Answered step by step

Verified Expert Solution

Question

1 Approved Answer

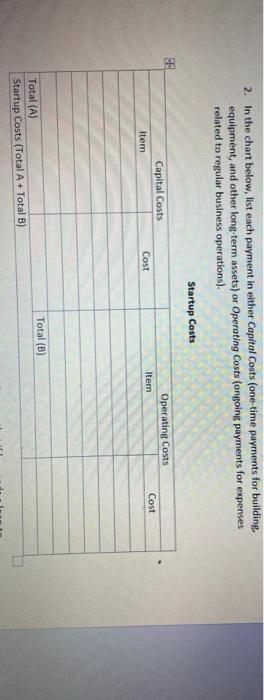

Dave Clark plans to open a sporting goods store in London, Ontario, as soon as he graduates from university in the spring. He did a

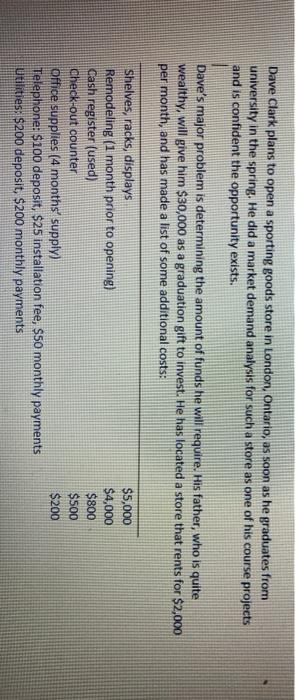

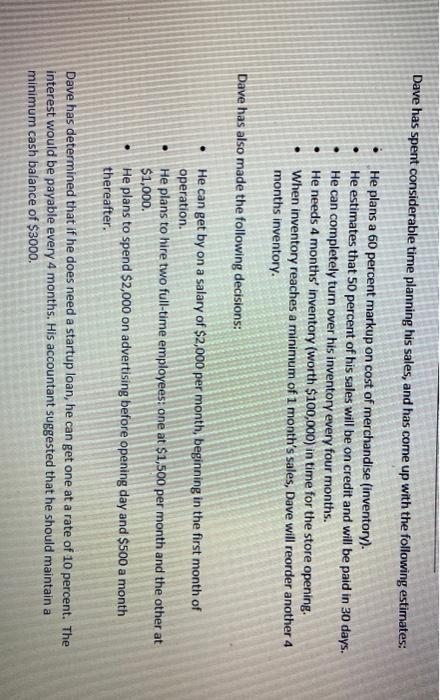

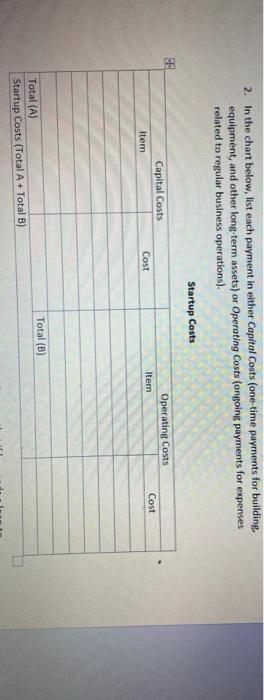

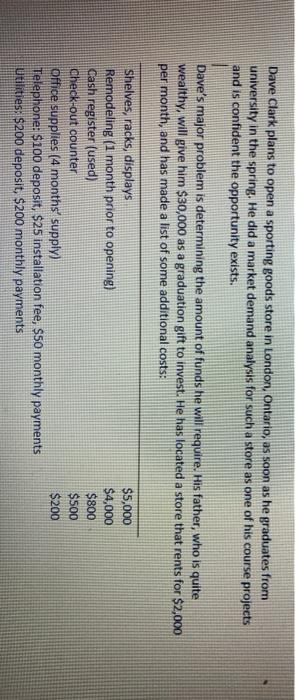

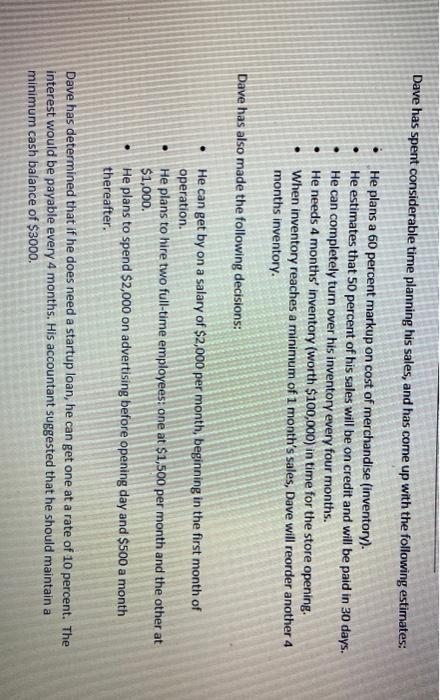

Dave Clark plans to open a sporting goods store in London, Ontario, as soon as he graduates from university in the spring. He did a market demand analysis for such a store as one of his course projects and is confident the opportunity exists. Dave's major problem is determining the amount of funds he will require. His father, who is quite wealthy, will give him $30,000 as a graduation gift to invest. He has located a store that rents for $2,000 per month, and has made a list of some additional costs: Shelves, racks, displays Remodeling (1 month prior to opening) Cash register (used) Check-out counter Office supplies (4 months supply) Telephone: $100 deposit, $25 installation fee, $50 monthly payments Utilities: $200 deposit, $200 monthly payments $5,000 $4,000 $800 $500 $200 Dave has spent considerable time planning his sales, and has come up with the following estimates: He plans a 60 percent markup on cost of merchandise (inventory). He estimates that 50 percent of his sales will be on credit and will be paid in 30 days. He can completely turn over his inventory every four months. He needs 4 months' inventory (worth $100,000) in time for the store opening. When inventory reaches a minimum of 1 month's sales, Dave will reorder another 4 months inventory. Dave has also made the following decisions: He can get by on a salary of $2,000 per month, beginning in the first month of operation. He plans to hire two full-time employees: one at $1,500 per month and the other at $1,000. He plans to spend $2,000 on advertising before opening day and $500 a month thereafter. Dave has determined that if he does need a startup loan, he can get one at a rate of 10 percent. The interest would be payable every 4 months. His accountant suggested that he should maintain a minimum cash balance of $3000. Step 1: Calculate the startup costs. 1. Identify all of the payments Dave will have to make before opening day. Assume salaries and wages are paid at the end of the month in which they are earned. 2. In the chart below, list each payment in either Capital Costs (one time payments for building equipment, and other long-term assets) or Operating costs (ongoing payments for expenses related to regular business operations). Startup Costs Capital Costs Item Operating Costs Item Cost Cost Total (B) Total (A) Startup Costs (Total A + Total B) 3. Determine whether Dave will need any external financing. Assume that if he needs a loan to start up the business, he can get one from his bank

