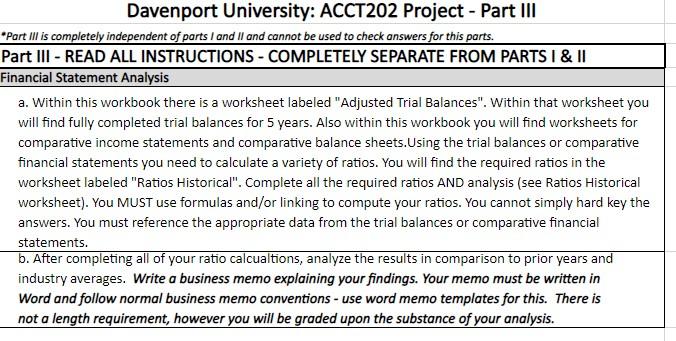

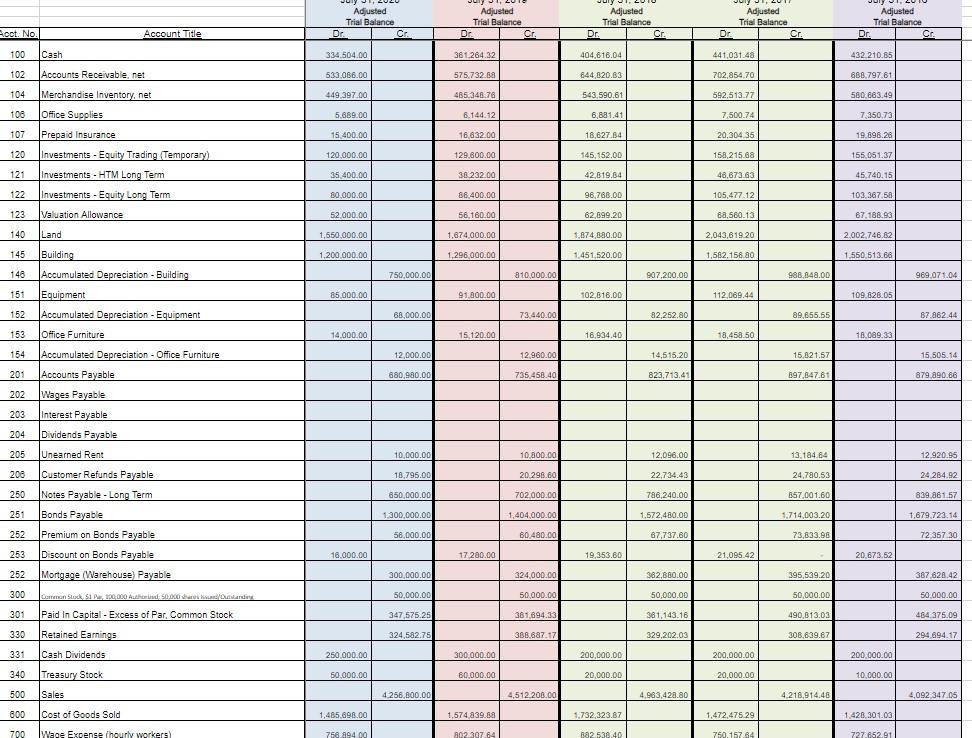

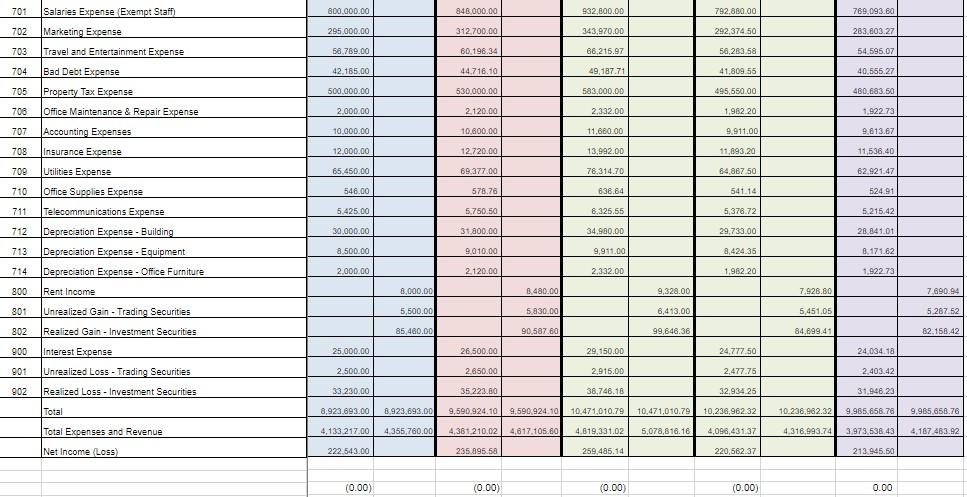

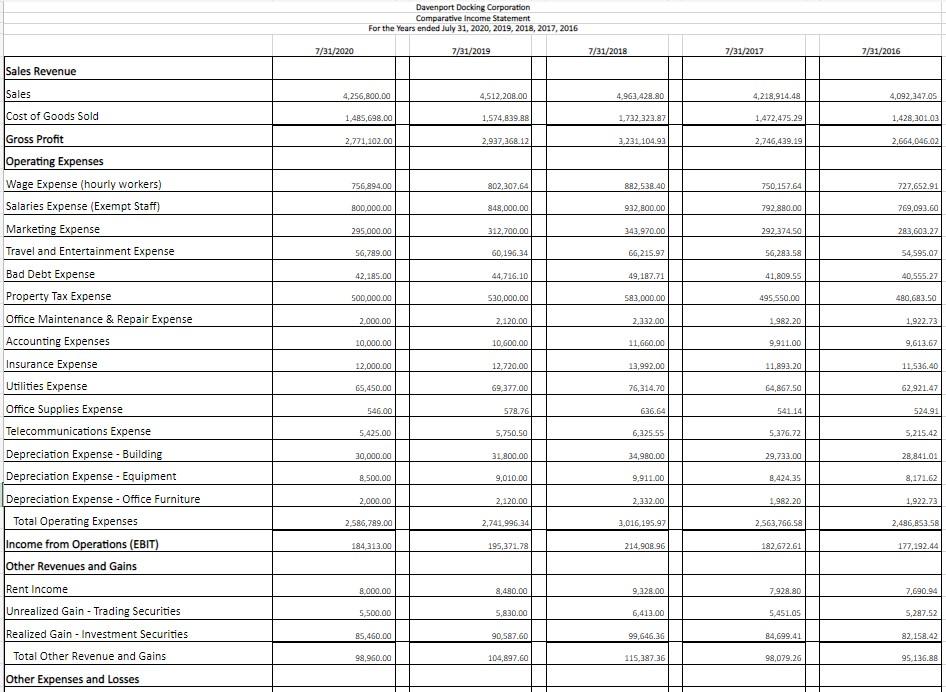

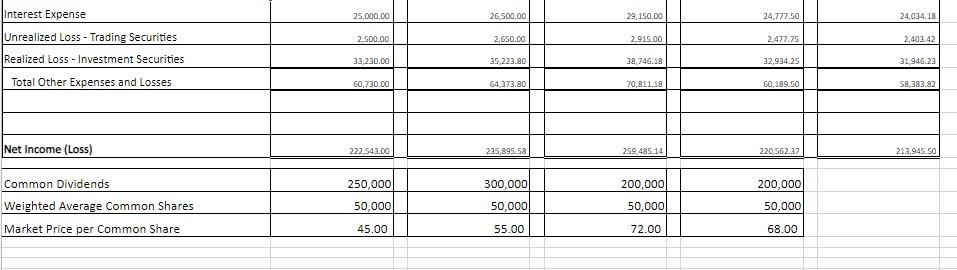

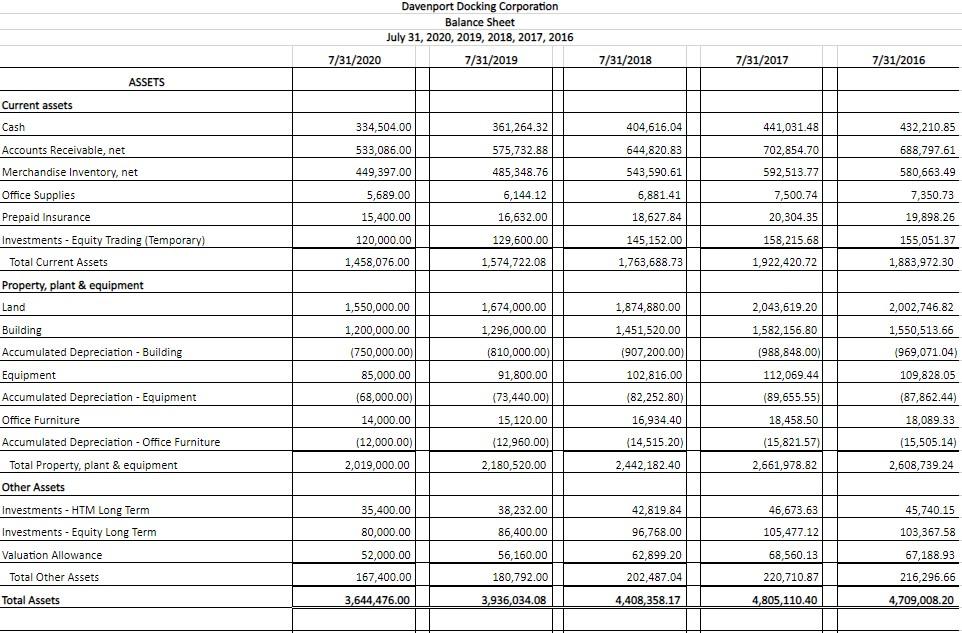

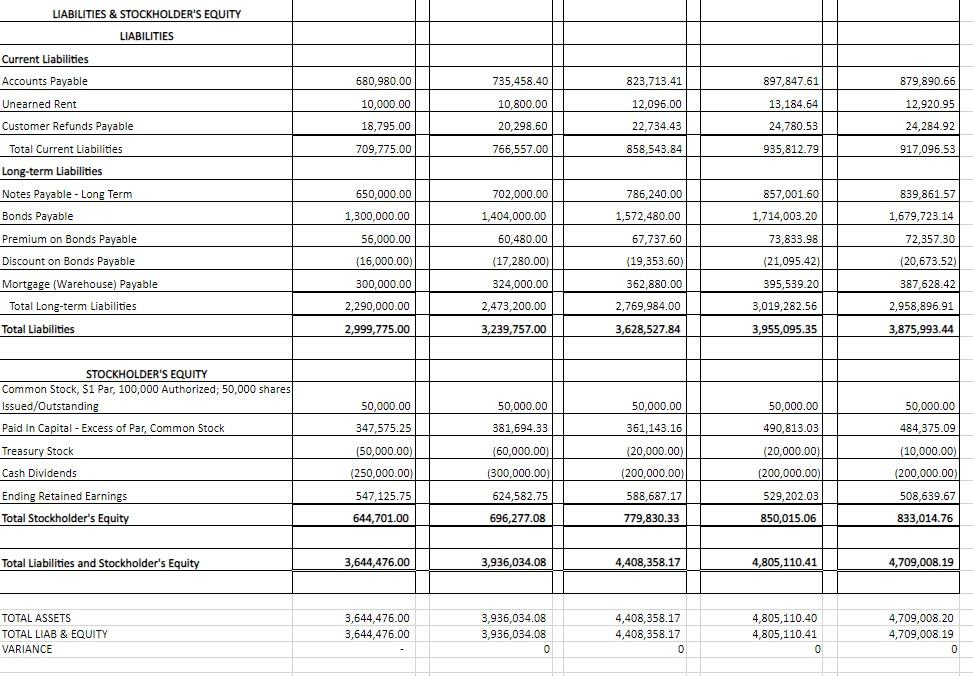

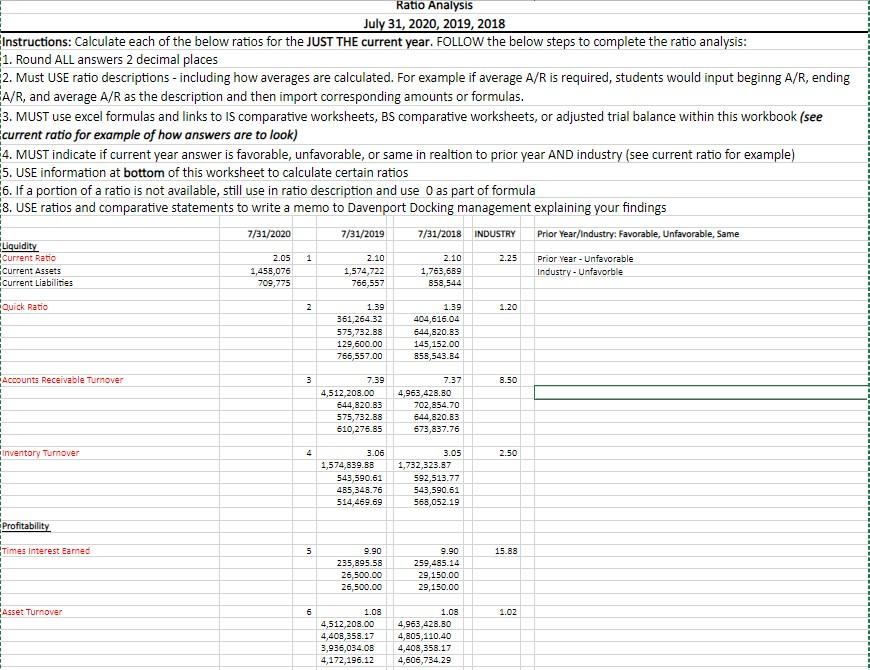

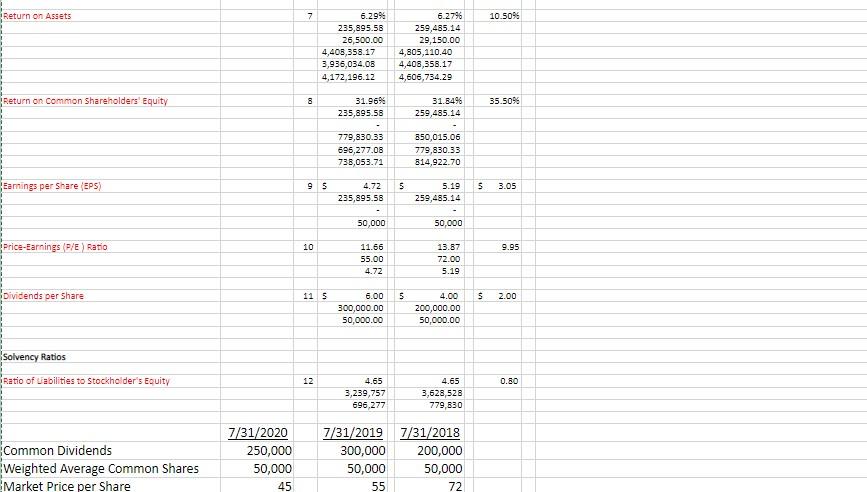

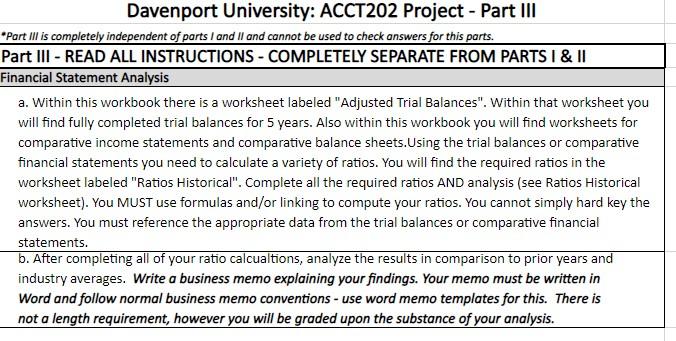

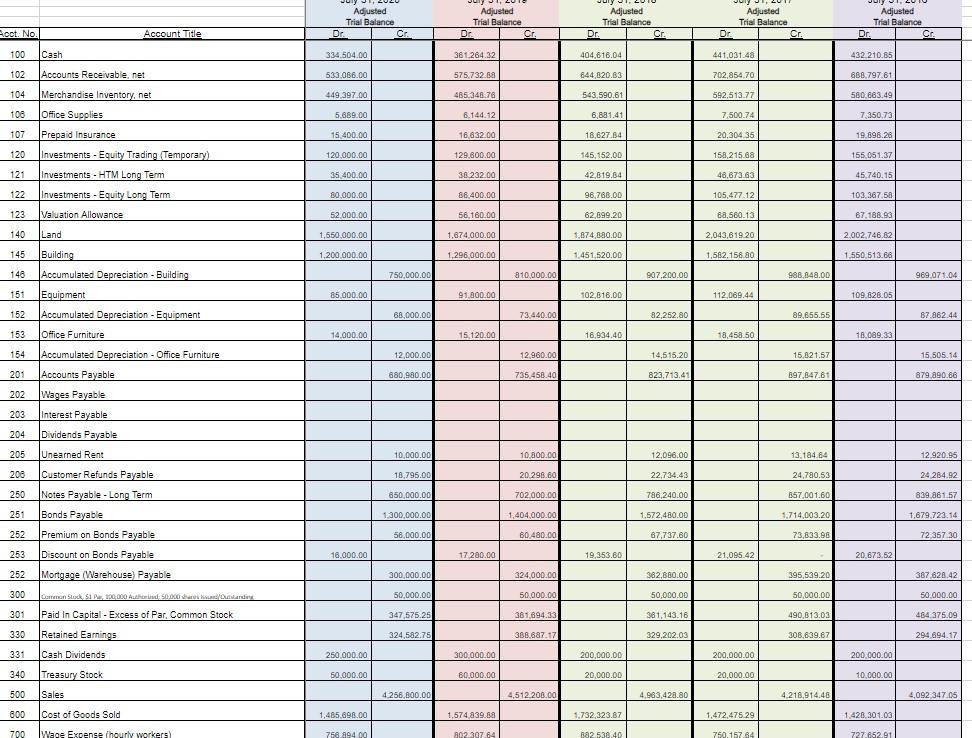

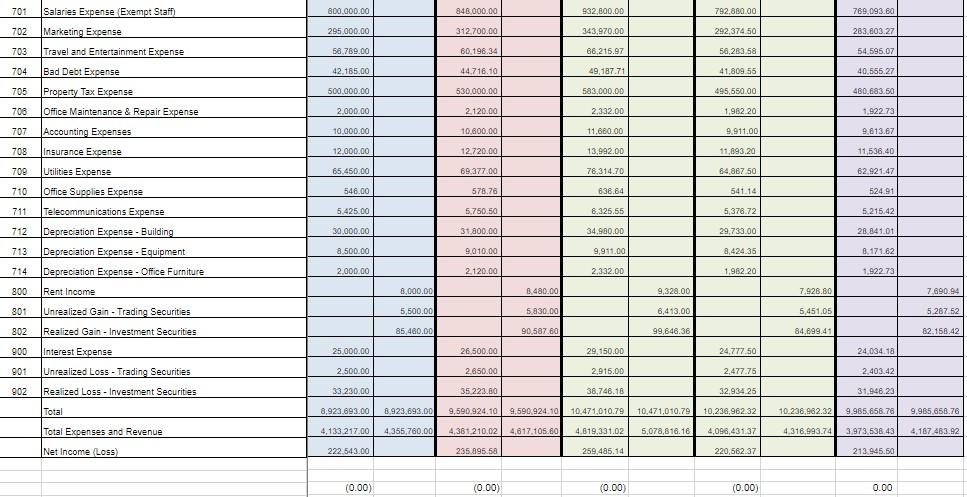

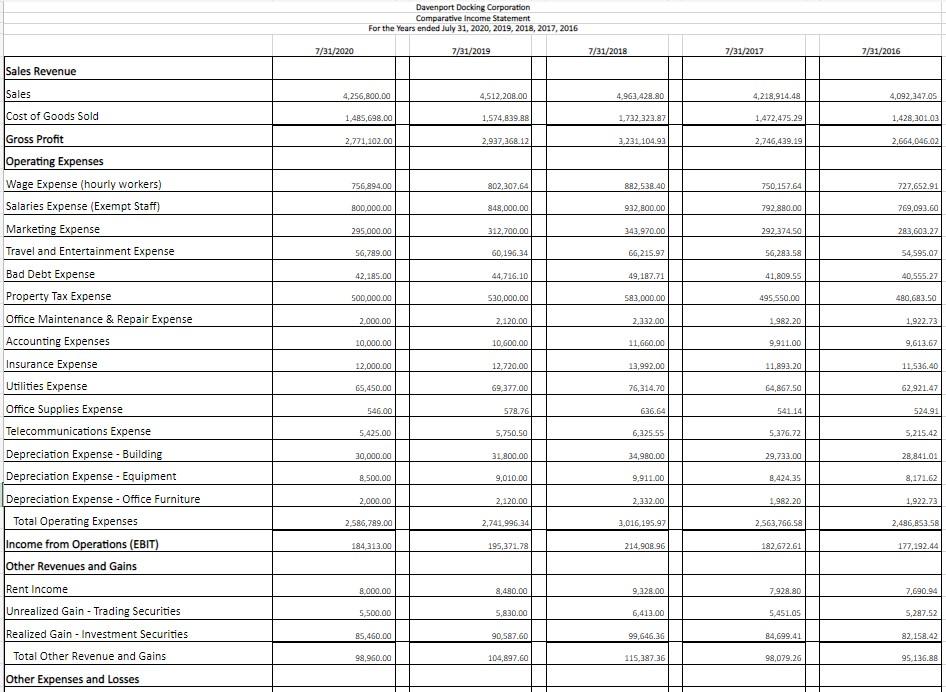

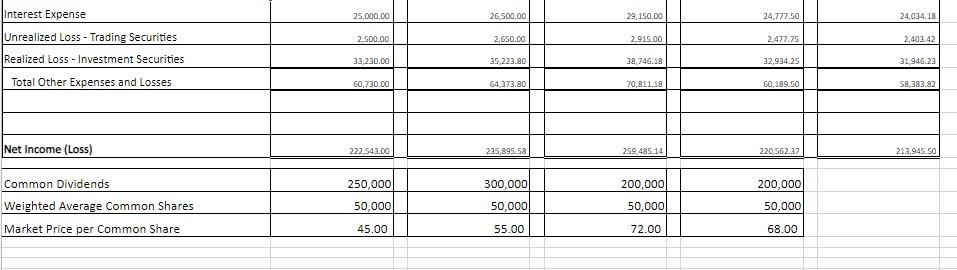

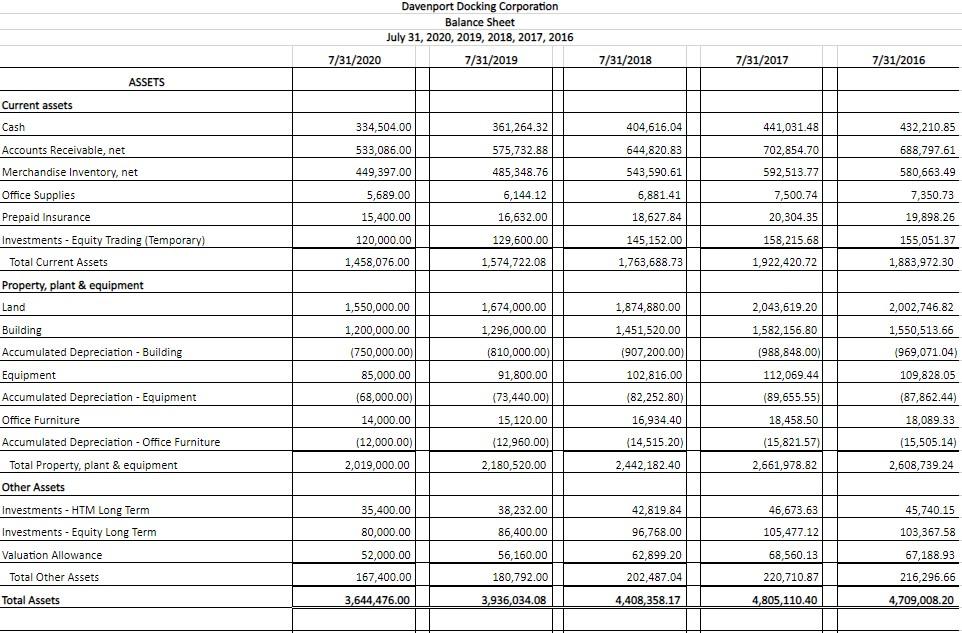

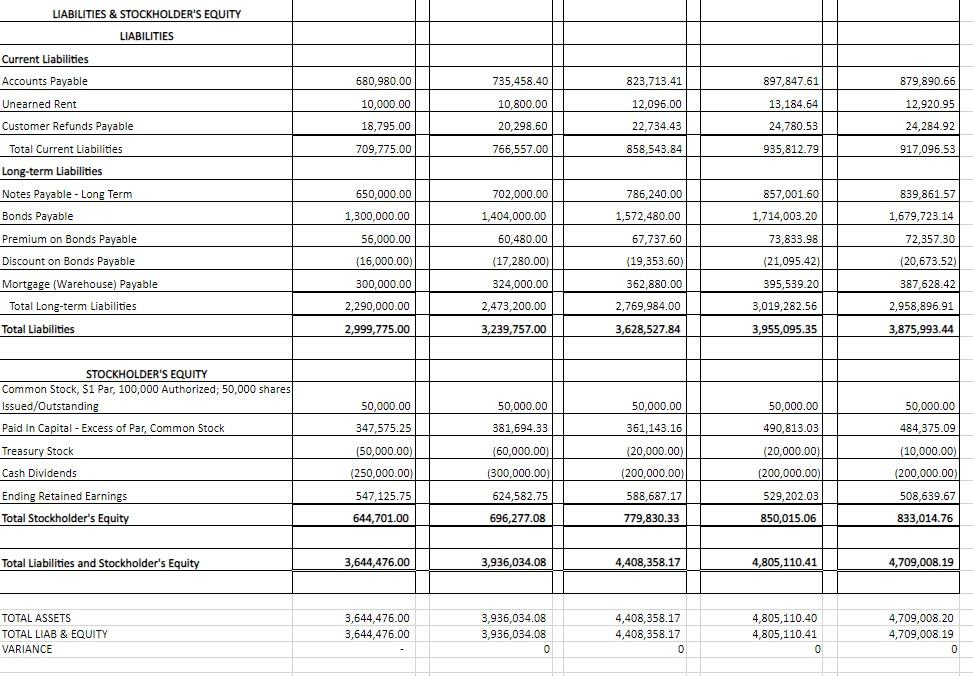

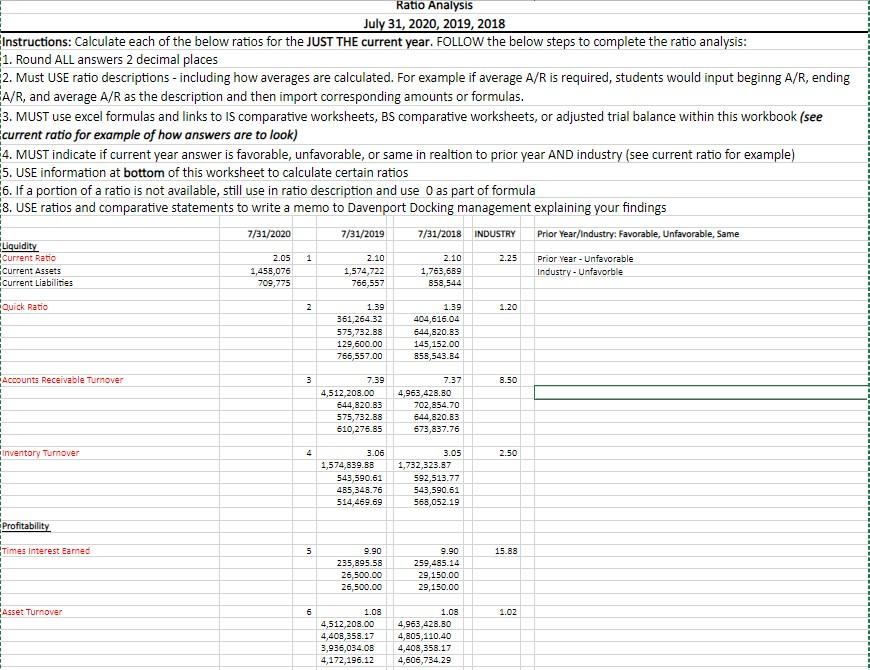

