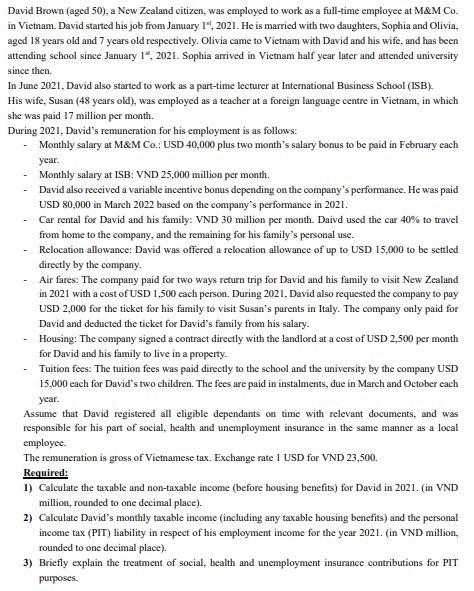

David Brown (aged 50), a New Zealand citizen, was employed to work as a full-time employee at M\\&M Co. n Vietnam. David started his job from January \\( 1^{\\text {st }}, 2021 \\). He is married with two daughters, Sophia and Olivia, aged 18 years old and 7 years old respectively. Olivia came to Vietnam with David and his wife, and has been attending school since January \\( 1 *, 2021 \\). Sophia arrived in Vietnam half year later and attended university ince then. in June 2021, David also started to work as a part-time lecturer at International Business School (ISB). His wife, Susan ( 48 years old), was employed as a teacher at a foreign language centre in Vietnam, in which he was paid 17 million per month. During 2021, David's remuneration for his employment is as follows: - Monthly salary at M\\&M Co.: USD 40,000 plus two month's salary bonus to be paid in February each year. - Monthly salary at ISB: VND 25,000 million per month. - David also received a variable incentive bonus depending on the company's performance. He was paid USD 80,000 in March 2022 based on the company's performance in 2021. - Car rental for David and his family: VND 30 million per month. Daivd used the car \40 to travel from home to the company, and the remaining for his family's personal use. - Relocation allowance: David was offered a relocation allowance of up to USD 15,000 to be settled directly by the company. - Air fares: The company paid for two ways return trip for David and his family to visit New Zealand in 2021 with a cost of USD 1,500 each person. During 2021. David also requested the company to pay USD 2,000 for the ticket for his family to visit Susan's parents in Italy. The company only paid for David and deducted the ticket for David's family from his salary. - Housing: The company signed a contract directly with the landlord at a cost of USD 2,500 per month for David and his family to live in a property. - Tuition fees: The tuition fees was paid directly to the school and the university by the company USD 15,000 each for David's two children. The fees are paid in instalments, due in March and October each year. Assume that David registered all eligible dependants on time with relevant documents, and was responsible for his part of social, health and unemployment insurance in the same manner as a local employec. The remuneration is gross of Vietnamese tax. Exchange rate 1 USD for VND 23,500. Required: 1) Calculate the taxable and non-taxable income (before housing benefits) for David in 2021. (in VND million, rounded to one decimal place). 2) Calculate David's monthly taxable income (including any taxable housing benefits) and the personal income tax (PIT) liability in respect of his employment income for the year 2021. (in VND million, rounded to one decimal place). 3) Briefly explain the treatment of social, health and unemployment insurance contributions for PIT purposes