Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) The Chief financial officer of Kurdishy Oil has given you the assignment of estimating the firm's cost of capital. The present capital structure,

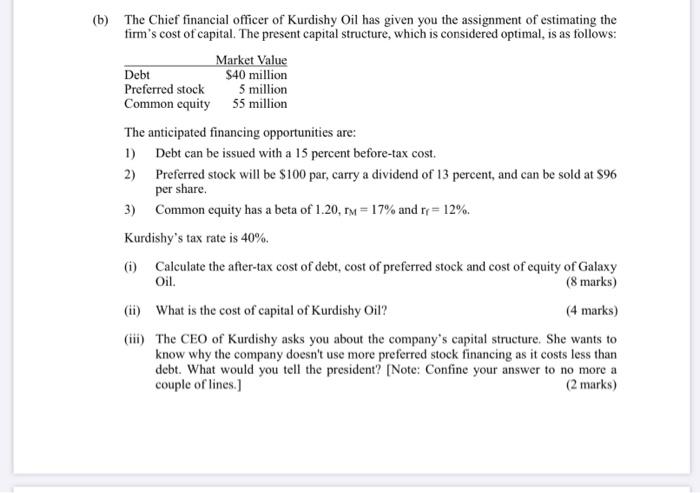

(b) The Chief financial officer of Kurdishy Oil has given you the assignment of estimating the firm's cost of capital. The present capital structure, which is considered optimal, is as follows: Debt Preferred stock Market Value $40 million 5 million Common equity 55 million The anticipated financing opportunities are: 1) Debt can be issued with a 15 percent before-tax cost. 2) Preferred stock will be $100 par, carry a dividend of 13 percent, and can be sold at $96 per share. 3) Common equity has a beta of 1.20, M = 17% and rr = 12%. Kurdishy's tax rate is 40%. (i) Calculate the after-tax cost of debt, cost of preferred stock and cost of equity of Galaxy Oil. (ii) What is the cost of capital of Kurdishy Oil? (8 marks) (4 marks) (iii) The CEO of Kurdishy asks you about the company's capital structure. She wants to know why the company doesn't use more preferred stock financing as it costs less than debt. What would you tell the president? [Note: Confine your answer to no more a couple of lines.] (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Cost of debt 15 1 40 9 Cost of preferred stock DividendPrice 1396 1354 Cost of equi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started