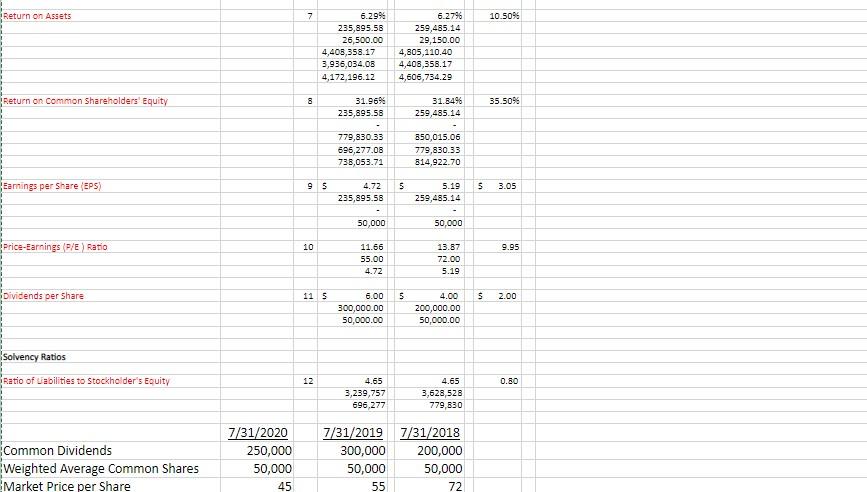

Davenport University: ACCT202 Project - Part III -Part III is completely independent of parts I and II and cannot be used to check answers for this parts. Part III - READ ALL INSTRUCTIONS - COMPLETELY SEPARATE FROM PARTS I \& II Financial Statement Analysis a. Within this workbook there is a worksheet labeled "Adjusted Trial Balances". Within that worksheet you will find fully completed trial balances for 5 years. Also within this workbook you will find worksheets for comparative income statements and comparative balance sheets.Using the trial balances or comparative financial statements you need to calculate a variety of ratios. You will find the required ratios in the worksheet