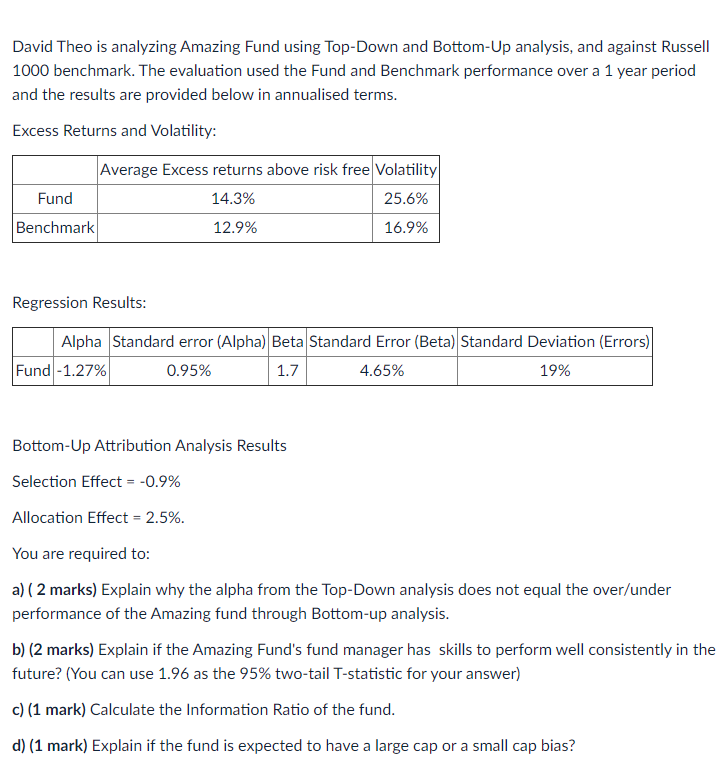

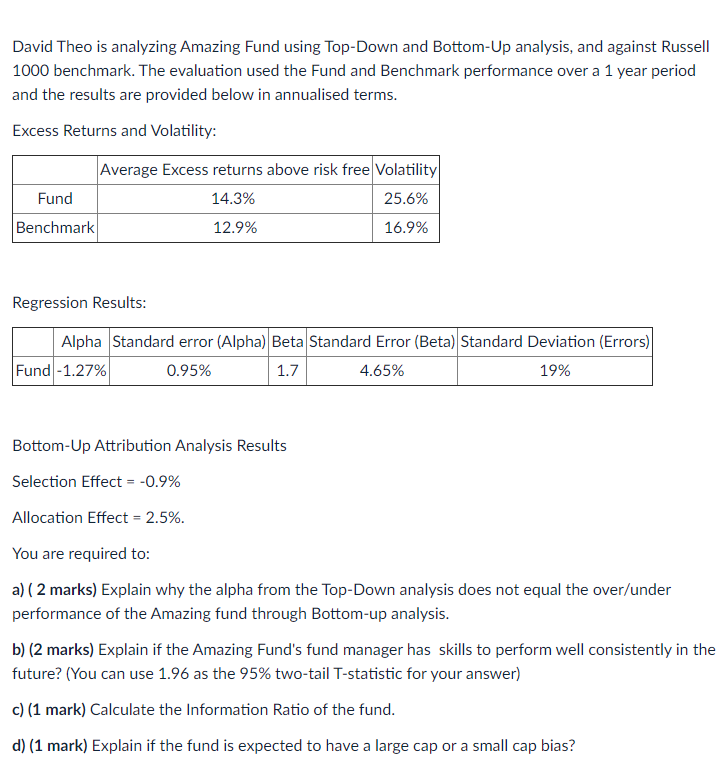

David Theo is analyzing Amazing Fund using Top-Down and Bottom-Up analysis, and against Russell 1000 benchmark. The evaluation used the Fund and Benchmark performance over a 1 year period and the results are provided below in annualised terms. Excess Returns and Volatility: Average Excess returns above risk free Volatility Fund 14.3% 25.6% Benchmark 12.9% 16.9% Regression Results: Alpha Standard error (Alpha) Beta Standard Error (Beta) Standard Deviation (Errors) Fund - 1.27% 0.95% 1.7 4.65% 19% Bottom-Up Attribution Analysis Results Selection Effect = -0.9% Allocation Effect = 2.5%. You are required to: a) (2 marks) Explain why the alpha from the Top-Down analysis does not equal the over/under performance of the Amazing fund through Bottom-up analysis. b) (2 marks) Explain if the Amazing Fund's fund manager has skills to perform well consistently in the future? (You can use 1.96 as the 95% two-tail T-statistic for your answer) c) (1 mark) Calculate the Information Ratio of the fund. d) (1 mark) Explain if the fund is expected to have a large cap or a small cap bias? David Theo is analyzing Amazing Fund using Top-Down and Bottom-Up analysis, and against Russell 1000 benchmark. The evaluation used the Fund and Benchmark performance over a 1 year period and the results are provided below in annualised terms. Excess Returns and Volatility: Average Excess returns above risk free Volatility Fund 14.3% 25.6% Benchmark 12.9% 16.9% Regression Results: Alpha Standard error (Alpha) Beta Standard Error (Beta) Standard Deviation (Errors) Fund - 1.27% 0.95% 1.7 4.65% 19% Bottom-Up Attribution Analysis Results Selection Effect = -0.9% Allocation Effect = 2.5%. You are required to: a) (2 marks) Explain why the alpha from the Top-Down analysis does not equal the over/under performance of the Amazing fund through Bottom-up analysis. b) (2 marks) Explain if the Amazing Fund's fund manager has skills to perform well consistently in the future? (You can use 1.96 as the 95% two-tail T-statistic for your answer) c) (1 mark) Calculate the Information Ratio of the fund. d) (1 mark) Explain if the fund is expected to have a large cap or a small cap bias