Question

Date Transaction Aug. 1 Cliff issues $50,000 shares of common stock for cash. Aug. 3 Cliff purchases barbering equipment for $32,500; $12,500 was paid immediately

Date Transaction

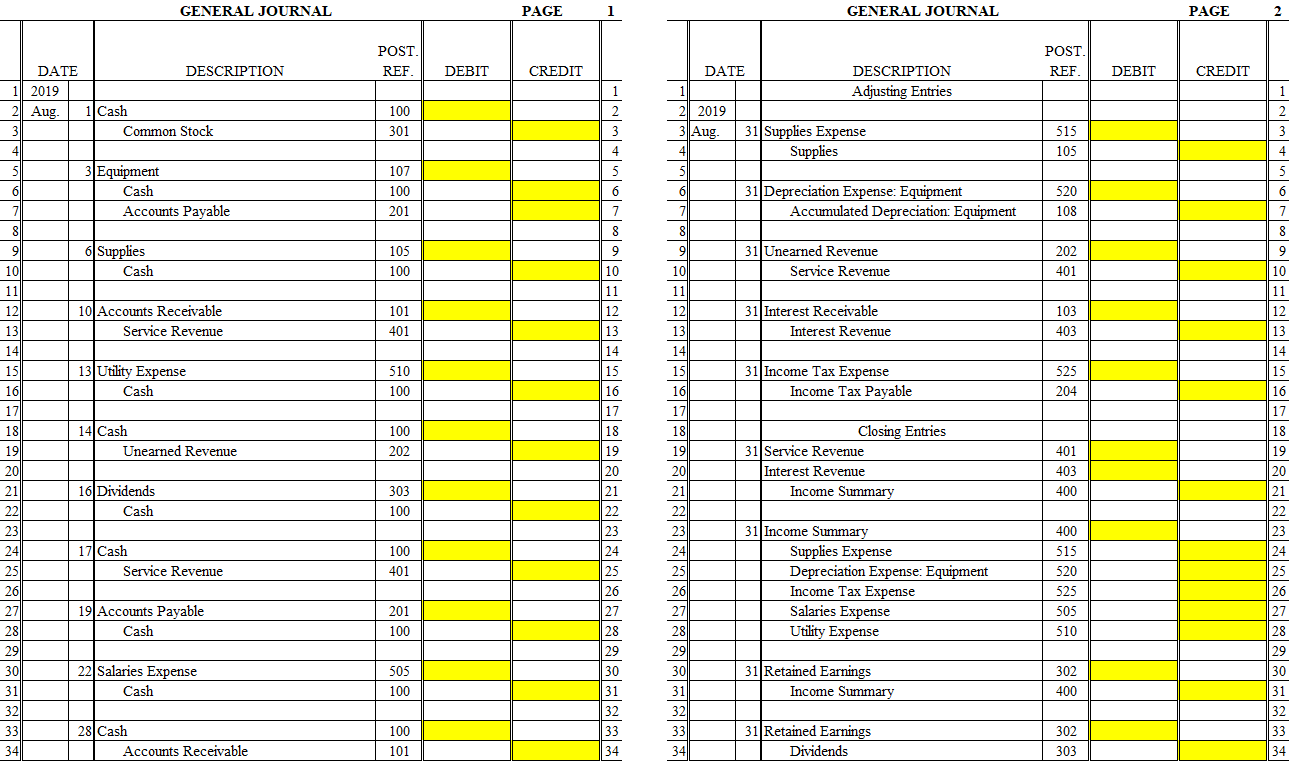

Aug. 1 Cliff issues $50,000 shares of common stock for cash.

Aug. 3 Cliff purchases barbering equipment for $32,500; $12,500 was paid immediately with cash, and the remaining $20,000 was billed to Cliff with payment due in 30 days. He decided to buy used equipment, because he was not sure if he truly wanted to run a barber shop. He assumed that he will replace the used equipment with new equipment within a couple of years.

Aug. 6 Cliff purchases supplies for $829 cash.

Aug. 10 Cliff provides $2,400 in services to a customer who asks to be billed for the services.

Aug. 13 Cliff pays a $58 utility bill with cash.

Aug. 14 Cliff receives $3,600 cash in advance from a customer for services not yet rendered.

Aug. 16 Cliff distributed $250 cash in dividends to stockholders.

Aug. 17 Cliff receives $3,000 cash from a customer for services rendered.

Aug. 19 Cliff paid $10,000 toward the outstanding liability from the August 3 transaction.

Aug. 22 Cliff paid $5,319 cash in salaries expense to employees.

Aug. 28 The customer from the August 10 transaction pays $1,200 cash toward Cliffs account.

ADJUSTMENTS

Date Transaction

Aug. 31 Cliff took an inventory of supplies and discovered that $136 of supplies remain unused at the end of the month.

Aug. 31 The equipment purchased on August 3 depreciated $1,355 during the month of August.

Aug. 31 Clipem Cliff performed $2,400 of services during August for the customer from the August 14 transaction.

Aug. 31 Reviewing the company bank statement, Clipem Cliff discovers $142 of interest earned during the month of August that was previously uncollected and unrecorded. As a new customer for the bank, the interest was paid by a bank that offered an above-market-average interest rate.

Aug. 31 Unpaid and previously unrecorded income taxes for the month are $5,481. The tax payment was to cover his federal quarterly estimated income taxes. He lives in a state that does not have an individual income tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started