Dave Clark plans to open a sporting goods store in London, Ontario, as soon as he graduates from university in the spring. He did a market demand analysis for such a store as one of his course projects and is confident the opportunity exists. Dave's major problem is determining the amount of funds he will require. His father, who is quite wealthy, will give him $30,000 as a graduation gift to invest. He has located a store that rents for $2,000 per month, and has made a list of some additional costs: Shelves, racks, displays Remodeling (1 month prior to opening) Cash register (used) Check-out counter Office supplies (4 months supply) Telephone: $100 deposit, $25 installation fee, $50 monthly payments Utilities: $200 deposit, $200 monthly payments $5,000 $4,000 $800 $500 $200 Dave has spent considerable time planning his sales, and has come up with the following estimates: He plans a 60 percent markup on cost of merchandise (inventory). He estimates that 50 percent of his sales will be on credit and will be paid in 30 days. He can completely turn over his inventory every four months. He needs 4 months' inventory (worth $100,000) in time for the store opening. When inventory reaches a minimum of 1 month's sales, Dave will reorder another 4 months inventory. Dave has also made the following decisions: He can get by on a salary of $2,000 per month, beginning in the first month of operation. He plans to hire two full-time employees: one at $1,500 per month and the other at $1,000. He plans to spend $2,000 on advertising before opening day and $500 a month thereafter. Dave has determined that if he does need a startup loan, he can get one at a rate of 10 percent. The interest would be payable every 4 months. His accountant suggested that he should maintain a minimum cash balance of $3000. Step 1: Calculate the startup costs. 1. Identify all of the payments Dave will have to make before opening day. Assume salaries and wages are paid at the end of the month in which they are earned. 2. In the chart below, list each payment in either Capital Costs (one time payments for building equipment, and other long-term assets) or Operating costs (ongoing payments for expenses related to regular business operations). Startup Costs Capital Costs Item Operating Costs Item Cost Cost Total (B) Total (A) Startup Costs (Total A + Total B) 3. Determine whether Dave will need any external financing. Assume that if he needs a loan to start up the business, he can get one from his bank

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started