Question

David borrowed a loan from Bank A for $15,000 for buying a car. The loan is for five years and is fully amortized. The

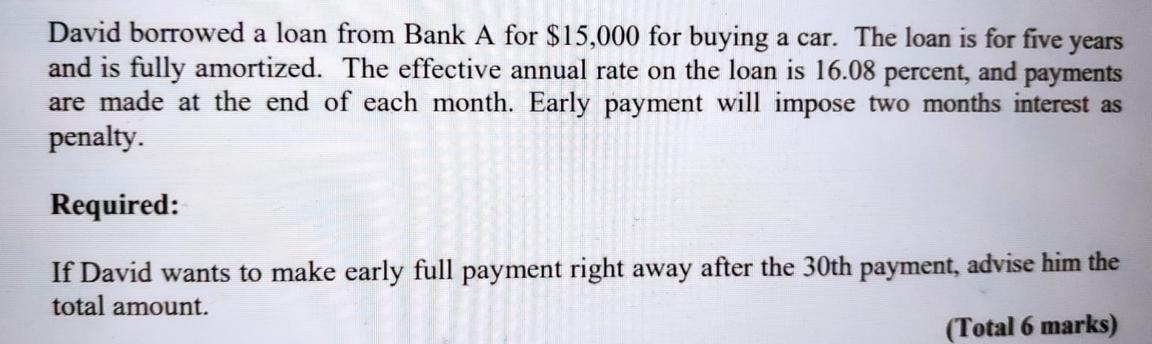

David borrowed a loan from Bank A for $15,000 for buying a car. The loan is for five years and is fully amortized. The effective annual rate on the loan is 16.08 percent, and payments are made at the end of each month. Early payment will impose two months interest as penalty. Required: If David wants to make early full payment right away after the 30th payment, advise him the total amount. (Total 6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total amount David needs to pay if he wants to make an early full payment after the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Core Concepts

Authors: Raymond M Brooks

2nd edition

132671034, 978-0132671033

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App