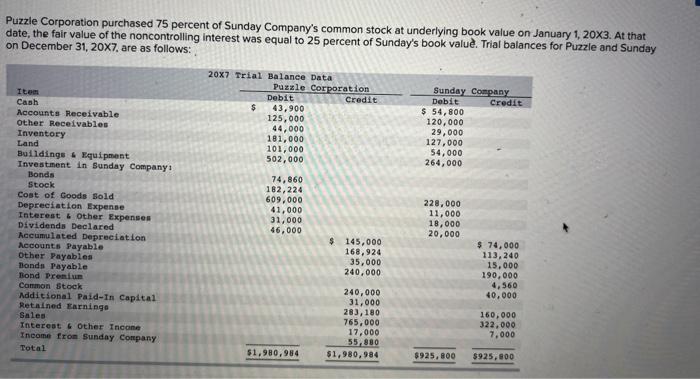

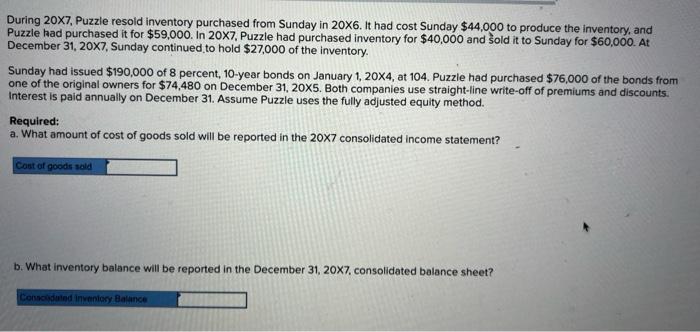

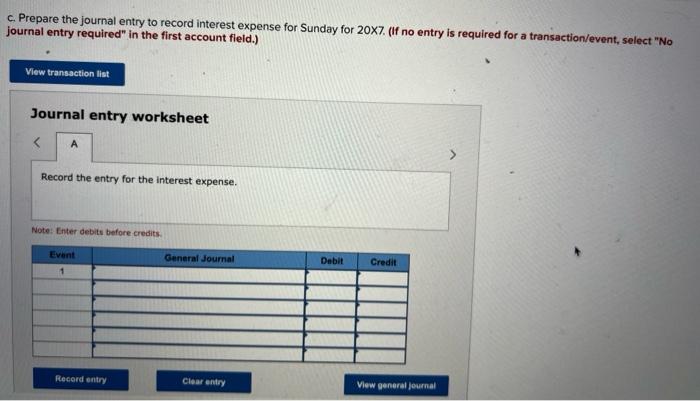

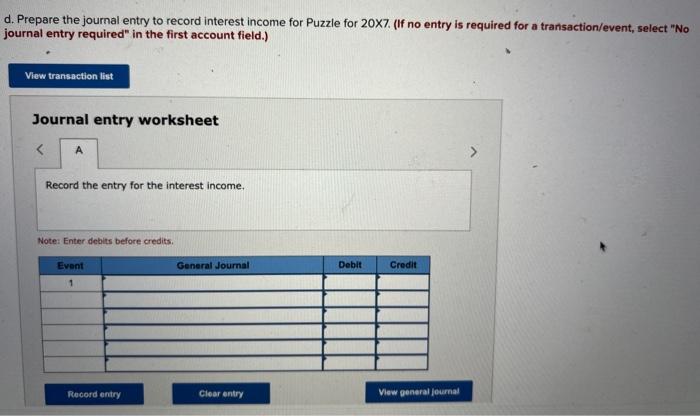

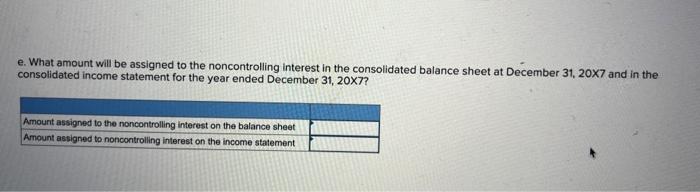

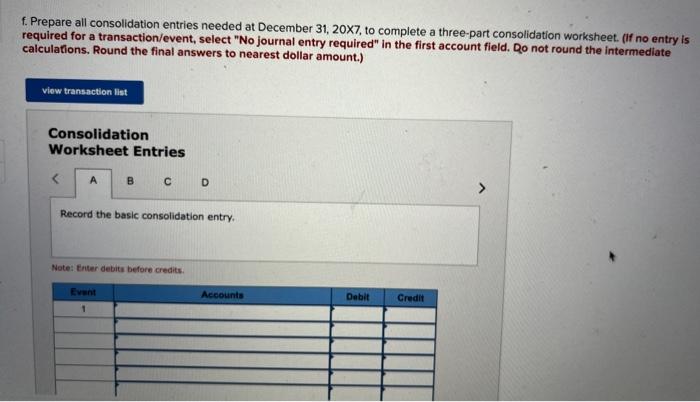

date, the fair value of the noncontrolling interest was equal to 25 percent of Sunday's book value. Trial balances for Puzzle and Sunday on December 31,207, are as follows: During 20X7, Puzzle resold inventory purchased from Sunday in 20X6. It had cost Sunday $44,000 to produce the inventory, and Puzzle had purchased it for $59,000. In 207. Puzzle had purchased inventory for $40,000 and ssold it to Sunday for $60,000. At December 31,207, Sunday continued to hold $27,000 of the inventory. Sunday had issued $190,000 of 8 percent, 10-year bonds on January 1,204, at 104. Puzzle had purchased $76,000 of the bonds from one of the original owners for $74,480 on December 31,205. Both companies use straight-line write-off of premiums and discounts. Interest is paid annually on December 31. Assume Puzzle uses the fully adjusted equity method. Required: a. What amount of cost of goods sold will be reported in the 207 consolidated income statement? b. What inventory balance will be reported in the December 31,207, consolidated balance sheet? c. Prepare the journal entry to record interest expense for Sunday for 207. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for the interest expense. Note: Enter debits before credits. 1. Prepare the journal entry to record interest income for Puzzle for 207. (If no entry is required for a transaction/event, select "No ournal entry required" in the first account field.) Journal entry worksheet e. What amount will be assigned to the noncontrolling interest in the consolidated balance sheet at December 31,207 and in the consolidated income statement for the year ended December 31,207 ? f. Prepare all consolidation entries needed at December 31, 20X7, to complete a three-part consolidation worksheet. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Qo not round the intermediate calculations. Round the final answers to nearest dollar amount.) Consolidation Worksheet Entries D