labeled "Ratios Historical". Complete all the required ratios AND analysis (see Ratios Historical worksheet). You MUST use formulas and/or linking to compute your ratios. You cannot simply hard key the answers. You must reference the appropriate data from the trial balances or comparative financial statements. b. After completing all of your ratio calcualtions, analyze the results in comparison to prior years and industry averages. Write a business memo explaining your findings. Your memo must be written in Word and follow normal business memo conventions - use word memo templates for this. There is not a length requirement, however you will be graded upon the substance of your analysis. LIABILITIES \& STOCKHOLDER'S EQUITY Ratio Analysis July 31, 2020, 2019, 2018 Instructions: Calculate each of the below ratios for the JUST THE current year. FOLLOW the below steps to complete the ratio analysis: 1. Round ALL answers 2 decimal places 2. Must USE ratio descriptions - including how averages are calculated. For example if average A/R is required, students would input beginng A/R, ending A/R, and average A/R as the description and then import corresponding amounts or formulas. 3. MUST use excel formulas and links to IS comparative worksheets, BS comparative worksheets, or adjusted trial balance within this workbook (see current ratio for example of how answers are to look) 4. MUST indicate if current year answer is favorable, unfavorable, or same in realtion to prior year AND industry (see current ratio for example) 5. USE information at bottom of this worksheet to calculate certain ratios 6. If a portion of a ratio is not available, still use in ratio description and use 0 as part of formula 8. USE ratios and comparative statements to write a memo to Davenport Docking management explaining your findings Davenport University: ACCT202 Project - Part III -Part III is completely independent of parts I and II and cannot be used to check answers for this parts. Part III - READ ALL INSTRUCTIONS - COMPLETELY SEPARATE FROM PARTS I \& II Financial Statement Analysis a. Within this workbook there is a worksheet labeled "Adjusted Trial Balances". Within