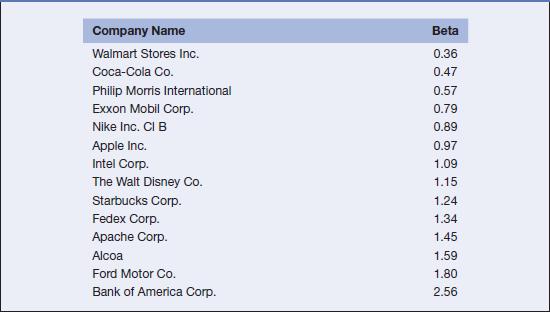

1. Alcoa was listed in Table 13-2 as a company that has a relatively high beta (a measure of stock price volatility). Alcoa produces aluminum

1. Alcoa was listed in Table 13-2 as a company that has a relatively high beta (a measure of stock price volatility). Alcoa produces aluminum and aluminum products. Go to its website at www.alcoa.com, and follow these steps: Under "Investors" select "Financial Reports." Select "Annual Reports and Proxy Information." Download the latest annual report. Scroll all the way down to "Selected Financial Data."

2. One of the characteristics of high beta stocks is that they often have volatile earnings performances. Let's check out Alcoa. Compute the year-to-year percentage change in "Diluted-Income from Continuing Operations" for each of the five years. Do the earnings appear to be volatile?

3. Companies with high betas and inconsistent performance are encouraged to keep their debt ratios low (under 50 percent). Compute the ratio of long-term debt to total assets for each of the five years for Alcoa. What does the pattern look like to you?

Company Name Beta Walmart Stores Inc. 0.36 Coca-Cola Co. 0.47 Philip Morris International 0.57 Exxon Mobil Corp. 0.79 Nike Inc. CI B 0.89 Apple Inc. 0.97 Intel Corp. 1.09 The Walt Disney Co. 1.15 Starbucks Corp. 1.24 Fedex Corp. 1.34 Apache Corp. 1.45 Alcoa 1.59 Ford Motor Co. 1.80 Bank of America Corp. 2,56

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Solution 2010 2011 2012 2013 2014 Diluted income form 025 055 018 214 021 Percentage change 12000 67...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started