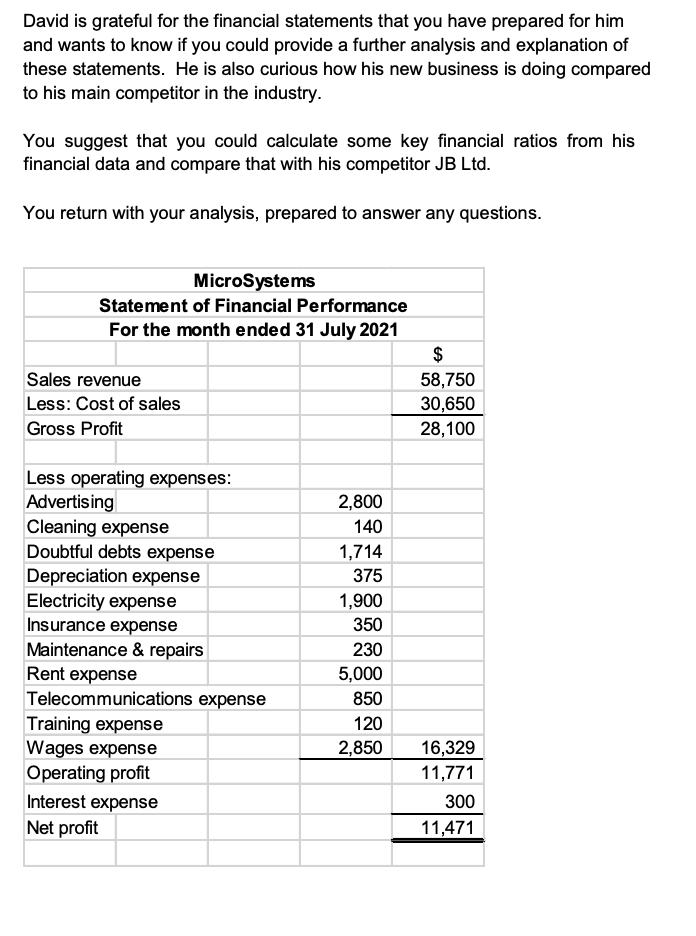

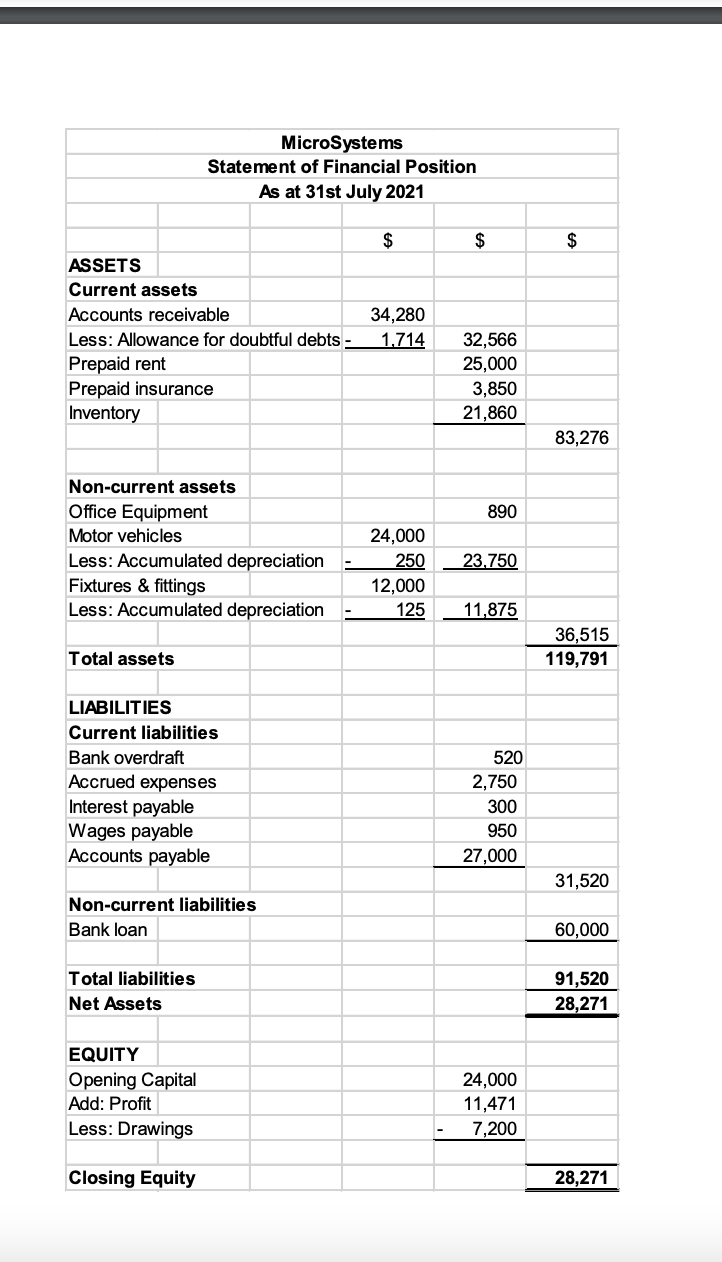

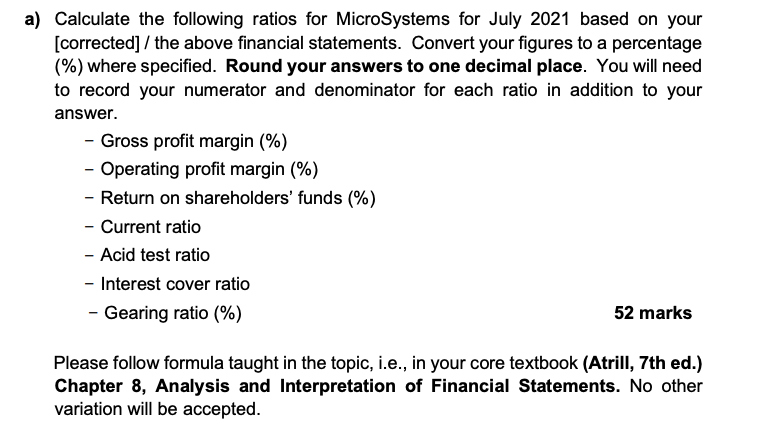

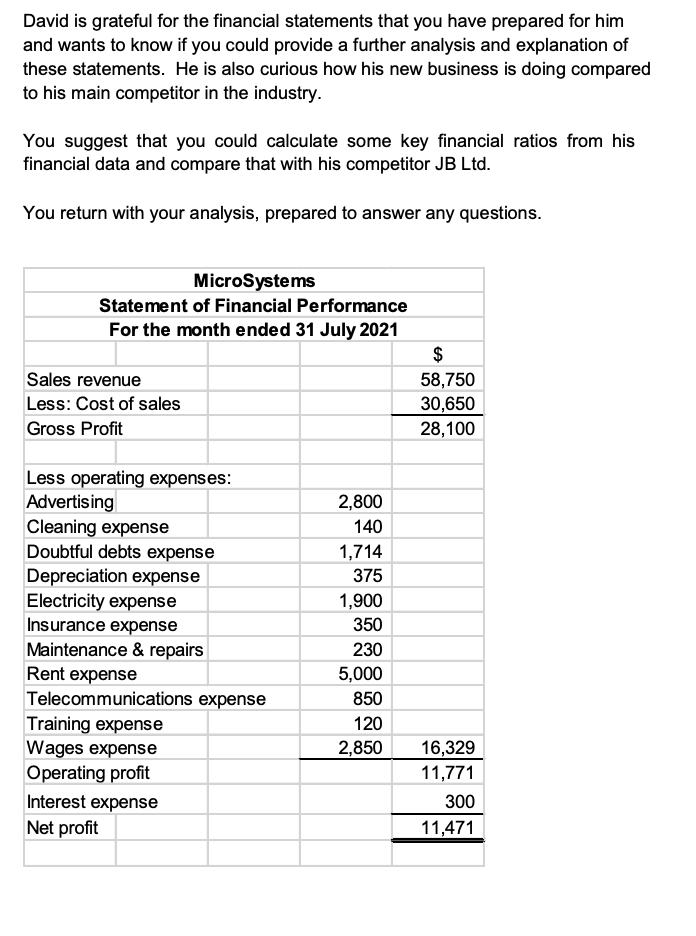

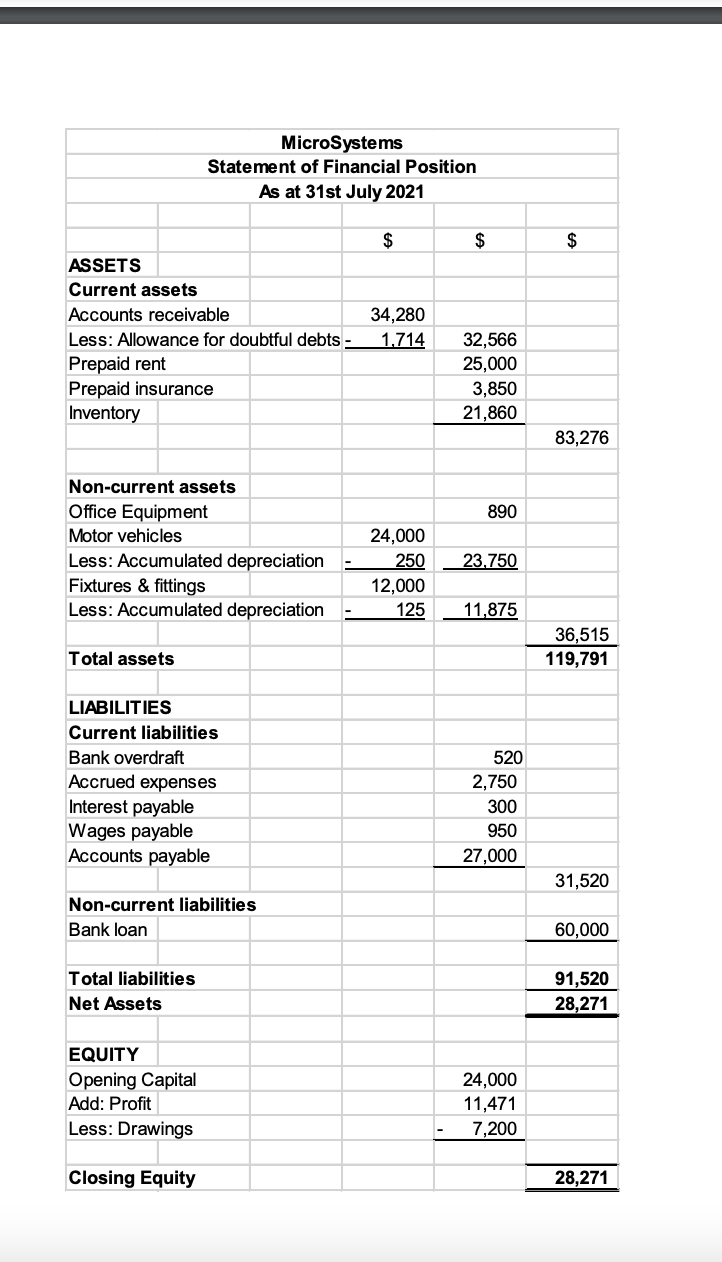

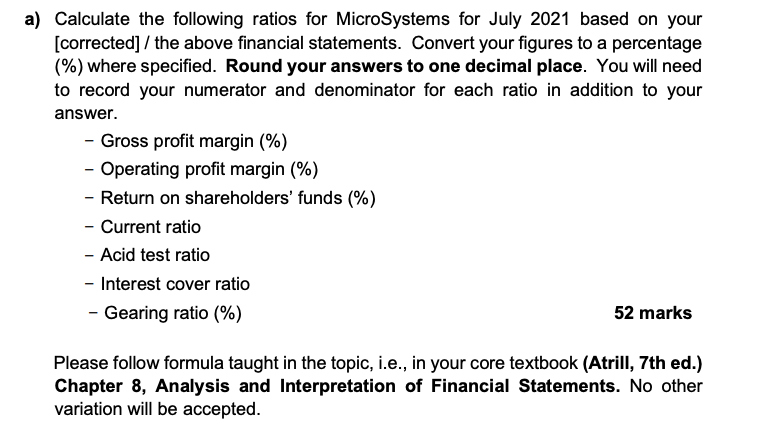

David is grateful for the financial statements that you have prepared for him and wants to know if you could provide a further analysis and explanation of these statements. He is also curious how his new business is doing compared to his main competitor in the industry. You suggest that you could calculate some key financial ratios from his financial data and compare that with his competitor JB Ltd. You return with your analysis, prepared to answer any questions. MicroSystems Statement of Financial Performance For the month ended 31 July 2021 Sales revenue Less: Cost of sales Gross Profit $ 58,750 30,650 28,100 Less operating