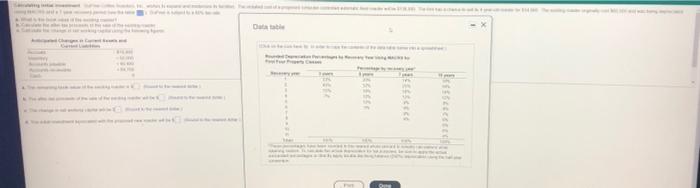

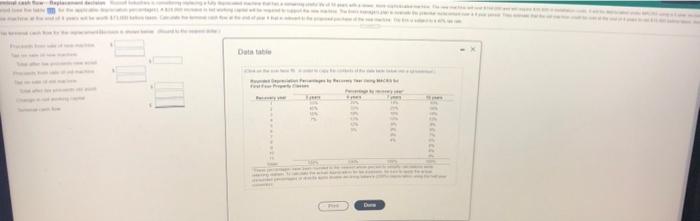

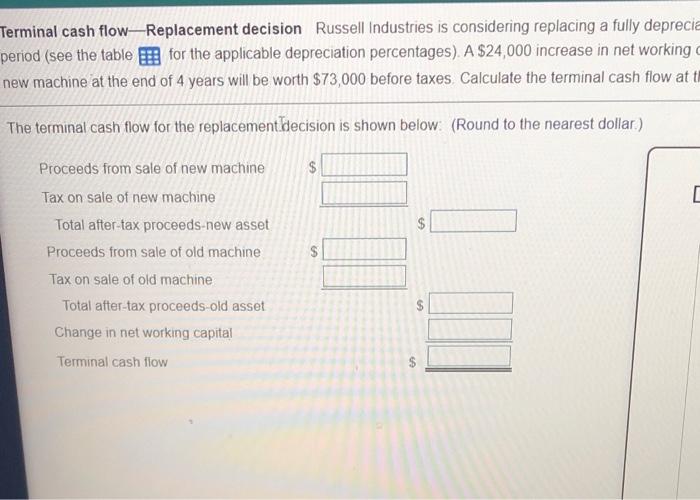

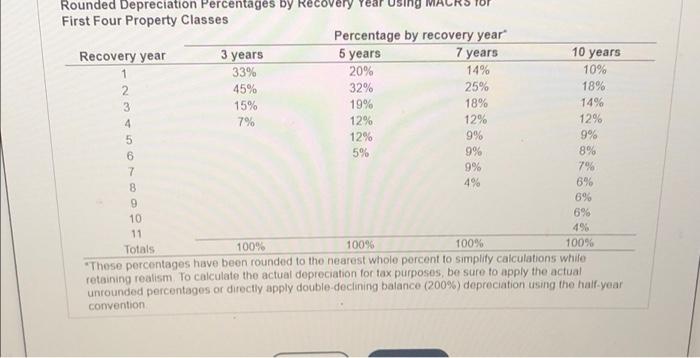

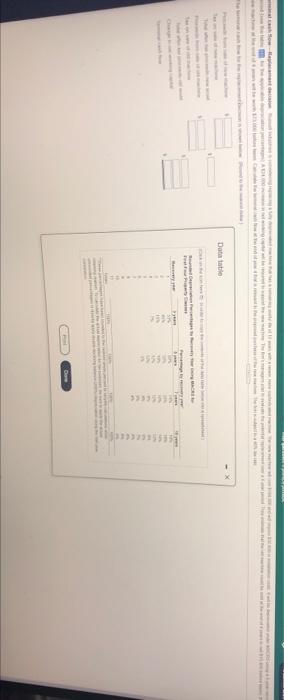

Date the 3533 1953311 0 0 733513511 Terminal cash flow-Replacement decision Russell Industries is considering replacing a fully deprecia period (see the table for the applicable depreciation percentages). A $24,000 increase in net working new machine at the end of 4 years will be worth $73,000 before taxes Calculate the terminal cash flow at t The terminal cash flow for the replacement decision is shown below: (Round to the nearest dollar.) $ $ $ Proceeds from sale of new machine Tax on sale of new machine Total after-tax proceeds-new asset Proceeds from sale of old machine Tax on sale of old machine Total after-tax proceeds old asset Change in net working capital Terminal cash flow $ $ 10 years Rounded Depreciation Percentages by Recovery Year First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 490 Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole porcent to simplity calculations while retaining realism To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the hair-year convention 5% Datatile 355535i Date the 3533 1953311 0 0 733513511 Terminal cash flow-Replacement decision Russell Industries is considering replacing a fully deprecia period (see the table for the applicable depreciation percentages). A $24,000 increase in net working new machine at the end of 4 years will be worth $73,000 before taxes Calculate the terminal cash flow at t The terminal cash flow for the replacement decision is shown below: (Round to the nearest dollar.) $ $ $ Proceeds from sale of new machine Tax on sale of new machine Total after-tax proceeds-new asset Proceeds from sale of old machine Tax on sale of old machine Total after-tax proceeds old asset Change in net working capital Terminal cash flow $ $ 10 years Rounded Depreciation Percentages by Recovery Year First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 490 Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole porcent to simplity calculations while retaining realism To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the hair-year convention 5% Datatile 355535i