Answered step by step

Verified Expert Solution

Question

1 Approved Answer

David Ltd. issued 340,00,000 equity shares of 10 each out of its registered capital of 310,00,00,000. The amount payable on these shares was as follows:

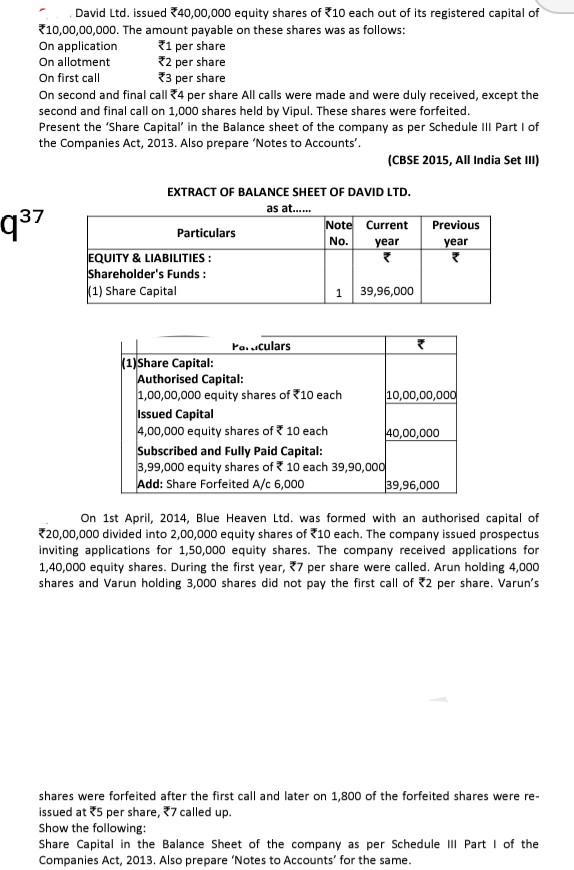

David Ltd. issued 340,00,000 equity shares of 10 each out of its registered capital of 310,00,00,000. The amount payable on these shares was as follows: On application 1 per share On allotment *2 per share On first call 3 per share On second and final call 34 per share All calls were made and were duly received, except the second and final call on 1,000 shares held by Vipul. These shares were forfeited. Present the 'Share Capital in the Balance sheet of the company as per Schedule Ill Part 1 of the Companies Act, 2013. Also prepare 'Notes to Accounts'. (CBSE 2015, All India Set III) EXTRACT OF BALANCE SHEET OF DAVID LTD. as at...... 37 Note Current Previous Particulars year year EQUITY & LIABILITIES: Shareholder's Funds: |(1) Share Capital 39,96,000 937 No. 1 Poruculars (1) Share Capital: Authorised Capital: 1,00,00,000 equity shares of 10 each 10,00,00,000 Issued Capital 4,00,000 equity shares of 10 each 40,00,000 Subscribed and fully Paid Capital: 3,99,000 equity shares of 10 each 39,90,000 Add: Share Forfeited A/c 6,000 39,96,000 On 1st April, 2014, Blue Heaven Ltd. was formed with an authorised capital of 20,00,000 divided into 2,00,000 equity shares of 10 each. The company issued prospectus inviting applications for 1,50,000 equity shares. The company received applications for 1,40,000 equity shares. During the first year, 7 per share were called. Arun holding 4,000 shares and Varun holding 3,000 shares did not pay the first call of 32 per share. Varun's shares were forfeited after the first call and later on 1,800 of the forfeited shares were re- issued at 5 per share, 37 called up. Show the following: Share Capital in the Balance sheet of the company as per Schedule III Part I of the Companies Act, 2013. Also prepare 'Notes to Accounts' for the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started