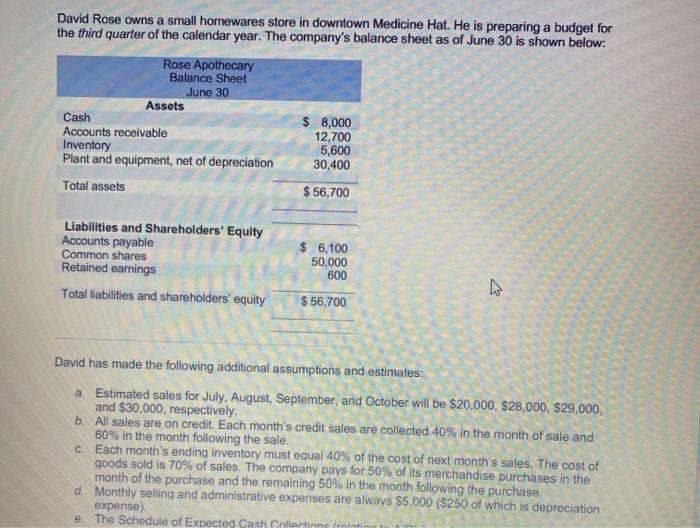

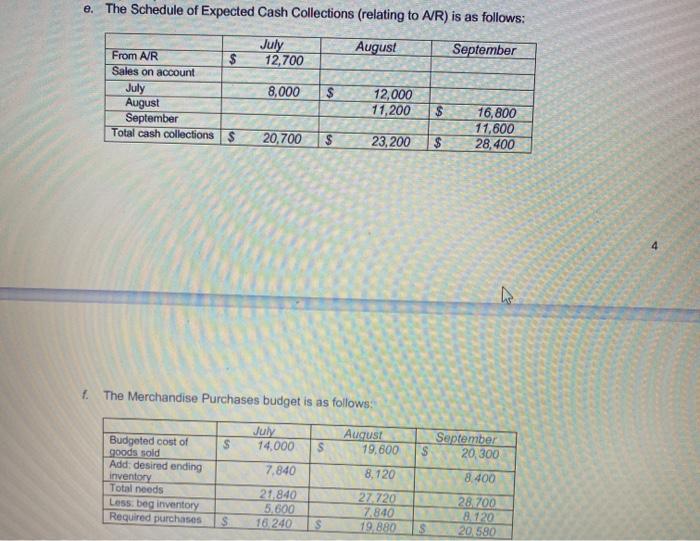

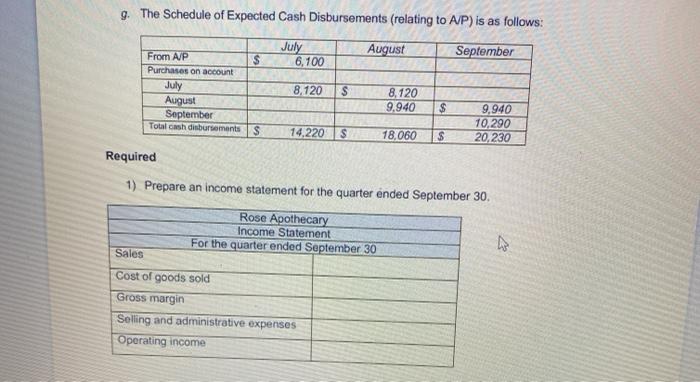

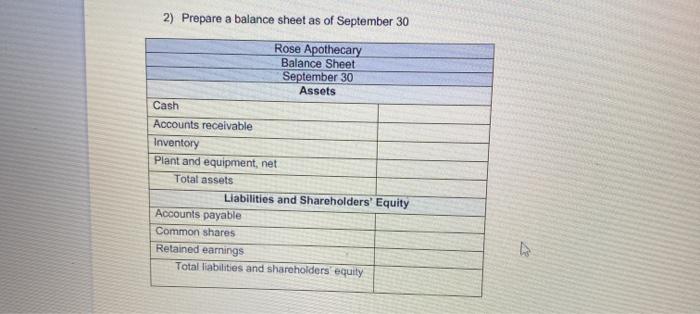

David Rose owns a small homewares store in downtown Medicine Hat. He is preparing a budget for the third quarter of the calendar year. The company's balance sheet as of June 30 is shown below: Rose Apothecary Balance Sheet June 30 Assets Cash $ 8,000 Accounts receivable 12,700 Inventory 5,600 Plant and equipment, net of depreciation 30,400 Total assets $ 56,700 Liabilities and Shareholders' Equity Accounts payable Common shares Retained earnings Total liabilities and shareholders' equity $ 6,100 50,000 600 $ 56,700 David has made the following additional assumptions and estimates: a. Estimated sales for July, August, September, and October will be $20,000, $28,000, S29,000, and $30,000, respectively. b. All sales are on credit. Each month's credit sales are collected 40% in the month of sale and 60% in the month following the sale. c. Each month's ending inventory must equal 40% of the cost of next month's sales. The cost of goods sold is 70% of sales. The company pays for 50% of its merchandise purchases in the month of the purchase and the remaining 50% in the month following the purchase d. Monthly selling and administrative expenses are always $5,000 ($250 of which is depreciation expense) e The Schedule of Expected Cash Collections relating e. The Schedule of Expected Cash Collections (relating to A/R) is as follows: August July 12,700 From A/R Sales on account September $ July 8,000 $ 12,000 11,200 $ August September Total cash collections $ 16.800 11,600 28,400 20,700 $ 23,200 $ 4 1. The Merchandise Purchases budget is as follows: July 14,000 $ August 19,600 September $ 20,300 7.840 Budgeted cost of goods sold Add desired ending Inventory Total needs Less beginventory Required purchases 8,120 8.400 21.840 5.600 16.240 27.720 7,840 19 880 28.700 8120 20580 S 9. The Schedule of Expected Cash Disbursements (relating to A/P) is as follows: July 6,100 August September $ From AP Purchases on account July August September Total cash disbursements 8,120 S 8,120 9,940 $ 9,940 10,290 20,230 $ 14,220 S 18.060 $ Required 1) Prepare an income statement for the quarter ended September 30 Rose Apothecary Income Statement For the quarter ended September 30 ho Sales Cost of goods sold Gross margin Selling and administrative expenses Operating income 2) Prepare a balance sheet as of September 30 Rose Apothecary Balance Sheet September 30 Assets Cash Accounts receivable Inventory Plant and equipment, net Total assets Liabilities and Shareholders' Equity Accounts payable Common shares Retained earnings Total liabilities and shareholders equily