that worksheet you will find fully completed trial balances for 5 years. Also within this workbook you will find worksheets for comparative income statements and comparative balance sheets.Using the trial balances or comparative financial statements you need to calculate a variety of ratios. You will find the required ratios in the worksheet labeled "Ratios Historical". Complete all the required ratios AND analysis (see Ratios Historical worksheet). You MUST use formulas and/or linking to compute your ratios. You cannot simply hard key the answers. You must reference the appropriate data from the trial balances or comparative financial statements. b. After completing all of your ratio calcualtions, analyze the results in comparison to prior years and industry averages. Write a business memo explaining your findings. Your memo must be written in Word and follow normal business memo conventions - use word memo templates for this. There is not a length requirement, however you will be graded upon the substance of your analysis. LIABILITIES \& STOCKHOLDER'S EQUITY Ratio Analysis July 31, 2020, 2019, 2018 Instructions: Calculate each of the below ratios for the JUST THE current year. FOLLOW the below steps to complete the ratio analysis: 1. Round ALL answers 2 decimal places 2. Must USE ratio descriptions - including how averages are calculated. For example if average A/R is required, students would input beginng A/R, ending A/R, and average A/R as the description and then import corresponding amounts or formulas. 3. MUST use excel formulas and links to IS comparative worksheets, BS comparative worksheets, or adjusted trial balance within this workbook (see current ratio for example of how answers are to look) 4. MUST indicate if current year answer is favorable, unfavorable, or same in realtion to prior year AND industry (see current ratio for example) 5. USE information at bottom of this worksheet to calculate certain ratios 6. If a portion of a ratio is not available, still use in ratio description and use 0 as part of formula 8. USE ratios and comparative statements to write a memo to Davenport Docking management explaining your findings