expenses: Advertising Cleaning expense Doubtful debts expense Depreciation expense Electricity expense Insurance expense Maintenance & repairs Rent expense Telecommunications expense Training expense Wages expense Operating profit Interest expense Net profit 2,800 140 1,714 375 1,900 350 230 5,000 850 120 2,850 16,329 11,771 300 11,471 MicroSystems Statement of Financial Position As at 31st July 2021 $ $ $ ASSETS Current assets Accounts receivable Less: Allowance for doubtful debts - Prepaid rent Prepaid insurance Inventory 34,280 1,714 32,566 25,000 3,850 21,860 83,276 890 Non-current assets Office Equipment Motor vehicles Less: Accumulated depreciation Fixtures & fittings Less: Accumulated depreciation 23.750 24,000 250 12,000 125 11,875 36,515 119,791 Total assets 520 LIABILITIES Current liabilities Bank overdraft Accrued expenses Interest payable Wages payable Accounts payable 2,750 300 950 27,000 31,520 Non-current liabilities Bank loan 60,000 Total liabilities Net Assets 91,520 28,271 EQUITY Opening Capital Add: Profit Less: Drawings 24,000 11,471 7,200 Closing Equity 28,271 a) Calculate the following ratios for MicroSystems for July 2021 based on your [corrected] / the above financial statements. Convert your figures to a percentage (%) where specified. Round your answers to one decimal place. You will need to record your numerator and denominator for each ratio in addition to your answer. - Gross profit margin (%) Operating profit margin (%) - Return on shareholders' funds (%) - Current ratio - Acid test ratio - Interest cover ratio - Gearing ratio (%) 52 marks Please follow formula taught in the topic, i.e., in your core textbook (Atrill, 7th ed.) Chapter 8, Analysis and Interpretation of Financial Statements. No other variation will be accepted