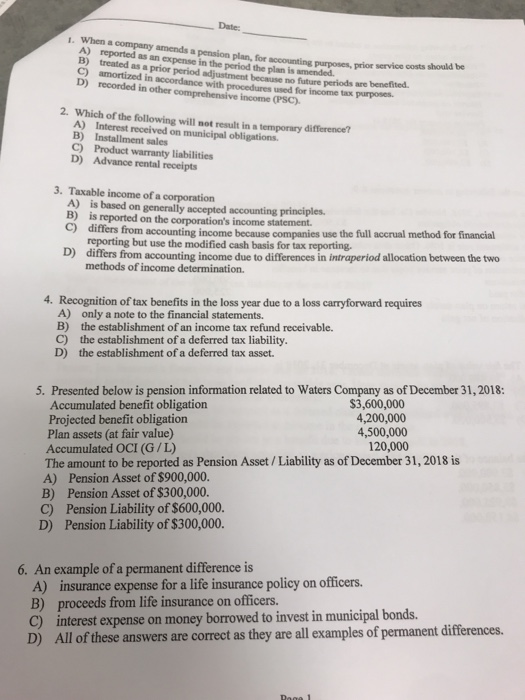

Date: When a company amends a pension plan, for accounting purposes, prior A) reported as an expense in the period the plan is amended. B) treated as a prior period adjustment because no future periods are benefited. C) amortized in accordance with procedures used for income tax purposes D) recorded in other comprehensive income (PSC) 1. service costs should be 2. Which of the following will not result in a temporary A) Interest received on municipal obligations B) difference? Installment sales Product warranty liabilities Advance rental receipts C) D) 3. Taxable income of a corporation A) is based on generally accepted accounting principles. B) is reported on the corporation's income statement. C) differs from accounting income because companies use the full accrual method for financial reporting but use the modified cash basis for tax reporting. D) differs from accounting income due to differences in intraperiod allocation between the two methods of income determination. Recognition of tax benefits in the loss year due to a loss carryforward requires A) only a note to the financial statements. B) the establishment of an income tax refund receivable. C) the establishment of a deferred tax liability. D) the establishment of a deferred tax asset. 4. 5. Presented below is pension information related to Waters Company as of December 31,2018: S3,600,000 4,200,000 4,500,000 120,000 Accumulated benefit obligation Projected benefit obligation Plan assets (at fair value) Accumulated OCI (G/L) The amount to be reported as Pension Asset/ Liability as of December 31, 2018 is A) Pension Asset of $900,000. B) Pension Asset of $300,000. C) Pension Liability of $600,000. D) Pension Liability of $300,000. 6. An example of a permanent difference is A) insurance expense for a life insurance policy on officers. B) proceeds from life insurance on officers. C) interest expense on money borrowed to invest in municipal bonds. D) Al Il of these answers are correct as they are all examples of permanent differences