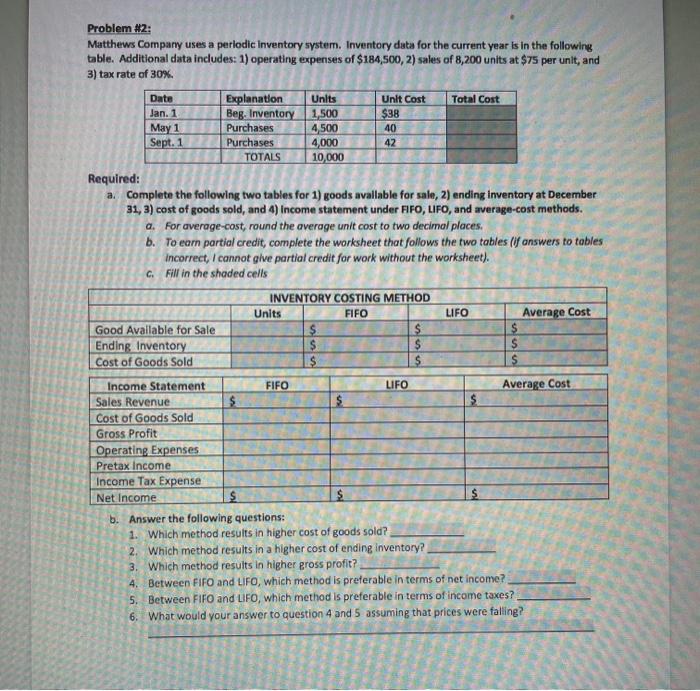

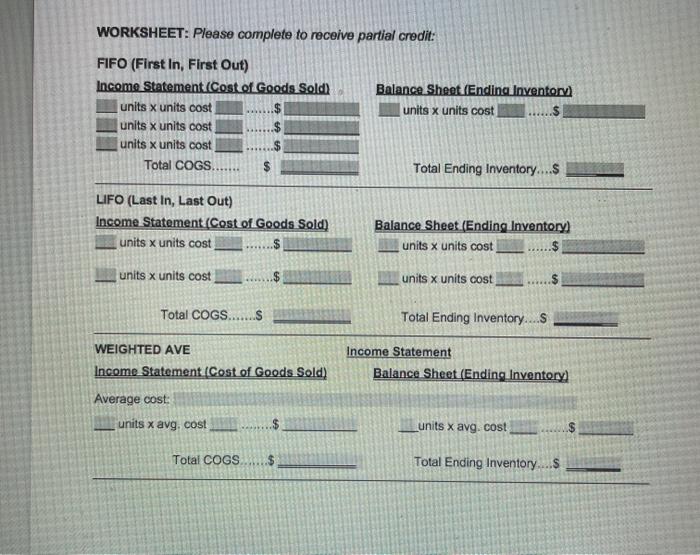

Date Unit Cost Total Cost 42 Problem #2: Matthews Company uses a periodic Inventory system. Inventory data for the current year is in the following table. Additional data includes: 1) operating expenses of $184,500, 2) sales of 8,200 units at $75 per unit, and 3) tax rate of 30% Explanation Units Jan. 1 Beg. Inventory 1,500 $38 May 1 Purchases 4,500 40 Sept. 1 Purchases 4,000 TOTALS 10,000 Required: a. Complete the following two tables for 1) goods available for sale, 2) ending inventory at December 31, 3) cost of goods sold, and 4) income statement under FIFO, LIFO, and average-cost methods. a. For average-cost, round the average unit cost to two decimal places b. To earn partial credit, complete the worksheet that follows the two tables (if answers to tables incorrect, I cannot give partial credit for work without the worksheet). C. Fill in the shaded cells INVENTORY COSTING METHOD Units FIFO LIFO Average Cost Good Available for Sale $ $ $ Ending Inventory $ $ $ Cost of Goods Sold $ $ Income Statement FIFO LIFO Average Cost Sales Revenue $ $ $ Cost of Goods Sold Gross Profit Operating Expenses Pretax Income Income Tax Expense Net Income $ $ b. Answer the following questions: 1. Which method results in higher cost of goods sold? 2. Which method results in a higher cost of ending inventory? 3. Which method results in higher gross profit? 4. Between FIFO and LIFO, which method is preferable in terms of net income? 5. Between FIFO and LIFO, which method is preferable in terms of income taxes? 6. What would your answer to question 4 and 5 assuming that prices were faling? WORKSHEET: Please complete to receive partial credit: FIFO (First In, First Out) Income Statement (Cost of Goods Sold Balance Sheet (Ending Inventory units x units cost units x units cost $ units x units cost units x units cost Total COGS $ Total Ending Inventory....$ LIFO (Last In, Last Out) Income Statement (Cost of Goods Sold) units x units cost $ Balance Sheet (Ending Inventory) units x units cost $ units x units cost units x units cost Total COGS....... Total Ending Inventory.... WEIGHTED AVE Income Statement (Cost of Goods Sold) Income Statement Balance Sheet (Ending Inventory) Average cost: units x avg. cost _units x avg. cost Total COGS Total Ending Inventory....$